Image source: Getty Images

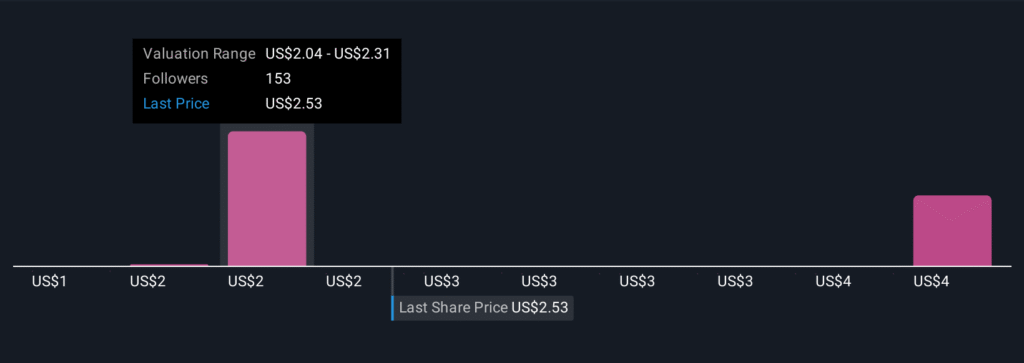

With UK large-cap stocks marching higher in 2025, the dividend yield offered by the FTSE 100 has been shrinking. But that’s not the same story with every business, particularly among smaller enterprises. In fact, STV Group‘s (LSE:STVG) taken quite a rough tumble lately, falling by over 55% in the last 12 months.

Despite this volatility, dividends have continued to flow into the pockets of shareholders. And right now, the stock offers an impressive 9.7% yield. If it can be maintained, this near-penny stock could prove to be a lucrative source of passive income for long-term investors.

So should investors be considering this business for their own portfolios?

A UK streaming opportunity

STV Group’s a Scottish multi-media enterprise with its own free-to-use streaming platform alongside a traditional broadcasting service, both supported by advertisements.

The group’s content includes a blend of scripted and unscripted shows, with its streaming platform drawing in over one million monthly active users. That makes it the largest streaming and broadcasting service in Scotland, controlling 19% of the market, versus Netflix‘s 13% and Sky’s 10%. And with management aiming to increase its viewership to over 1.5 million by 2026, the increase in eyeballs is expected to drive digital advertising revenue higher.

But if that’s the case, why has the stock been stuck on a downward trajectory over the last 12 months?

With a weak creative commissioning environment in the UK, lots of projects have been cancelled or delayed. As such, new programmes are taking longer to arrive on STV’s platform, making attracting and retaining audiences far more challenging.

This has ultimately culminated in a slowdown in lower advertising revenues and even a full-year profit warning, that’s understandably spooked investors.

Potential for a comeback?

The company’s scheduled to release its half-year results next week, giving investors a more detailed insight into what’s going on behind the scenes. However, it’s worth pointing out that despite the challenges, there’s some encouraging progress being made.

As previously mentioned, STV Group controls the lion’s share of the Scottish streaming market despite fierce competition. At the same time, management’s been finding areas to improve operational efficiency, positioning the group to benefit from improved profitability once market conditions improve.

That’s good news for dividend investors, given that shareholder payouts are ultimately driven by earnings and cash flow, not top-line expansion. What’s more, with delayed projects expected to resume in 2026, the headwinds the company’s facing may soon come to an end, allowing growth and potentially even the share price to bounce back.

The bottom line

With an almost double-digit dividend yield, it’s hard not to be tempted by STV Group shares today. However, the exact timing of when market conditions will improve remains a bit of a mystery. If the recovery takes too long, dividends may be adversely impacted, sending shares further in the wrong direction.

As such, I’m keeping STV Group on my watchlist for now. But with earnings just around the corner, investors may also want to keep tabs on this business for both its income and recovery potential.