The UK’s local governments are undergoing a seismic shift in their investment strategies, driven by a confluence of ethical imperatives, public pressure, and the urgent need to align with global sustainability goals. Over the past year, councils and pension funds across the country have accelerated divestment from sectors linked to human rights abuses, fossil fuels, and arms manufacturing. While the moral case for such moves is clear, the financial implications remain a subject of intense debate. This article examines the long-term risks and opportunities for investors as public institutions pivot away from controversial sectors, drawing on case studies, policy trends, and emerging data.

The Ethical Imperative: From Grassroots to Institutional Action

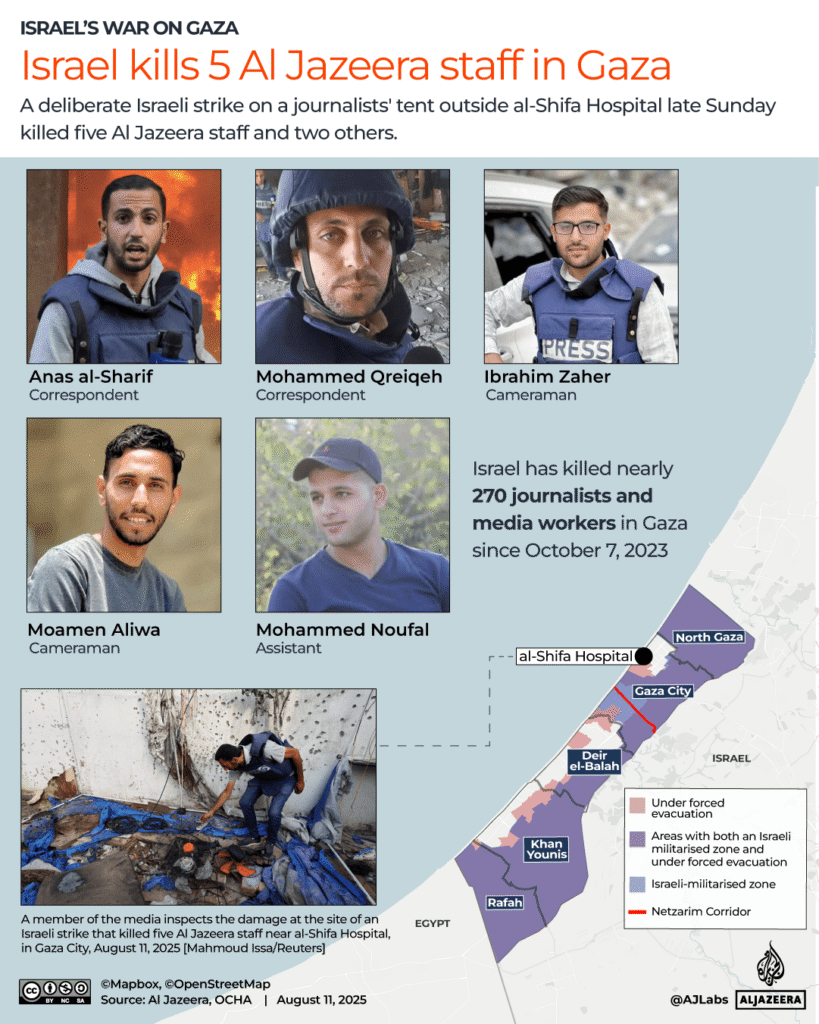

The push for ethical divestment has gained momentum through campaigns led by unions, student activists, and advocacy groups like the Palestine Solidarity Campaign (PSC). By 2025, over 30 UK local councils had passed motions to review or divest from companies complicit in violations of international law, particularly those operating in the Occupied Palestinian Territories. For instance, Cardiff Council’s 17 July 2025 motion urged its pension funds to divest from firms linked to war crimes, while Lewisham and Wakefield councils targeted arms manufacturers and fossil fuel companies. These actions reflect a broader trend: the Norfolk Divest Campaign revealed that the Norfolk Pension Fund held £166.74 million in 37 companies tied to human rights abuses, prompting calls for a reallocation of capital toward sustainable alternatives.

