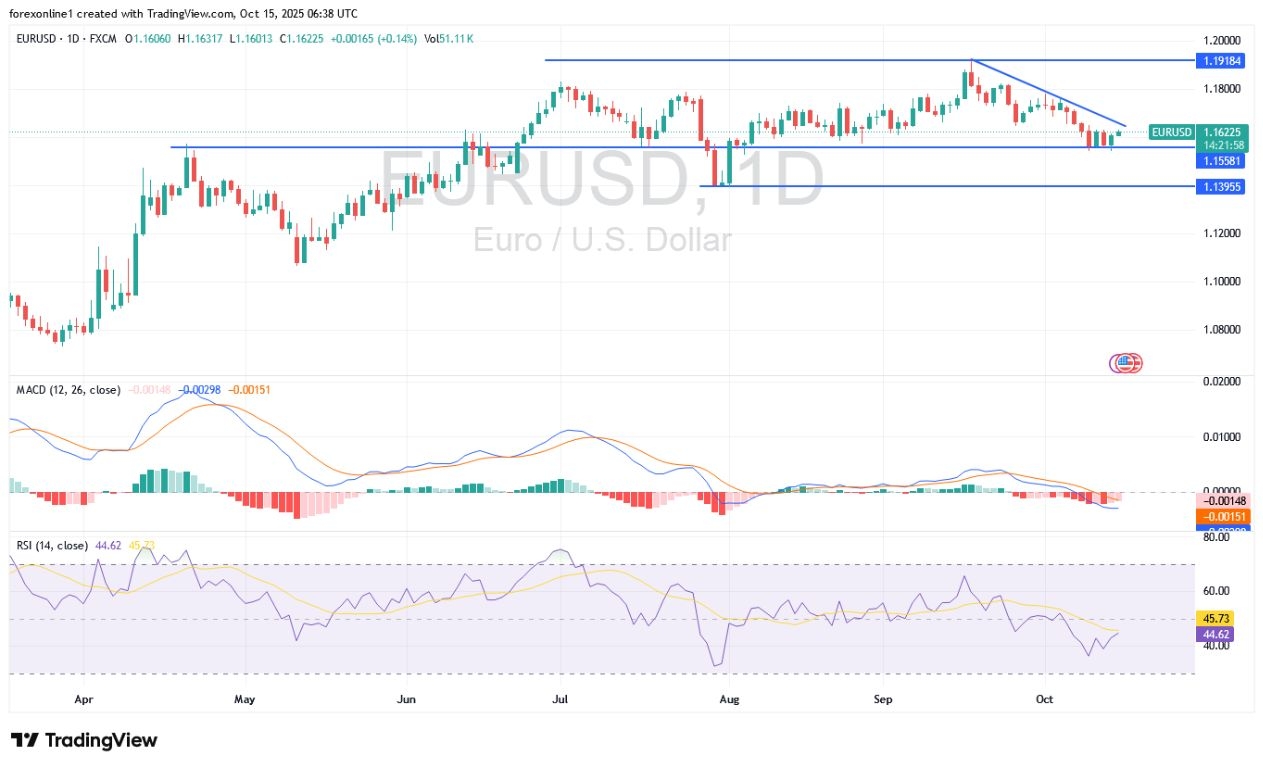

Wednesday, October 15, 2025: Analysis of euro price against the dollar EUR/USD

EUR/USD Analysis Summary Today

- General Trend: Bearish.

- Today’s Support Points for EUR/USD: 1.1540 – 1.1460 – 1.1380.

- Today’s Resistance Points for EUR/USD: 1.1670 – 1.1730 – 1.1800.

EUR/USD Trading Signals:

- Buy the EUR/USD from the support level of 1.1510, target 1.1700, and stop loss 1.1420.

- Sell the EUR/USD from the resistance level of 1.1720, target 1.1500, and stop loss 1.1700.

Technical Analysis of EUR/USD Today:

The Euro against the U.S. Dollar (EUR/USD) exchange rate continued its losses to reach a two-month low when it tested the 1.1542 support level. Subsequent attempts to bounce higher failed to move above the 1.1630 level amid declining buying interest, which kept the Euro trading lower. Forex currency market analysts warn of the potential for further losses toward the 1.15 support if sentiment does not improve.

According to performance across reliable trading company platforms, the dollar’s rise extended, with the U.S. Dollar Index (DXY) reaching a ten-week high above 99.50 before retreating to 99.30. Analysts suggest that the dollar’s recent rise went against market trends and forced partial covering of U.S. dollar short positions.

They added that there is still a high degree of skepticism about the U.S. dollar’s ability to significantly cross the 100 resistance level on the dollar index, a level that quickly reversed in May. However, some cautious analysts note that conditions remain oversold, but with no signs of stability yet, the Euro price might fall below 1.1540. The next support level at 1.1490 is unlikely to appear today.

Technically, if the EUR/USD pair takes another hit, we expect good buying on dips near 1.150… A return to the 1.170 resistance, albeit not smoothly or unilaterally, remains our preferred option.

Political uncertainty in France continues to cast a shadow. In this regard, President Macron is scheduled to meet with party leaders on Friday before naming a new Prime Minister. Rabobank warned: “Political risks remain until budget negotiations are complete. The incoming French Prime Minister still faces difficult negotiations… and any concessions will weaken fiscal discipline.”

Meanwhile, New York Fed President Williams hinted at further monetary easing, stating, “My focus is on the downside risks to the labor market,” pointing to reduced inflation pressures stemming from tariffs. Experts believe his statements reflect the majority view within the Federal Open Market Committee (FOMC) that further rate cuts are likely in upcoming meetings.

The scenario for the EUR/USD decline remains the strongest. According to the daily chart performance, the 14-day RSI is still around a reading of 43 (below the neutral line), confirming the bears’ dominance over the currency pair’s direction. At the same time, the MACD indicator lines are strongly tilted downwards. A break below the 1.1600 support signals a stronger bearish move until technical indicators reach the oversold peak. Conversely, over the same timeframe, the 1.1800 resistance will remain the most crucial for a clear change towards an uptrend in EUR/USD. The currency pair will be affected today by a new round of statements from U.S. Federal Reserve officials regarding the future of the bank’s interest rates and the outlook for the U.S. economy amid the ongoing government shutdown.

Trading Tips:

Dear TradersUp trader, look for stronger selling pressure before considering buying the Euro/Dollar again, but without risk, no matter how strong the trading opportunity is.Powell warns of weak US jobs.

Powell Warns of U.S. Job Weakness

Federal Reserve Chair Jerome Powell acknowledged during the National Association for Business Economics (NABE) meeting in Philadelphia that U.S. economic activity is slightly stronger than expected, but warned of increasing risks to employment. He stated: “While the country’s unemployment rate remained low through August, payroll gains have slowed sharply, likely due in part to lower labor force growth resulting from lower immigration and labor market participation rates. Amid a less dynamic and more flexible labor market, the downside risks to employment appear to have risen.”

Jerome Powell also indicated that the US Federal Reserve may complete its balance sheet reassessment in the coming months, indicating that liquidity conditions are gradually tightening. He warned that delaying action could exacerbate the impact of tariffs and the potential for job losses, while the recent lack of key data has increased uncertainty about the outlook for monetary policy.

EUR/USD (Daily Chart)

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.