These companies are benefiting from exciting megatrends that are here to stay.

These three companies are distinct, and their stocks present a range of risk-reward considerations for investors. I’m going to run through them in ascending order of risk and reward potential, so industrial software company PTC (PTC -0.17%) is probably the lowest risk, followed by machine vision specialist Cognex (CGNX -0.97%), and then air taxi manufacturer Joby Aviation (JOBY 7.16%).

PTC and the digital revolution in manufacturing

PTC is demonstrating excellent underlying growth even as its customers are facing challenging conditions. This speaks to the critical importance of its software products to the modern manufacturing economy. In a nutshell, its key growth driver is the increasing adoption of digital technology in manufacturing processes, whereby the physical and digital worlds connect to provide data and insights that allow companies to continuously improve the development, manufacturing, servicing, and ultimately disposal of their products.

I appreciate this is a lot to take in conceptually, but consider the concept of a closed-loop digital thread, whereby a continuous flow of data coming from a product’s design (using PTC computer aided design [CAD] software), engineering and manufacturing (PTC’s product lifecycle management [PLM] software), through to servicing (PTC sells service lifecycle management [SLM] software).

The data created by these different elements is digitally analyzed to continuously improve the process at every stage of the loop, whether that involves redesigning a product to optimize manufacturing, modifying a product’s manufacturing process to enhance serviceability, or even enhancing the servicing of a product after it has been redesigned.

PTC’s offerings are essential to the modern manufacturing economy, and with the company increasingly converting its revenues into cash flow, the stock is an excellent long-term investment.

Image source: Getty Images.

Cognex’s long-term uptrend

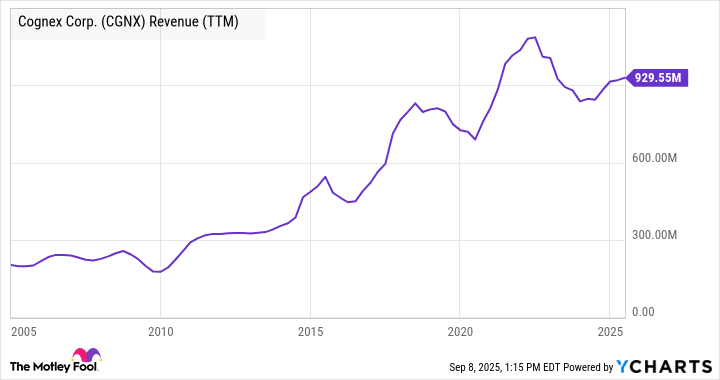

This stock should be viewed as having a higher risk-reward profile than PTC due to the significant cyclicality of its end markets. That’s abundantly clear from the chart of its long-term revenue growth. Cognex offers machine vision technology, with key end markets including consumer electronics, automotive, logistics, and packaging (consumer goods and healthcare).

CGNX Revenue (TTM) data by YCharts.

Cognex’s machine vision solutions allow its customers to conduct high-speed inspections of automated processes (such as factory production and e-commerce logistics) while also monitoring and guiding production. The technology has excellent underlying secular growth prospects. Still, the reality is that when its customers cut back on their investments in production lines or product development, Cognex’s revenue growth will be challenged.

As such, long-term investors should expect the cyclicality of its revenue to continue. Still, they should also expect the long-term revenue uptrend apparent in the chart above to continue. If it does so, the upside potential for the stock is significant.

Joby Aviation and air taxis

This is the option with the highest risk for investors, but also the highest potential rewards. Joby is a leading player in the electric vertical takeoff and landing (eVTOL) aircraft market. It’s also leading the race toward regulatory certification for its small aircraft.

The importance of that last point needs to be emphasized, not least as one of the key plus points of its rivals, like Archer Aviation, is supposed to be that they have an advantage in the race because they are leaning into multiple technology partners, while Joby is following a vertically integrated engineering strategy whereby its engineers develop “much of the aircraft in-house” so that the company can “develop systems and components that are specifically engineered for their intended applications” according to its Securities and Exchange Commission filings.

Yet Joby has the lead in the eVTOL race.

The phrase “vertically integrated” also explains and differentiates its business strategy. Instead of selling its aircraft to third parties, Joby plans to manufacture, own, and operate its aircraft, creating a service along the lines of an Uber for air taxis. Indeed, Uber is an investor in Joby, and the latter now owns the Uber Elevate brand.

Image source: Joby Aviation.

Joby also has a commercial agreement with Delta Air Lines (which is also an investor in it) whereby Delta customers will be able to book an eVTOL to either end of their flight. In addition, Joby has forged an alliance with Toyota, which bought a $250 million stake in it. That should help reassure investors concerned about the risks of Joby largely developing and manufacturing its own aircraft.

While there are no guarantees Joby’s ambitious plans will come to fruition, the company is making real progress on its journey. And it has the backing of powerful investors that are leaders in their respective fields.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Cognex, PTC, and Uber Technologies. The Motley Fool recommends Delta Air Lines. The Motley Fool has a disclosure policy.