Micron Technology will report earnings on Tuesday, after the close. (Photo by Jakub Porzycki/NurPhoto via Getty Images)

NurPhoto via Getty Images

Key Takeaways

- Tech Stocks And IPO Market Propel Equities To Weekly Gains

- Investors Eye Fed Cuts, PCE Inflation Report, And Economic Data

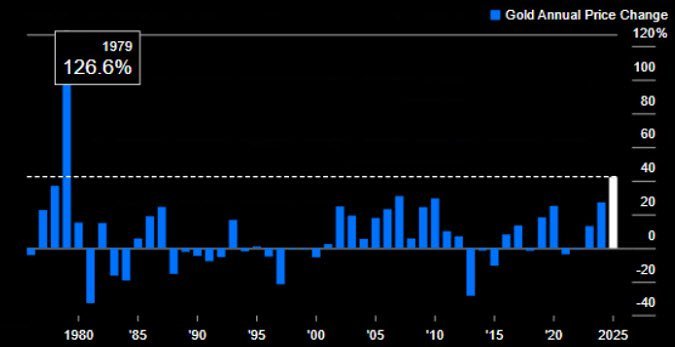

- Gold Hits Record High As Bond Market Volatility Fuels Demand

It was a strong week for equites with all four major indices posting solid gains. Tech led the way with the Nasdaq Composite gaining almost 2.25%. That was followed by small cap stocks as the Russell 2000 added just under 2.2%. The S&P 500 gained nearly 1.25%, while the Dow Jones Industrial Average was up just over 1%.

With triple witching now behind us, markets will have a week filled with economic data and members of the Fed speaking to consider. According to the CME Fed Watch Tool, markets are expecting two more rate cuts this year, one when the Fed meets in October and another at the December meeting. The data this week will likely be heavily scrutinized, not because I think the Fed will change its mind about cutting rates, but rather, I get the sense the market is hoping for the Fed to be even more aggressive with monetary policy.

It’s not uncommon, once the market gets a rate cut, to become eager for more. In fact, as we neared the September meeting, there was growing chatter the Fed might cut by 50 basis points instead of the quarter-point that had been forecast. I think if we see any signs of a weakening economy, especially outside of the labor market, talk of a half-point cut will likely gain momentum. We’ll get our first reports tomorrow with both the Services and Manufacturing Purchasing Managers Index (PMI) due out. The big number this week, however, will be Friday’s Personal Consumption Expenditures (PCE) Index. That is the Fed’s preferred inflation gauge and that report will probably get a lot of attention and anticipation as Friday nears.

The strength of the market recently has been largely driven by technology stocks. At the same time, we’ve seen a robust IPO market. I think the IPO market is one of the stronger bullish indicators as most of these companies were oversubscribed (more people wanted to be part of the IPO than shares available). According to the Wall Street Journal, there is currently $7.7 trillion in money market funds, suggesting that despite recent market strength, there remains a lot of money on the sidelines. With that much money on the sidelines, it could bode well for other companies planning to go public.

Taking a look at some individual issues, Pfizer is in talks to buy Metsera for $4.9 billion. Metsera makes a weight loss pill and Pfizer, after unsuccessfully trying to develop their own, has decided it makes more sense to purchase Metsera. Saks in in talks to sell a 49% stake to Bergdorf Goodman for $1 billion. Oracle will be part of the consortium that purchases TikTok and will be the company responsible for providing security once the company becomes U.S. owned. Lastly, we do have a couple earnings taking place this week. Micron Technology will report tomorrow after the close and then Costco is scheduled to release their earnings on Thursday after the close. Looking forward to third quarter earnings, which are still a way off, FactSet is estimating earnings to be up nearly 8%, which would mark the 9th consecutive quarter of earnings growth.

Elsewhere, gold has hit yet another record high. In premarket, gold futures are up over 1% to $3747 per ounce, continuing its torrid run this year. I think one reason for the price action in gold has to do with uncertainty over the bond market. Typically, investors turn to bonds when they are concerned about equities, but this year, the bond market has been a bit volatile. I believe the result of that has been a turn toward both gold and silver.

For today, I’m watching crypto assets. Both Bitcoin and Ethereum had large overnight selloffs but have recovered much of those losses in premarket trading. I’m also watching both quantum computing stocks and nuclear power stocks. Stocks in those categories have had massive gains recently as a part of the growth in Artificial Intelligence. I’m interested if these stocks will continue their run or if we see some profit taking. As always, I would stick with your investing plan and long-term objectives.