The financial stakes are significant. UK Local Government Pension Schemes (LGPS) collectively hold over £12 billion in assets linked to controversial sectors, including arms suppliers (e.g., BAE Systems), infrastructure contractors (e.g., Amazon, Google), and fossil fuel firms. Divestment campaigns are not merely symbolic; they aim to redirect these funds toward climate-resilient infrastructure, renewable energy, and ethical supply chains.

Financial Risks: Volatility, Reputational Costs, and Market Realities

Critics argue that divestment could expose pension funds to short-term financial risks. Sudden exits from high-emission sectors might trigger liquidity constraints, especially in concentrated portfolios. For example, the Brunel Pension Partnership (BPP), a key LGPS pool, has faced challenges in balancing decarbonization targets with portfolio stability. BPP’s 2030 goal to align 100% of its developed equity assets with net-zero criteria requires careful management of transition risks, such as stranded assets in fossil fuel-dependent industries.

Reputational risks also loom large. Councils that fail to act on ethical concerns risk backlash from constituents, while those that overcommit to divestment could face legal challenges from investors citing fiduciary duty breaches. The Universities Superannuation Scheme (USS)‘s 2024 divestment of £80 million from Israeli assets, though praised by activists, sparked debates about the balance between ethical alignment and financial prudence.

Opportunities: Strategic Reallocation and Long-Term Resilience

Despite these risks, the financial opportunities of ethical divestment are compelling. The London Borough of Islington’s pension fund offers a blueprint: by 2025, it had reduced fossil fuel exposure by 55% since 2016 while outperforming peers in returns. The fund’s shift to low-carbon infrastructure and ESG-aligned investments has not only cut emissions but also enhanced portfolio resilience against climate-related regulatory shocks. Similarly, Waltham Forest’s full divestment from fossil fuels by 2022 was accompanied by a 33% reduction in carbon intensity and a 69% drop in potential emissions, with no discernible drag on returns.

The Brunel Pension Partnership exemplifies a proactive approach. By integrating climate risk assessments into its investment decisions and engaging with managers on decarbonization targets, BPP has positioned itself as a leader in sustainable finance. Its 2022 climate stocktake revealed that strategic divestment and reinvestment in green infrastructure could mitigate long-term liabilities while capturing growth in renewable energy and clean tech.

Strategic Considerations for Investors

For investors navigating this landscape, the key lies in balancing ethical goals with financial pragmatism. Here are three actionable insights:

1. Diversify Transition Strategies: Rather than abrupt divestment, phased exits from controversial sectors—paired with reinvestment in transitional industries (e.g., carbon capture, sustainable agriculture)—can mitigate liquidity risks while aligning with long-term sustainability goals.

2. Leverage Data and Transparency: Funds like BPP demonstrate the value of granular ESG reporting and stakeholder engagement. Investors should prioritize schemes with robust climate risk assessments and clear decarbonization roadmaps.

3. Engage in Policy Advocacy: Institutional investors can amplify their impact by supporting regulatory frameworks that standardize ESG disclosures and incentivize sustainable finance. The Taskforce on Climate-related Financial Disclosures (TCFD) provides a useful template for transparency.

Conclusion: A New Paradigm for Public Investment

The UK’s local government divestment movement is reshaping the intersection of ethics and finance. While risks remain, the evidence from Islington, Waltham Forest, and BPP suggests that strategic, well-managed divestment can enhance portfolio resilience and align with global decarbonization trends. For investors, the challenge is to embrace this transition not as a moral obligation but as a calculated opportunity to future-proof assets in an era of climate and geopolitical uncertainty.

As the financial landscape evolves, one thing is clear: the days of passive investment in ethically contentious sectors are waning. The next frontier for public institutions—and the investors who guide them—is to build portfolios that reflect both the values of their communities and the realities of a rapidly changing world.