Potential signal:

- While I don’t necessarily think this will happen on Monday, if we break above the top of the candlestick from the Friday trading session, I would be a buyer of the USD/CAD pair, perhaps even a bigger position than usual, with a stop loss at 1.3833 below.

- My target would be 1.40, which is where I would move to break even.

- My final target might be closer to 1.42 at this point.

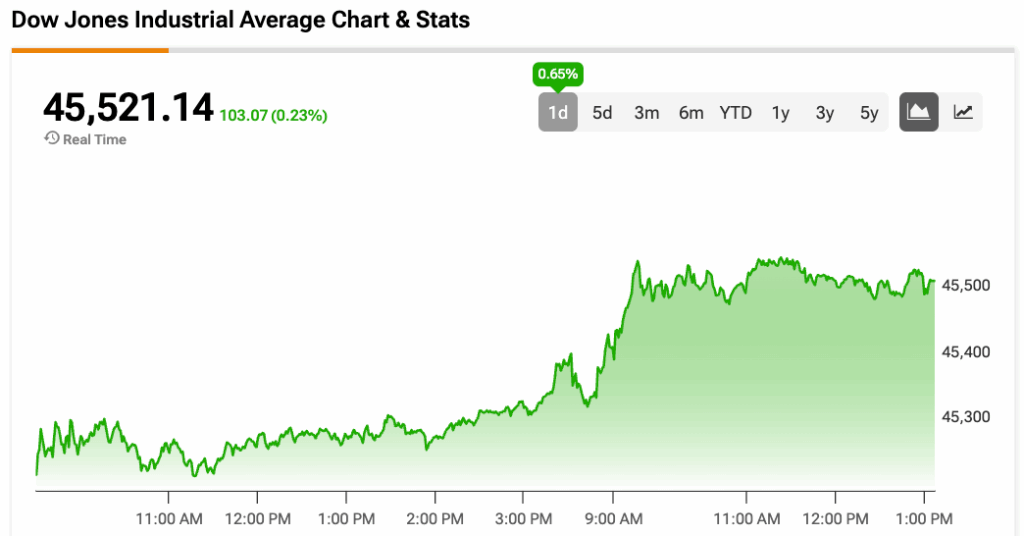

During the Friday session the US dollar fell rather hard against the Canadian dollar after initially trying to rally. All things being equal, this is a market that is worth watching due to the fact that the market has been bottoming for a while, but the fact that Jerome Powell suggested that perhaps they were at least “open to cutting rates” has traders out there thinking that perhaps the US dollar will start to shrink again.

This is the first time Jerome Powell has even remotely suggested that it was a possibility, so course Wall Street has taken off with this situation, and it’s likely that we will continue to see them try to push the Federal Reserve into this corner. That being said, I think at this point in time we have to look very closely at Canada itself, because quite frankly, the United States needs a little bit of a boost, I imagine Canada is in serious trouble. Think about what’s going on at the moment: We have trade tensions between the 2 countries, and 20% of Canada’s GDP comes from exports to the United States. In other words, if Canada is to thrive, they desperately need the US to do the same. This is the way it is under normal circumstances, and we are most certainly not in normal circumstances.

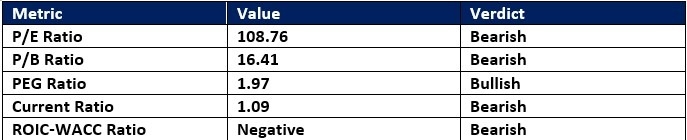

Technical Analysis

The technical analysis is a bit confusing at the moment, because we are from a longer-term standpoint bullish, from an intermediate standpoint bearish, and from a short-term standpoint somewhat bullish. After all, we had broken to the upside, but it looks like the 200 Day EMA is going to continue to cause a few problems. If we can break above the top of the candlestick for the Friday session, then I think that would be a very ugly turn of events for the Canadian dollar, and we could see the US dollar truly take off.

Keep in mind, this is a situation where this is the initial “knee-jerk reaction” that everybody is looking at, and that isn’t always the best move. While it does make a certain amount of sense for the US dollar lose strength against some currencies, Canada might be a bit of a different scenario.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.