Bearish view

- Sell the GBP/USD pair and set a take-profit at 1.3450.

- Add a stop-loss at 1.3625.

- Timeline: 1-2 days.

Bullish view

- Buy the GBP/USD pair and set a take-profit at 1.3625.

- Add a stop-loss at 1.3450.

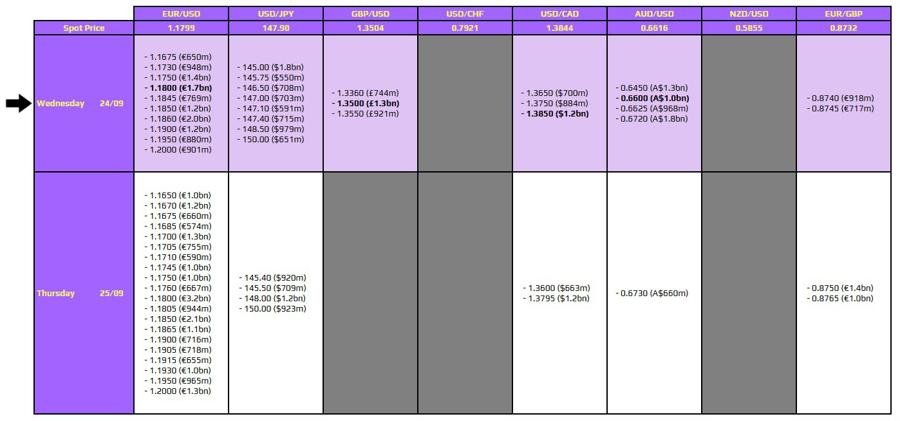

The GBP/USD pair was flat on Wednesday morning as traders continued to reflect on last week’s Federal Reserve and Bank of England’s interest rates decision. It was trading at 1.3517, a few points above last week’s low of 1.3455.

Traders Eye BoE and Federal Reserve Next Actions

The GBP/USD pair held steady after the Fed and the BoE started their divergence last week.

In the US, Jerome Powell and his team decided to slash interest rates by 0.25% for the first time this year, bringing the official cash rate to between 4.00% and 4.25%.

The bank pointed to the slowing labor market, where the economy created just 22,000 jobs in August, a figure that will likely be revised lower next week. Another figure showed that the unemployment rate rose to 4.3 %.

Fed’s officials who talked this week expressed mixed opinions on what to expect. In a statement on Tuesday, Jerome Powell said nothing new as he kept his options open for what to do in the next meetings.

Chicago’s Austan Goolsbee, Atlanta’s Raphael Bostic, and Cleveland’s Beth Hammack warned that the Fed should not ignore that inflation was still rising when determining its next course of action.

They believe that the bank should not cut interest rates aggressively, noting that the labor market was still resilient, with the unemployment rate being low.

The GBP/USD exchange rate is also reacting to the Bank of England’s decision to leave the rates unchanged. In a statement on Tuesday, Huw Pill, warned that inflation remained too high.

Pill’s statement mirrored that of the OECD, which warned that the country’s inflation will be much higher than it had predicted at its last forecast in June. The UK will also have a higher inflation rate than most other developed countries.

GBP/USD Technical Analysis

The GBP/USD exchange rate was flat on Wednesday and was trading at 1.3525, a few points above last week’s low of 1.3450.

It has found support slightly above the Ichimoku cloud indicator and the 50-day Exponential Moving Average (EMA).

However, the pair is slightly below the lower line of the rising wedge pattern, one of the most common reversal patterns in technical analysis.

Therefore, there is a risk that it will continue falling as sellers target the psychological level at 1.3450. A move above the resistance at 1.3600 will invalidate the bearish outlook.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best UK forex brokers in the industry for you.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.