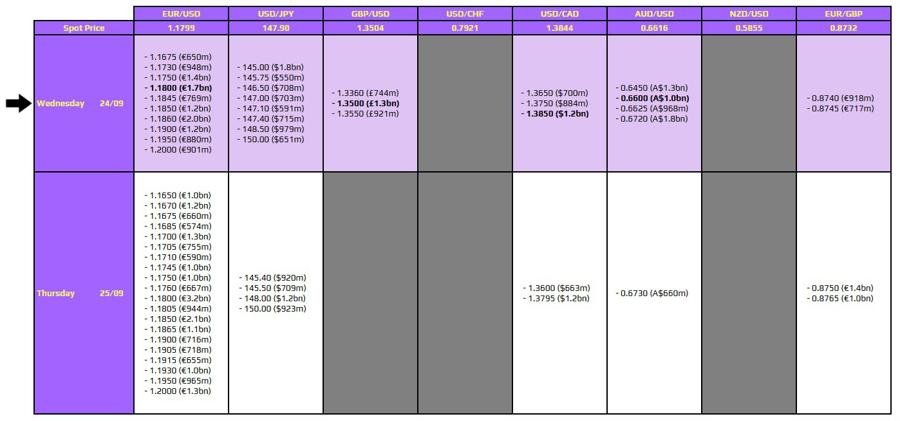

- The USD/JPY outlook suggests some strength in the yen after Friday’s slightly hawkish BoJ policy meeting.

- Japan has to choose a new prime minister on October 4th.

- Traders will watch Fed policymakers’ remarks for more clues on rate cuts.

The USD/JPY outlook suggests some strength in the yen after Friday’s slightly hawkish Bank of Japan policy meeting. Meanwhile, the dollar retreated at the start of a week when Fed policymakers will reveal their views on the economy and future policy moves.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

On Friday, the Bank of Japan held its policy meeting and decided to keep interest rates unchanged. However, the hawkish surprise came when two members voted to hike interest rates. The move briefly boosted the yen, but dollar strength undid all these gains.

However, focus has returned to what this could mean for future policy. Internal pressure means policymakers are gaining confidence that the economy needs higher borrowing costs. Therefore, it increases the likelihood of a near-term rate hike.

However, before that, Japan has to choose a new prime minister on October 4th. The new leader will also play a huge role in determining the BoJ’s policy path.

Meanwhile, the Fed assumed a more dovish tone last week and cut rates by 25-bps. This week, traders will watch policymakers’ remarks for more clues on rate cuts. Dovish remarks could weigh on the dollar.

USD/JPY key events today

Traders are not anticipating any key economic releases from the US or Japan. Therefore, the pair could consolidate.

USD/JPY technical outlook: Aiming to test the 149.00 range resistance

On the technical side, the USD/JPY price trades above the 30-SMA, with the RSI above 50, suggesting a bullish bias. The move comes after the price got rejected at the 146.50 support level. Bears made an attempt to breach this support but failed, allowing bulls to take charge.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

However, although bulls are in the lead, the price is still consolidating on a larger scale. It is trading in a sideways move between the 149.00 resistance and the 146.50 support. In this range, bears and bulls are showing almost equal strength. As a result, the price is just chopping through the SMA.

Nevertheless, since bulls are currently in the lead, the price could soon challenge the range resistance. However, it seems ready to retest the SMA before climbing. A bullish breakout would allow USD/JPY to retest the 150.75 key resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.