A broad-based selloff swept global stock markets this morning after U.S. Treasury Secretary Scott Bessent told the Financial Times that China “will be hurt the most” if it doesn’t submit to Washington’s trade demands. At the same time, China showed no signs of backing down from President Trump’s trade war: It imposed sanctions banning Chinese companies from doing business with the U.S. subsidiaries of South Korean shipbuilder Hanwha Ocean. South Korea’s KOSPI fell 0.63% on the news.

S&P 500 futures were down 0.87% this morning. Markets in Asia and Europe were almost all down, with Japan’s Nikkei 225 off 2.58% and Europe’s Stoxx 600 down 0.49% by midmorning.

Beijing’s new export controls on rare earth materials—which the U.S. is dependent on—are “a sign of how weak their economy is, and they want to pull everybody else down with them,” Bessent said. “Maybe there is some Leninist business model where hurting your customers is a good idea, but they are the largest supplier to the world,” he told the FT. “If they want to slow down the global economy, they will be hurt the most.”

“They are in the middle of a recession/depression, and they are trying to export their way out of it. The problem is they’re exacerbating their standing in the world.” (China is, in fact, doing very well. Its exports rose 8.3% in September and the World Bank expects China’s GDP to grow 4.8% this year. U.S. growth is forecast at 1.4%.)

The mood among traders today is a stark reversal from yesterday, when the S&P 500 rose 1.56% after investors realized that Trump and China President Xi Jinping will likely meet at the upcoming APEC conference at the end of October—an opportunity for both men to reach one of Trump’s famous deals.

Elsewhere, there wasn’t much to cheer up the markets. One third of bettors on Polymarket think the U.S. government shutdown will go on beyond November 8.

Pantheon Macroeconomics noted that consumer sentiment remains low: The University of Michigan’s consumer survey, which asks whether buyers feel now is a good time to make a major purchase, “now points to year-over-year growth in this measure of core spending slowing to near-zero soon, a far cry from the 6% pace earlier this year,” according to Samuel Tombs and Oliver Allen.

Goldman Sachs added to the gloom by publishing a note this morning titled “Jobless growth.” “The modest job growth alongside robust GDP growth seen recently is likely to be normal to some degree in the years ahead. We expect the great majority of U.S. potential GDP growth to come from solid productivity growth boosted by advances in artificial intelligence (AI), with only a modest contribution from labor supply growth due to population aging and lower immigration,” authors Pierfrancesco Mei and David Mericle said.

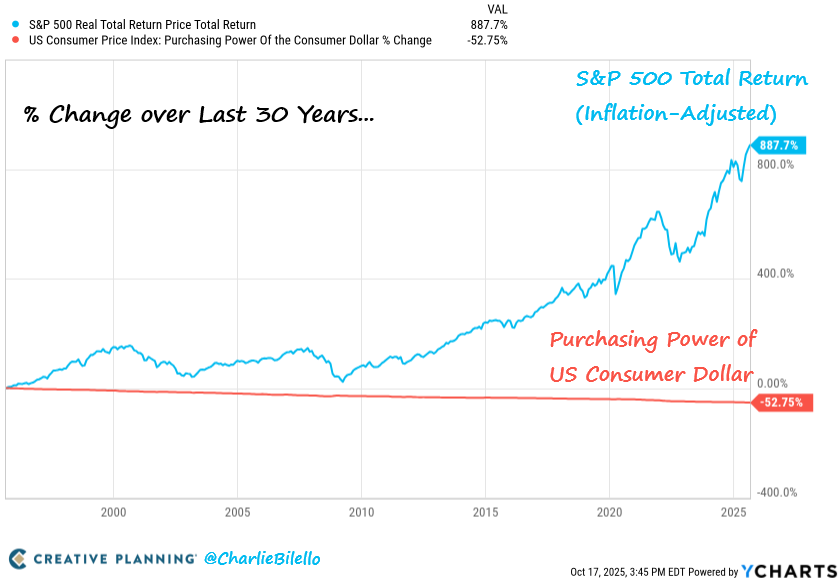

In the longer term, however, most analysts continue to see stocks going up, driven largely by the tech and AI sector.

“Roughly half of this S&P 500 bull has been driven by just seven stocks: Amazon (AMZN), Alphabet (GOOG/L), Apple (AAPL), Broadcom (AVGO), Meta (META), Microsoft (MSFT), and NVIDIA (NVDA),” Jeff Buchbinder and Adam Turnquist of LPL Financial told clients in a note. But, “The Fed is in the middle of a rate-cutting cycle and inflation appears to be under control despite increased tariffs, likely eliminating that as a potential bull market killer.”

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were down 0.87% this morning. The index closed up 1.56% in its last session.

- STOXX Europe 600 was down 0.47% in early trading.

- The U.K.’s FTSE 100 was flat in early trading.

- Japan’s Nikkei 225 was down 2.58%.

- China’s CSI 300 was down 1.2%.

- The South Korea KOSPI was down 0.63%.

- India’s Nifty 50 was down 0.42% before the end of the session.

- Bitcoin was down to $111.8K.