At the interbank foreign exchange, the rupee opened at 88.80, registering a decline of 7 paise over its previous close. File.

| Photo Credit: Reuters

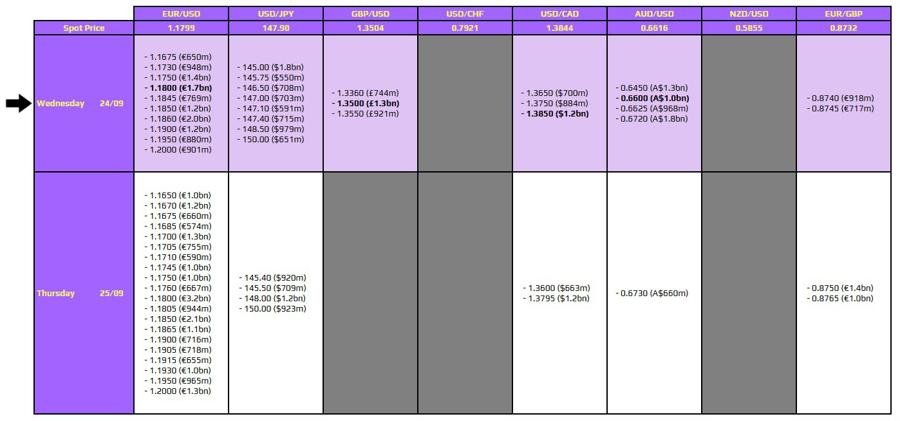

The rupee depreciated 7 paise from its all-time closing low to 88.80 against U.S. dollar in early trade on Wednesday (September 24, 2025) dragged down by tariff and H-1B visa issues amid persistent foreign fund outflows.

Forex traders said rupee is hovering near its all-time low level as enhanced U.S. tariffs on Indian goods as well as U.S. H-1B visa fee hike dented investor sentiments.

Moreover, investors’ risk-aversion and trade policy uncertainty has also exacerbated the rupee’s depreciation.

At the interbank foreign exchange, the rupee opened at 88.80, registering a decline of 7 paise over its previous close. In initial trade the rupee also touched 88.71 against the greenback.

On Tuesday (September 23), the rupee depreciated 45 paise to close at a fresh all-time low of 88.73 against the U.S. dollar. It had touched an all-time intraday low of 88.82 against the U.S. dollar.

“The H-1B visa fees has only aggravated the overall issues that India and US need to resolve,” said Anil Kumar Bhansali, Head of Treasury and Executive Director Finrex Treasury Advisors LLP.

Mr. Bhansali further noted that RBI has allowed the weakening considering the plight of the exporters.

“We may see new lows this week towards 89.00 before a pullback could be seen to enable importers to buy dollars,” he said.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.09% higher at 97.35.

Brent crude, the global oil benchmark, was trading 0.24% higher at $67.79 per barrel in futures trade.

On the domestic equity market front, the Sensex dropped 380.48 points to 81,721.62 in early trade, while the Nifty declined 106.45 points to 25,063.05.

Meanwhile, Foreign Institutional Investors offloaded equities worth ₹3,551.19 crore on Tuesday, according to exchange data.

Published – September 24, 2025 09:53 am IST