Reuters’ Naveen Thukral and Ella Cao reported that “Chinese buyers booked at least 10 cargoes of Argentine soybeans after Buenos Aires on Monday scrapped grain export taxes, three traders said on Tuesday, dealing another setback to U.S. farmers already shut out of their top market and hit by low prices.”

“Argentina’s temporary tax move boosts the competitiveness of its soybeans, prompting traders to secure cargoes for fourth-quarter inventories in China, a period usually dominated by U.S. shipments but now clouded by Washington’s trade war with Beijing,” Thukral and Cao reported. “The Panamax-sized shipments of 65,000 metric tons each are scheduled for November, with CNF (cost and freight) prices quoted at a premium of $2.15-$2.30 per bushel to the Chicago Board of Trade (CBOT) November soybean contract, two traders with direct knowledge of the matter said.”

“One of the traders said Chinese buyers had booked 15 cargoes,” Thukral and Cao reported. “The deals are a fresh blow for U.S. farmers, who are missing out on billions of dollars of soybean sales to China halfway through their prime marketing season as unresolved trade talks freeze exports and rival South American suppliers led by Brazil step in to fill the gap, traders and analysts have said.”

“‘These deals were done last night after Argentina’s decision on export tax,’ said one of the traders, declining to be identified as they were not authorised to speak with media,” Thukral and Cao reported. “‘It clearly means that China doesn’t need U.S. beans.’”

Argentina Suspends Some Agriculture Export Taxes

Reuters’ Maximilian Heath and Aida Pelaez-Fernandez reported that “Argentina’s government on Monday temporarily eliminated export taxes on grains and their by-products, as well as on beef and poultry, in a bid to speed up sales abroad and rake in much-needed dollars to prop up the flagging peso currency.”

“The decree published Monday suspends export taxes on soy, corn, wheat and their by-products, including biodiesel. It will last through the end of October, or until declared exports reach $7 billion,” Heath and Pelaez-Fernandez reported. “This significantly eases the tax burden for exports from the key sector, from a prior level of 26% on soybeans, 24.5% on soybean oil and meal and 9.5% on corn.”

“The tax break could cause a rush to sell, especially as farmers look for cash to fund planting for next season, analysts said,” according to Heath and Pelaez-Fernandez’s reporting. “Significant portions of the 2024/25 grains harvests worth more than $8 billion remain unsold, according to analyst Lorena D’Angelo.”

China Still Hasn’t Purchased Any U.S. Soybeans

The Purdue Center for Commercial Agriculture’s Joana Colussi and Michael Langemeier reported that “the U.S. soybean harvest began in September without any orders from the world’s largest buyer: China. American producers are harvesting a crop the U.S. Department of Agriculture (USDA) estimates at 4.3 billion bushels, and there is no indication of when shipments to China will resume.”

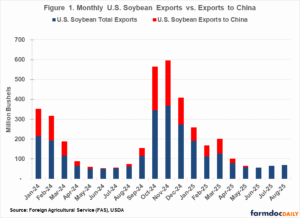

“In 2024, the United States shipped nearly 985 million bushels to China, accounting for 51% of the nation’s total soybean exports that year,” Colussi and Langemeier reported. “In 2025, U.S. soybean exports to China from January through August totaled only 218 million bushels – 29% of total exports for the period. In June, July, and August, shipments to China were effectively zero.”

“The combination of a 20% retaliatory tariff and China’s Value-Added Tax (VAT) and Most-Favored-Nation (MFN) duties has pushed the overall duty rate on U.S. soybeans to 34% in 2025,” Colussi and Langemeier reported. “Although this new retaliatory rate is 5% lower than during the 2018 trade war, the added duties should keep U.S. soybean prices higher than South American supplies ahead of the U.S. harvest this fall, stated the American Soybean Association in a letter sent to the White House in August.”

“If a trade deal isn’t reached this fall, U.S. soybean producers reliant on Chinese buyers could suffer significant losses, adding even more financial stress to crop farms,” Colussi and Langemeier reported.