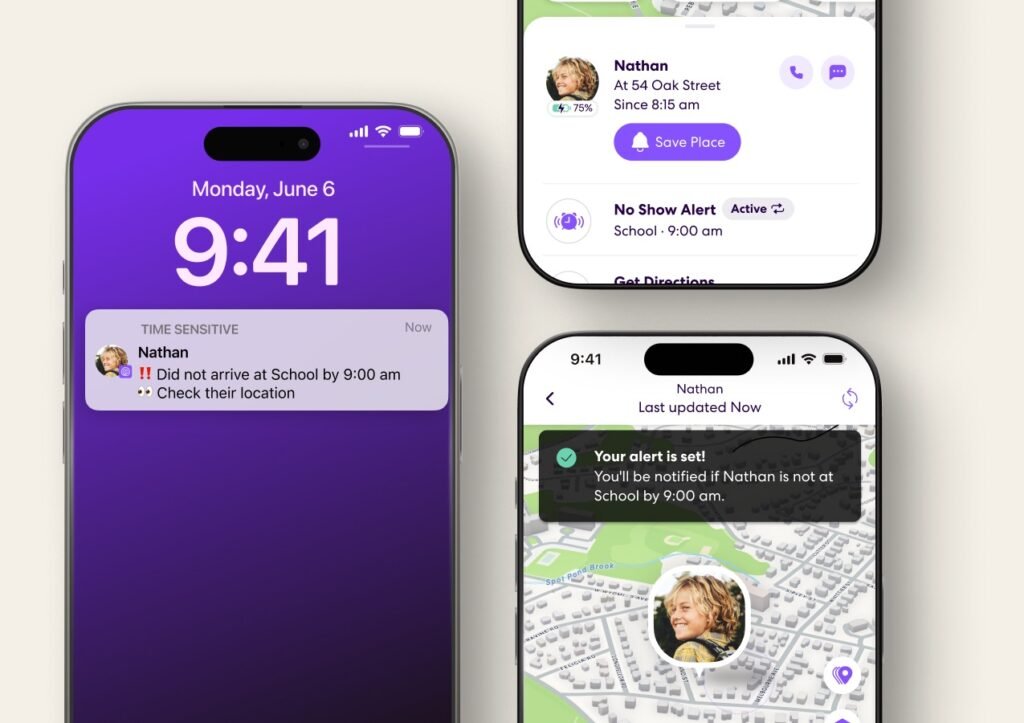

Consumers typically rely on a diverse array of apps to manage their financial lives: a mobile banking app for their current account, a digital wallet for payments, a separate app for stock trading, another for budgeting, and yet another for insurance.

Each app, while excellent in its specific function, exists in a silo, forcing the customer to be the integrator of their own financial ecosystem. This “app store” model, however, is now being challenged by a powerful, consolidating force: the financial super app.

A financial super app is a single, all-in-one platform that seamlessly integrates a wide range of financial services, often extending into adjacent lifestyle and commerce features. Think of a platform that allows you to pay a friend, trade stocks, buy insurance, book travel, and get a loan, all within a single application. While this model has long been dominant in Asia with giants like WeChat and Alipay, its emergence in the UK and US is signaling a new frontier for digital banking, one that promises to fundamentally reshape customer experience, competition, and innovation.

![]() “The era of fragmented financial apps is ending. The financial super app is a game-changer, consolidating services into a single ecosystem. This isn’t just about convenience; it’s about a new battle for customer loyalty where integration and data are the ultimate weapons.”

“The era of fragmented financial apps is ending. The financial super app is a game-changer, consolidating services into a single ecosystem. This isn’t just about convenience; it’s about a new battle for customer loyalty where integration and data are the ultimate weapons.”

The Super App Model: From a Single Service to a Seamless Ecosystem

The super app model is not just about bundling services; it is a strategic approach built on a foundation of user data and network effects. It typically begins with a highly engaging and frequently used core function—often payments or social messaging—and then gradually expands into other services.

The key drivers behind the super app’s power are:

- Customer Convenience: It eliminates the need for users to download and manage multiple apps, simplifying their digital life and providing a single, consistent user interface for all their financial needs.

