Fear over credit quality in U.S. regional banks rippled through markets on Friday, dragging global financial stocks lower for a time before they regained their losses, and reviving memories of the crisis of confidence that shook sentiment just over two years ago.

The selloff hit Wall Street’s main indexes as futures wavered, deepening investor anxiety that was already heightened by escalating U.S.-China trade tensions and renewed worries about the global economic outlook.

The banking sector’s exposure to two recent U.S. auto bankruptcies has rekindled concerns about lending standards more than two years after Silicon Valley Bank’s failure, when high interest rates drove paper losses on its bonds and sparked a rout of global bank stocks.

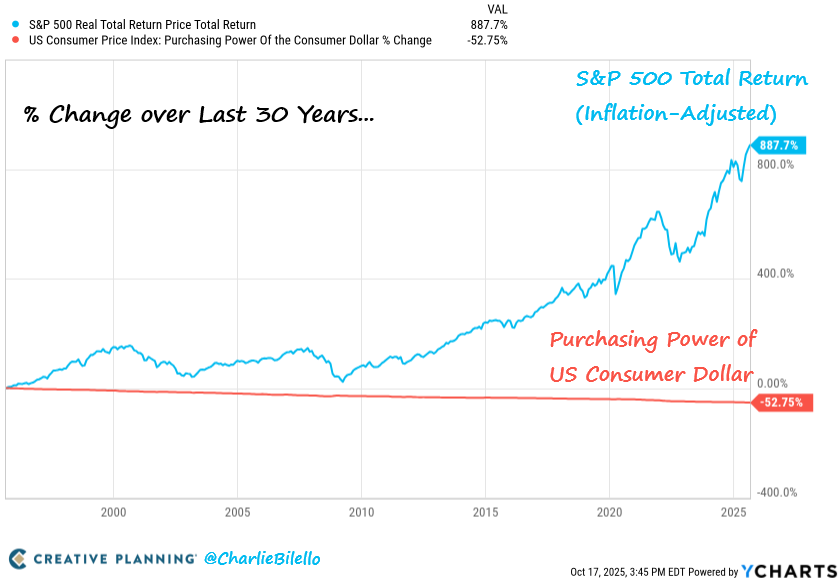

Investors are now trying to assess whether recent issues in U.S. credit markets will have a similar effect, as an overnight selloff on Wall Street rippled across Asia and Europe and shone a spotlight on the recent AI-led surge in broader stock markets, which some fear could have created a bubble.

Some analysts say that at this stage, the concerns around U.S. regional banks appears idiosyncratic rather than a sign of something more systemic.

“Pockets of the U.S. banking sector including regional banks have given the market cause for concern,” said Russ Mould, investment director at AJ Bell.

This includes Utah-based Zions Bancorporation flagging an unexpected loss on two loans and Arizona-based Western Alliance alleging a borrower had committed fraud.

Financial stocks hit globally

Some top U.S. banks fell in arket trading on Friday, ending a week of solid earnings from Wall Street’s top banks on a downbeat note.

Bank of America and Citigroup declined 0.33 per cent and 0.4 per cent, respectively.

“What we see in the banks selling off overnight in the U.S., Asia wakes up to it, Europe wakes up to it and so it spreads,” said TD Securities head of global macro strategy James Rossiter.

European banks fell almost three per cent, with Deutsche Bank and Barclays sliding around six per cent, and Societe Generale down 4.6 per cent, after financial firms in Asia, especially Japanese banks and insurers, sank.

Zions Bancorp, at the heart of the investor scrutiny, recovered some lost ground, after closing down 13 per cent on Thursday. Western Alliance was also up 1.2 per cent in early premarket trade after losing roughly 11 per cent on Thursday.

“Despite growing hopes of further rate cuts this year, attention is turning to the underlying health of the economy, as emerging credit losses amongst America’s regional banks raised further questions about lending practices,” said Derren Nathan, head of equity research, Hargreaves Lansdown.

Investors fear risks in private credit

The latest selloff came after Zions said it would take a $50 million US loss on two commercial and industrial loans from its California unit, while Western Alliance disclosed it had initiated a lawsuit alleging fraud by Cantor Group V, LLC. Attorneys for Cantor denied the allegations.

Such disclosures would not typically impact broader markets, but drew attention as they followed the collapse of two U.S. companies, FirstBrands and Tricolor.

Those failures rattled investors who are worried about risks in private credit, a booming but less regulated market where companies have borrowed heavily in the past few years.

The gloom spread across other pockets of the financial sector, weighing on mortgage lenders, buy-now-pay-later firms and brokerages.

Analysts say that any cracks in credit on Wall Street are likely to spill over into other areas of the financial sector.

