Palantir already has a ton of growth priced into its stock.

Palantir (PLTR -2.14%) has been one of the top artificial intelligence (AI) stocks to own in 2025. The stock is up an astounding 144% as of the time of writing, and shows no signs of slowing down. Impressive financial results are fueling its stock rise, as Palantir continues to blow expectations out of the water quarter after quarter.

Several strong tailwinds are blowing in Palantir’s favor, but can they keep propelling the stock to new heights over the next three years? Let’s take a look.

Image source: Palantir.

Palantir’s platform is powering decisions in multiple industries

Palantir’s AI platform was originally intended for government use, and it established a solid foothold in that industry before expanding to the commercial side. While the government side of its business is still strong and makes up the majority of its revenue, Palantir’s commercial offerings have also done quite well, especially in the U.S.

Palantir’s products allow its clients to take in massive data streams, process them through AI, and then deliver actionable insights that help people make the most informed decisions possible. Additionally, with its AIP (artificial intelligence platform) product, users can automate tasks and deploy AI agents to assist with this process.

This strong offering has led to incredible growth, with revenue rising 47% year over year to $451 million on the commercial side and 49% year over year to $553 million for its government clients. That results in a combined 48% growth rate for the second quarter, and there are really no signs of slowing down.

If Palantir can keep that up, the stock will likely grow at a similar rate — if it is priced at a reasonable level. That’s a big if, because Palantir’s stock is quite expensive.

Palantir’s stock has gotten very expensive

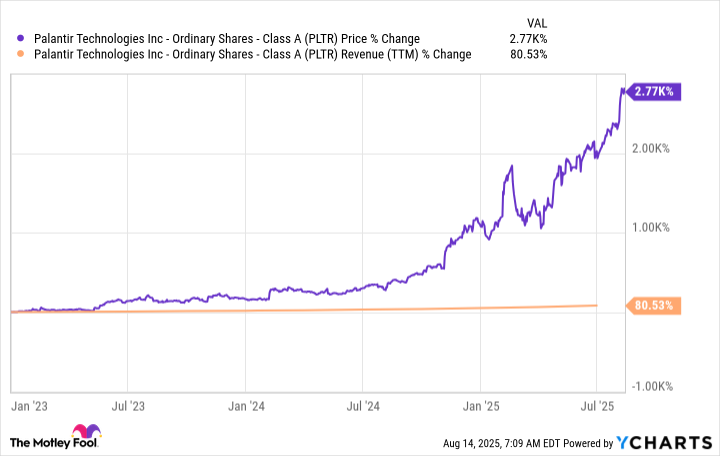

Since 2023, Palantir’s revenue has risen by around 80%, while the stock is up more than 2,700%.

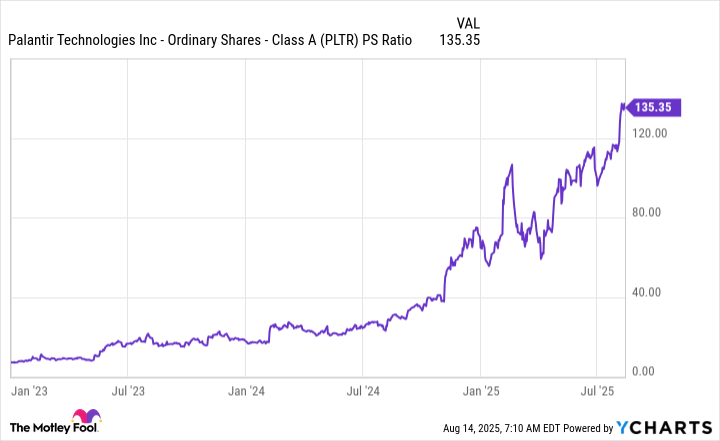

That’s an odd stat, and points to Palantir’s valuation rising drastically. At 135 times sales, Palantir’s stock is undoubtedly one of the most expensive on the market.

PLTR PS Ratio data by YCharts. P/S = price-to-sales.

This means that there is significant growth already baked into the stock, and that could be a large headwind for Palantir moving forward. But what could its stock price be in three years?

Let’s say that Palantir’s growth rate accelerates to 50% and it maintains that rate over the three-year analysis period. If Palantir can achieve a 35% profit margin (a very high level for software companies), then it would generate about $11.6 billion in revenue and $4.1 billion in profits. That’s a sizable jump from today’s $3.4 billion in revenue and $773 million in profits, but at today’s valuation, it would still yield an expensive stock.

If we assigned a very high multiple of 50 times forward earnings, that would value Palantir at a market cap of $205 billion. At today’s current share count, that would price Palantir’s stock at $86.30, under half of its current price. That’s a massive decline, but it shows that there’s well over three years of growth baked into Palantir’s stock price already.

Palantir isn’t a bad company by any means. The growth that it’s displaying is phenomenal, and it’s a clear leader in AI technology. However, the market has gotten ahead of itself and has baked several years of growth into Palantir’s stock price. This will cause headwinds for the stock over the next few years, and may cause it to underperform the market even though it’s growing at such a rapid pace.

As a result, I think investors should look at alternative AI companies that don’t have near the growth rate baked into the stock price that Palantir does.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.