- Data-Driven Insights: By aggregating a user’s entire financial and behavioral data in one place, the super app can leverage AI and machine learning to offer hyper-personalized products, proactive financial advice, and contextual recommendations that are impossible for a single-service app to provide.

- Network Effects: The more users and services that join the ecosystem, the more valuable the app becomes. A robust payment network, for example, attracts more merchants, which in turn attracts more users, creating a virtuous cycle of growth.

- Customer Loyalty: A super app becomes an indispensable part of a user’s daily routine, leading to deeper engagement and higher customer loyalty that is difficult for a competitor to replicate.

The UK and US Landscape: The Challenge and the Opportunity

The journey towards super apps in the UK and US is different from Asia. The market is more mature, regulations are more fragmented, and consumers are deeply entrenched in the traditional banking system. However, several key players are actively pursuing this model:

- Challenger Banks: Fintechs like Revolut in the UK have successfully evolved from a multi-currency travel card into a platform offering everything from current accounts and stock trading to crypto and insurance. They are building a strong, digitally native user base that is highly receptive to the super app model.

- Payments Platforms: Platforms like PayPal and its subsidiary Venmo have a strong foundation in peer-to-peer payments and a massive user base. They are actively expanding into new financial services, such as high-yield savings accounts and buy-now-pay-later (BNPL) options, leveraging their network to become a central financial hub.

- Traditional Banks: Recognizing the threat, some established banks are adopting a “bank-as-a-platform” strategy, creating their own app ecosystems or partnering with fintechs to integrate third-party services into their own digital channels. This defensive move aims to retain customer loyalty by offering a consolidated experience.

The Impact on the Financial Ecosystem

The rise of financial super apps has profound implications for every player in the financial services industry:

- Payments Become a Feature, Not a Product: In a super app, payments are not the final destination but the foundation. They become a frictionless, invisible layer that enables commerce and other services, changing the competitive dynamic for payments providers.

- Increased Competition: Super apps blur the lines between traditional banking, investing, and commerce. This puts direct pressure on incumbent banks, who must decide whether to compete directly by building their own ecosystem or collaborate by becoming a strategic partner within a super app’s platform.

- The New Battleground is Data: The super app’s primary asset is not just its technology but its rich, aggregated data. This gives them an unparalleled ability to understand customer behavior and deliver hyper-personalized services, raising the bar for every competitor in the market.

- Reshaping the Role of Fintechs: For fintech startups, the super app model creates both a challenge and an opportunity. They must either build a compelling enough service to attract a large user base to their own platform or build a niche service that can be seamlessly integrated into a larger super app ecosystem via open APIs.

- Regulatory Scrutiny: As these platforms consolidate vast amounts of financial and personal data, they will come under intense regulatory scrutiny for issues of data privacy, consumer protection, and market power. Regulators in the UK and US are already grappling with how to oversee these new, hybrid financial entities.

Challenges and the Path Forward

While the super app model’s potential is clear, its success in the UK and US is not guaranteed. Challenges include:

- Consumer Behavior: Unlike in Asia where super apps emerged from a less-developed financial infrastructure, UK and US consumers are already accustomed to a fragmented, “best-of-breed” app ecosystem. Changing these ingrained habits will be difficult.

- Regulatory Hurdles: The absence of a single regulatory body to oversee these all-in-one platforms creates a complex operational environment.

- Building Trust: Financial super apps, which hold a customer’s money, data, and social interactions, must build an unparalleled level of trust with their users. A single data breach or privacy scandal could be catastrophic.

The Future of Finance is All-in-One

The rise of the financial super app is more than a fleeting trend; it is the fundamental trajectory of digital banking. It represents the logical endpoint of a decade of digital transformation, driven by the consumer’s desire for simplicity, convenience, and a more integrated financial life.

For financial institutions and fintechs, the message is clear: the future is about moving beyond a single service to creating a seamless, all-in-one ecosystem that captures a customer’s entire financial journey. Whether by building their own super app, or by becoming an indispensable service within one, the players that succeed in this new era will be those that embrace integration, leverage data intelligently, and build a platform that is not just a tool for money, but a central hub for life.