Hong Kong is ideally positioned to drive the global climate transition by leveraging its status as an international financial center, and has long stood as Asia’s frontrunner in green and sustainable finance, speakers told a forum on Monday.

“While the world may be facing substantial geopolitical challenges, Hong Kong is fully committed to becoming a reliable and resourceful partner in the global green transformation,” Financial Secretary Paul Chan Mo-po said at the Hong Kong Green Finance Association (HKGFA) annual forum.

The event kicked off this year’s Hong Kong Green Week with a No 8 typhoon warning signal in force as severe tropical storm Tapah pounded the territory with powerful winds and rainstorms on Monday morning. The warning was lowered to a No 3 signal in the afternoon.

READ MORE: HK Green Week, B&R Summit, Macao international fireworks contest

Undeterred by the extreme weather, policymakers, regulators and industry insiders convened at the forum to examine the global climate transition and to discuss strategies for navigating climate finance in an era marked by geopolitical uncertainties.

Delivering his speech, Chan highlighted the special administrative region’s achievements in green finance, saying it has the potential to become a global transition finance hub, which can support “hard-to-abate sectors to decarbonize”.

In the first half of 2025, estimated issuances of sustainable debt in the city reached over $34 billion, up 15 percent from a year earlier, according to Chan. Over 200 ESG (environmental, social and governance) funds have been authorized, with assets under management exceeding $140 billion, marking an increase of more than 50 percent in just three years, he added.

The financial chief also pointed to the recent progress on the Hong Kong Taxonomy for Sustainable Finance, stressing its pivotal role in scaling up capital flows to accelerate green transformation.

Earlier in the day, the Hong Kong Monetary Authority (HKMA) announced the launch of a public consultation to expand the taxonomy, extending sector coverage and including transition finance elements.

The taxonomy serves as a critical tool to classify economic activities based on their alignment with specific sustainability objectives, helping to channel relevant capital flows while mitigating risks of greenwashing.

Ma Jun, HKGFA chairman and president, underscored Hong Kong’s continuing leadership in advancing green finance on various fronts, citing examples such as the city’s alignment of local disclosure standards with the International Sustainability Standards Board, and its issuance of tokenized green bonds.

Ma added that Asia is playing an increasingly important role in the field of green and sustainable finance, with China’s green lending growing 25 percent year-on-year on top of the balance of 40 trillion yuan ($5.61 trillion) in the first six months of 2025, which was the largest in the world.

“Looking ahead, we believe the HKSAR and the Chinese mainland will be well-positioned to play a pivotal role in advancing Asia’s climate leadership,” he said. “Hong Kong has the capability and responsibility to serve as the regional platform for standard-setting, policy dialogue, product innovation, and capacity building.”

READ MORE: Hong Kong seen as critical in advancing Asia’s climate leadership

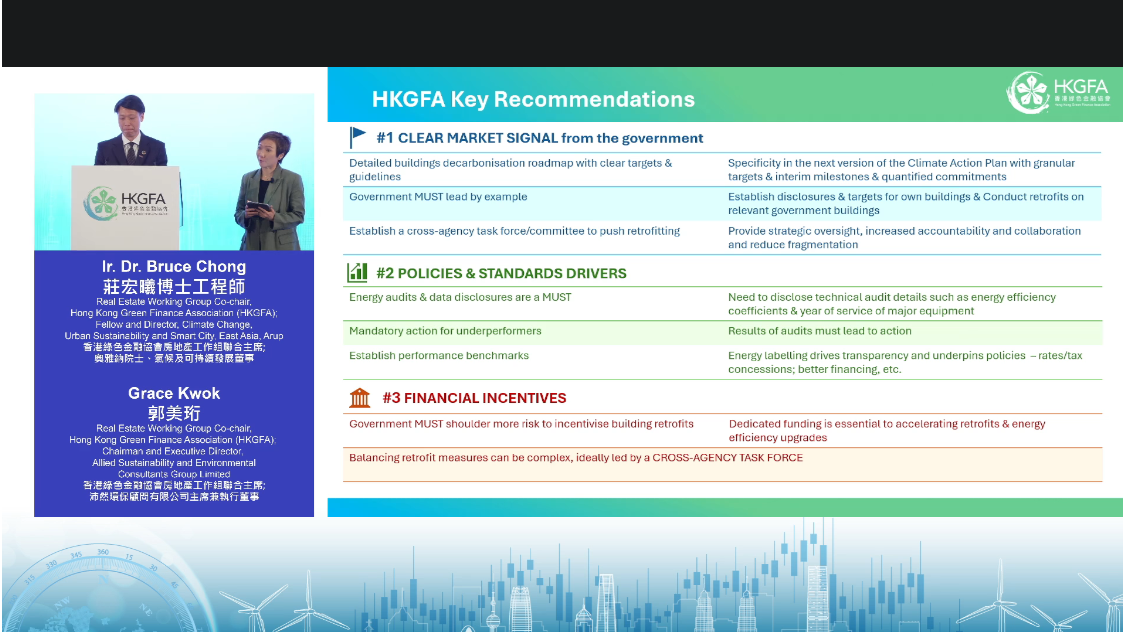

During the forum, the HKGFA also released a report on activating Hong Kong’s retrofitting market, outlining a strategic roadmap to enhance energy efficiency in the city’s building stock.

According to the report, buildings in Hong Kong are responsible for 60 to 65 percent of the city’s total carbon emissions, while energy usage in commercial buildings has risen since 2015. The trend highlights a “critical market failure” due to cost barriers, risk aversion, and a lack of comprehensive policy and financing strategies, the report warned.

To break this stalemate, researchers propose solutions for the HKSAR government, including establishing a cross-agency task force to push retrofitting, introducing mandatory energy audits and data disclosures, as well as providing more financial incentives.

Contact the writer at gabylin@chinadailyhk.com