Buy-now-pay-later lenders Affirm and Klarna fell 2.3 per cent and 0.4 per cent, respectively, while consumer finance firm SoFi declined 1.3 per cent. Robinhood and Interactive Brokers fell 2.6 per cent each.

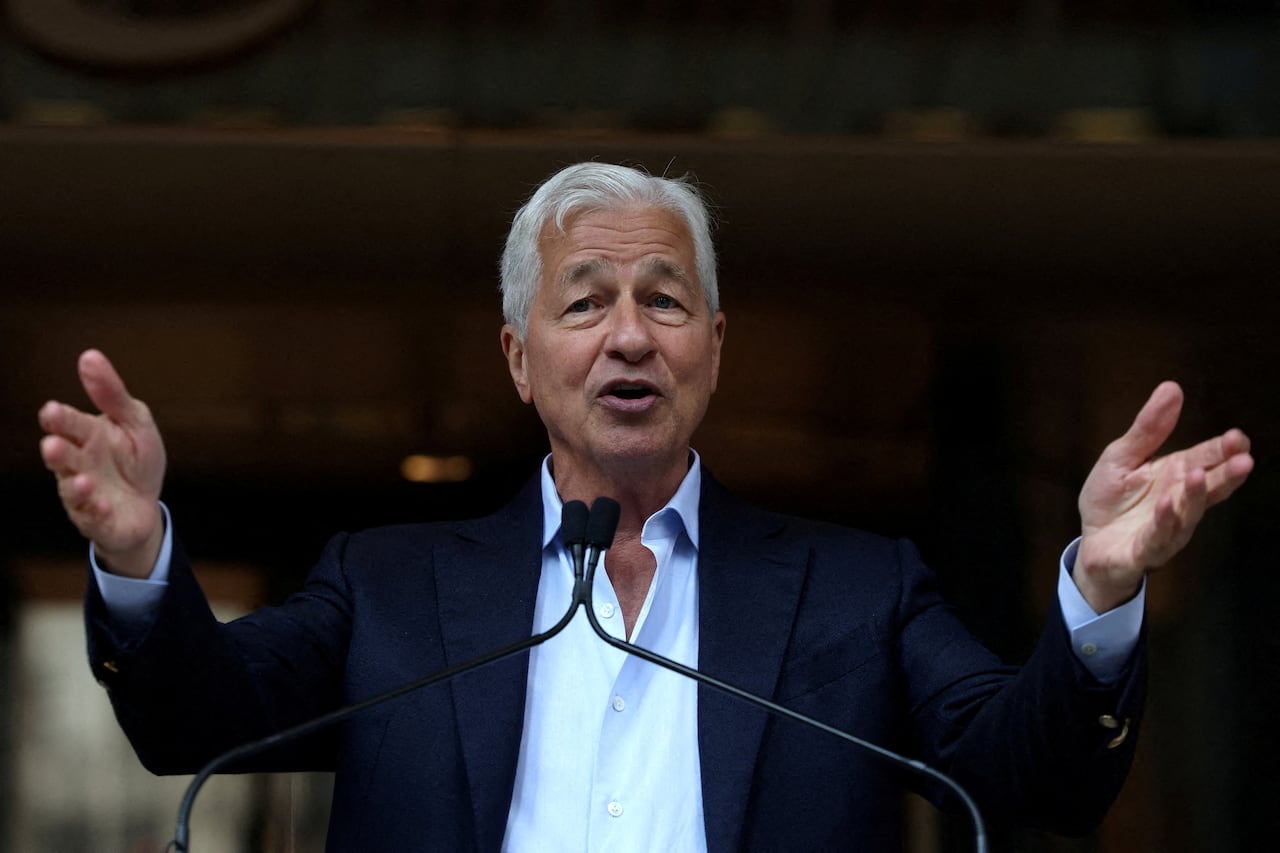

Earlier this week, JPMorgan Chase CEO Jamie Dimon said this about credit markets: “When you see one cockroach, there are probably more, and so everyone should be forewarned.”

Broader market impact

“The market is clearly priced for perfection,” said Bo Pei, analyst at US Tiger Securities. “This leaves sentiment vulnerable, so even isolated negative headlines can trigger outsized reactions like what we saw yesterday.”

European bank shares are up some 40 per cent year-to-date, while world stocks have risen 16 per cent, as investors flocked to companies that might benefit from the AI boom.

Gold, meanwhile, hit a fresh record high, set for its best week in more than 17 years.

“The market has been concerned on a bubble brewing on private credit for the past few months,” said Alan Devlin, global financials research analyst at Impax Asset Management. “The market is basically shooting first, asking questions later.”