The company has turned into a soaring meme stock rather quickly.

A soaring stock market has seen the return of the meme stock trade. Investors have begun to pile into beaten-down stocks with low share prices, hoping for a turnaround. Opendoor Technologies (OPEN -3.87%) looks like the current poster child of the 2025 meme stock run, with its digital real estate business model.

Its shares are up over 1,000% and recently passed $10 on the backs of a changing business model, new executives, and a passionate set of shareholders. Should you chase Opendoor stock and buy it, even though it has zoomed past $10?

Opendoor’s struggling business model

Opendoor’s stock was in the gutter for a good reason: Its current business is unprofitable. The company uses a digital platform to buy homes from people with cash offers and then sell them to buyers, hopefully at a profit. This is home flipping at a national scale, funded by debt, and with extremely thin gross profit margins. Last quarter, gross margin was just 8.2%.

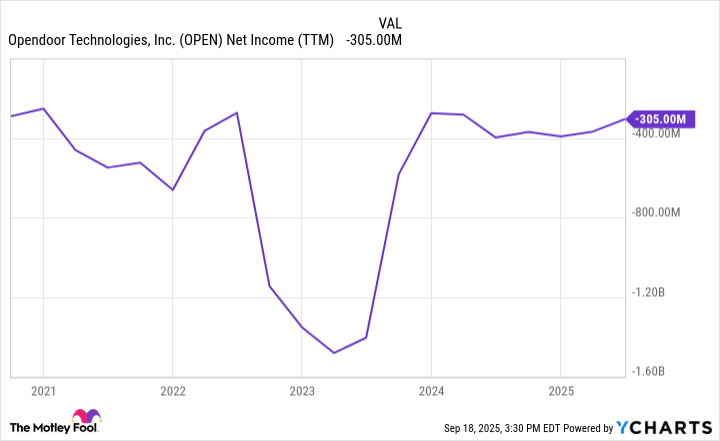

This business grew during the real estate boom of 2020 and 2021 but still failed to generate a bottom-line profit with any consistency. Then, the housing market froze, and so did the transactions flowing through the Opendoor marketplace, which led to declining revenue and gross profit. Both trailing revenue and gross profit are off 70% from highs, which shows the struggles of Opendoor’s business model.

Over the last 12 months, Opendoor’s business generated just $417 million in gross profit and had a net loss of $305 million. Investors were betting that Opendoor was headed for bankruptcy. That is, until activist investors joined in and forced changes at the executive level.

Image source: Getty Images.

Executive incentives and fast-moving changes

Earlier this summer, some large professional investors began to buy Opendoor stock, which led to individual traders piling in and turning it into a meme stock.

Now, the company is using these investors as inspiration to shake up its operations. It brought in a new CEO from Shopify, Kaz Nejatian, who was previously chief operating officer (COO) at the highly successful e-commerce software company. Opendoor also brought two founders back to the board of directors, and they said that major lay-offs were imminent to save on costs.

The new CEO has just arrived, but will likely bring some major changes to Opendoor’s business. The company has already made some changes to its business model by adding real estate agents as partners, using Opendoor’s software to funnel demand to its platform. On top of this, new changes that use artificial intelligence (AI) may be added, although it is unclear what the exact details will be, since Nejatian was just hired on Sept. 10. Investors should watch Opendoor’s actions closely and look at upcoming quarterly earnings to see the exact path it will follow in the future to try to generate a profit.

OPEN Net Income (TTM) data by YCharts.

Is Opendoor stock a buy?

At the current stock price of $10, Opendoor has a market cap of around $7.5 billion. That is a 20x gain from the lows in June, a miraculous turnaround for the business and bringing it back to its merger price when it went public through a special purpose acquisition company (SPAC).

Valuing Opendoor stock is hard, since it does not generate any earnings today. On the one hand, investors may disregard it entirely because it has failed to ever post a profit for shareholders and has burned tons of cash over the years. On the other hand, investors may want to look to the future and see a potential disruptor with the sharp new CEO from Shopify joining the mix.

Even still, Opendoor stock may be pricing in too much in rosy assumptions from this management team. A market cap of $7.5 billion is close to 20x its trailing gross profit. This implies that the company needs to manufacture significant growth in the years to come in order for the stock price to rise. At this stage, we have no clue if this turnaround strategy will even work. If it does, a lot of this success is baked into the stock.

Opendoor stock looks overvalued at $10 a share.

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Shopify. The Motley Fool has a disclosure policy.