Following a less-than-expected earnings announcement on August 21, 2025, Walmart (WMT) experienced a 4% decline in its stock price, juxtaposed with a 7.21% overall increase in the last month. This uptick could reflect positive sentiment from its comprehensive buyback activities and robust partnership announcements, including collaborations with AN Supps and Pure Protein. While broader market conditions showed volatility, with the S&P 500 seeing a streak of declines and awaiting Fed Chair Powell’s speech, Walmart’s engaged strategy with new product offerings and solid earnings growth might have contributed to its overall positive month, countering broader market trends.

The recent decline of 4% in Walmart’s share price following its earnings announcement contrasts the company’s 7.21% monthly increase, showing how immediate-term results can occasionally diverge from broader investor sentiment. This pricing shift comes amidst Walmart’s expansive buyback strategies and new partnerships, which may bolster long-term faith even if short-term market reactions are mixed. Over the past five years, Walmart achieved a total shareholder return, including dividends, of 152.39%. In comparison, Walmart outperformed the US Consumer Retailing industry and the broader US Market over the past year, underscoring its resilience in a fluctuating market environment.

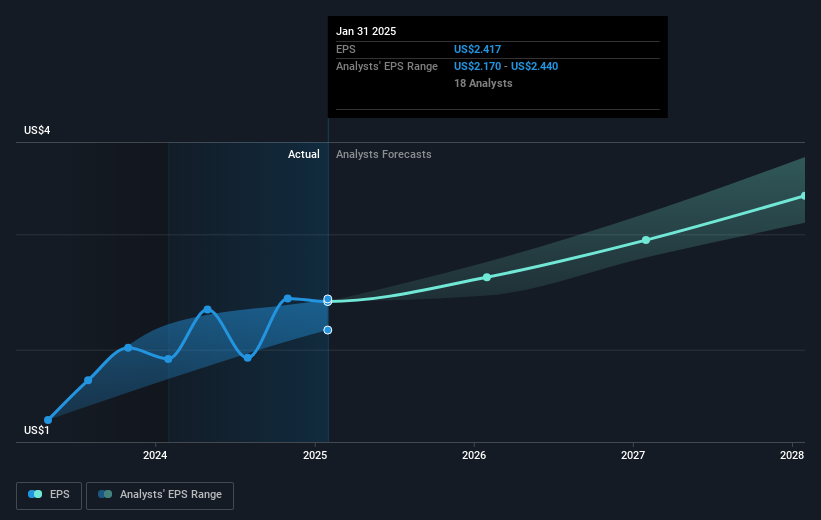

The news concerning Walmart’s strategic advancements and partnerships could influence future revenue and earnings positively. Investments in supply chain automation and ventures in e-commerce are poised to enhance operational efficiencies, striving for sustained growth. Analysts currently project Walmart’s revenue to increase to $775.20 billion by 2028, with earnings anticipated to reach $25.60 billion. Against the current share price of US$102.57 and a consensus price target of US$110.95, the stock’s 8.17% mark up to its price target suggests the potential for an upward adjustment, based on the fulfillment of forecasted growth metrics. However, this projected growth relies on successful execution against identified risks, including cost management and international expansion efficacy.

Assess Walmart’s future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com