Long-term investors should pick stakes in companies building global AI infrastructure and enterprise data ecosystems.

The global artificial intelligence (AI) market is projected to surge more than 6 times from $279.2 billion in 2024 to approximately $1.81 trillion by 2030, according to Grand View Research.

Image source: Getty Images.

While Nvidia is expected to be a key beneficiary of this explosive growth, it won’t be the only winner. Here are two other brilliant AI-powered stocks well positioned to ride this massive wave of growth.

Oracle

Oracle (ORCL 6.67%) is rapidly transforming from a legacy database software vendor into a crucial player in the global AI infrastructure buildout. Enterprises are increasingly choosing Oracle to build large-scale GPU-centric data centers for AI model training and inferencing (real-time deployment of AI models). Its latest quarterly results reflect its strengthening growth trajectory.

In the first quarter of fiscal 2026 (ended Aug. 31, 2025), Oracle’s revenue rose 12% year over year to $14.9 billion, while non-GAAP (adjusted) operating income grew 7% to around $6.2 billion. Cloud revenue grew at a much faster pace, 27% year over year, to nearly $7.2 billion. This growth was driven by a 54% surge in cloud infrastructure (OCI) revenue and a 32% increase in cloud database services on a year-over-year basis.

Autonomous database (cloud-based, self-managing database service) revenue jumped 43%. Multicloud database revenue — where Oracle embeds its data centers inside Microsoft‘s Azure, Amazon‘s AWS, and Alphabet‘s Google Cloud infrastructure — skyrocketed a shocking 1,529% on a year-over-year basis. Finally, remaining performance obligations (RPO), a metric used to track contracted revenue backlog, soared 359% year over year to $455 billion. Oracle has also planned $35 billion of capital expenditures in fiscal year 2026, with a focus mainly on data center equipment.

Oracle differentiated itself from the competition by building AI-optimized gigawatt-scale data centers that are reportedly faster and more cost-efficient at training models than any competitors’. Beyond targeting the multitrillion-dollar AI training market, the company is also focusing on the even bigger AI inferencing market. This is possible since Oracle is already the largest custodian of high-value private enterprise data globally.

The company’s recently introduced AI database enables clients to vectorize (convert into numbers with algorithms for efficient storage and retrieval) their enterprise data, making it possible for AI models to understand it completely. The company also made it easier to connect all databases, including Oracle AI database and cloud storage data, to advanced reasoning models such as ChatGPT, Gemini, and Meta Platforms‘ Llama — enabling secure, high-speed AI-powered reasoning on private data. These AI-powered capabilities are further driving enterprise demand.

Oracle trades at about 48 times forward earnings, richer than Microsoft’s forward price-to-earnings multiple of 33 or Alphabet’s 25. However, although its valuation is rich, it reflects investor confidence that Oracle’s $455 billion backlog will translate into accelerating cloud revenue and expanding margins as AI infrastructure expands. Hence, it seems a smart pick in 2025.

Snowflake

Enterprise data player Snowflake (SNOW -0.46%) operates a leading cloud-native and fully managed data platform called the AI Data Cloud. The company is also expanding its AI capabilities by investing extensively in models and agent-based systems.

The company’s recent earnings results highlight its business momentum. In the second quarter of fiscal 2026 (ended July 31), revenue rose 32% year over year to $1.1 billion. RPO increased 33% year over year to $6.9 billion, and net revenue retention was a robust 125%. Non-GAAP operating margin has also improved by 6 percentage points year over year to 11%.

Snowflake is also seeing rapid expansion in its customer base. In the second quarter, the company added 533 customers, including 15 Global 2000 companies. Snowflake ended the second quarter with 654 customers generating over $1 million in revenue in the last 12 months.

The Snowflake data platform can be hosted on Azure, AWS, and Google Cloud infrastructure — either in single-cloud or multicloud configurations. While customers hosting on AWS are the largest customer cohort for Snowflake, customers hosting on the Azure cloud were the fastest-growing cohort for Snowflake in the second quarter, albeit starting from a smaller base. This deep alignment with hyperscalers has expanded Snowflake’s reach, but has also made it highly reliant on partner priorities as it grows in new geographies and markets.

Beyond unifying data across clouds, Snowflake’s AI data cloud also offers clients several AI-powered capabilities. Snowflake Intelligence (now in public preview) enables users to interact with both structured and unstructured data, converting enterprise data into actionable insights. These are used to build intelligent agents. Cortex AI SQL enables models to be integrated directly into SQL, allowing teams to utilize AI capabilities without requiring data movement. The company’s recently launched Gen2 data warehouses also deliver 2 times faster performance and greater efficiency without increasing costs.

AI has become the primary catalyst driving Snowflake’s adoption by new customers. Nearly 50% of new client accounts in the second quarter were influenced by AI use cases. AI also powers approximately 25% of deployed use cases, while more than 6,100 accounts utilize Snowflake AI weekly. However, since Snowflake bills based on usage, new migrations and workloads can drive short-term consumption spikes that later normalize, resulting in uneven near-term trends.

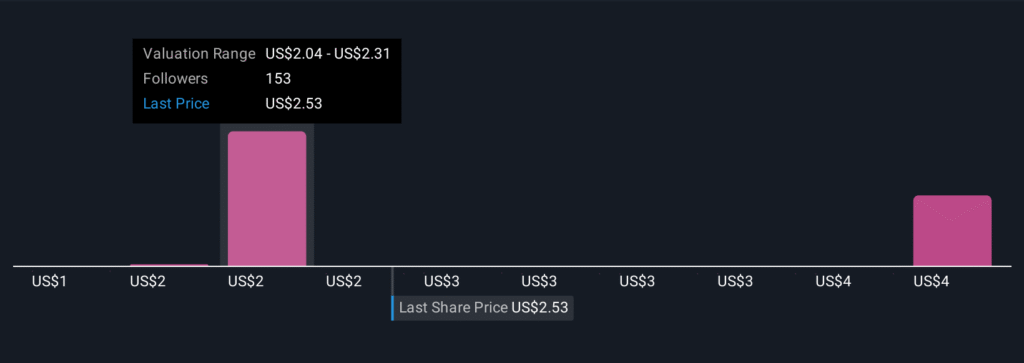

Snowflake trades at 18.2 times sales, which is lower than its five-year average price-to-sales multiple of 34.2. Considering the company’s corrected valuation, combined with its AI-powered growth prospects and robust project pipeline, the stock appears to be a worthwhile investment at this time.

Manali Pradhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.