“It’s not sustainable,” Trump told Fox Business in an interview, when asked whether the high levies could remain. “But that’s what the number is, it’s probably not, you know, it could stand, but they forced me to do that.”

The remarks come amid renewed uncertainty over trade tensions between the world’s two largest economies.

US tariffs on Chinese imports had surged as high as 145% in a series of tit-for-tat measures, raising concerns about a global economic slowdown. Temporary 90-day truces have paused some levies, but the latest one is set to expire on November 10, creating a narrow window for negotiation.

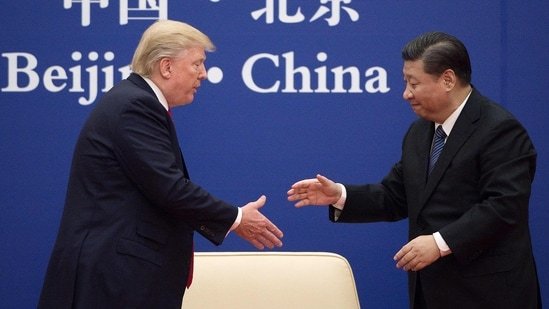

Trump also struck a personal tone on his rapport with Xi, stating, “I get along great with him… I think we’re going to be fine with China, but we have to have a fair deal. It’s got to be fair.”

Live Events

Last week, he threatened an additional 100% tariff on Chinese goods and floated canceling the upcoming meeting, ahead of the Asia-Pacific Economic Cooperation summit in South Korea.The current tariff framework has been a source of anxiety for global markets. Businesses dependent on Chinese imports have faced higher input costs, and some US exporters have struggled with retaliatory measures. Beyond tariffs, US-China trade relations have been complicated by technology and strategic concerns. The Trump administration has expanded restrictions on Chinese technology companies and proposed levies on Chinese ships entering US ports, while Beijing has tightened export controls on critical raw materials such as rare earths.

Trump’s insistence on a “fair deal” signals a potential willingness to negotiate, though he has repeatedly stressed that any agreement must prioritise American interests. His comments that China “is always looking for an edge” reflect the administration’s view that the trade imbalance and intellectual property issues remain unresolved.

With the November 10 deadline approaching and the APEC summit serving as the stage for high-level discussions, the coming weeks will be critical for setting the tone of US-China economic relations. How the two leaders navigate these tensions could have ripple effects not only on bilateral trade but also on global growth prospects and investment confidence.