Artificial intelligence (AI) infrastructure investments are on the rise, and one Nvidia partner is uniquely positioned to take advantage of the trend.

Back in October, a data center company known as Nebius Group (NBIS 1.77%) listed on the Nasdaq stock exchange. At the time, the company was relatively unknown and did not experience much investor enthusiasm during its public offering.

The reason for this is that Nebius was not a high-profile start-up that investors were anxiously waiting to go public. Rather, Nebius was a spinoff from a Russian internet conglomerate, called Yandex. Following its listing on the Nasdaq, Nebius completed a $700 million private placement that caught the interest of semiconductor powerhouse Nvidia.

Throughout 2025, Nebius has worked closely with Nvidia as the company is playing an important role in equipping data centers with Nvidia’s latest Blackwell GPU architecture. In addition, Nebius has several other business segments spanning various pockets of the artificial intelligence (AI) realm, including software applications and autonomous driving.

In my eyes, this diversified ecosystem draws parallels to Amazon. Let’s explore how Nebius could emerge as the Amazon of the AI infrastructure market and assess if now is a good time to buy the stock.

Nebius and the neocloud

Nebius is emerging as a major player in the neocloud market. Similar to CoreWeave and Oracle, Nebius offers AI infrastructure as a service. Essentially, the company outfits data centers with Nvidia GPU architectures and subsequently rents access to this infrastructure to other businesses.

In some ways, this is not dissimilar to the objective of Amazon’s cloud computing platform, Amazon Web Services (AWS). AWS allows developers to build and scale applications on Amazon’s infrastructure, stored in data centers spread across the globe. Today, Nebius’ AI infrastructure reach includes data centers in New Jersey, Kansas City, Iceland, Finland, France, the United Kingdom, and Israel.

According to the company’s financials, Nebius’ core infrastructure platform boasted a $249 million annual recurring revenue (ARR) run rate at the end of the first quarter. While this might seem small compared to the multibillion-dollar deals of its rivals, Nebius guided that its ARR run rate should be in the range of $750 million to $1 billion by the end of the year.

Considering Nebius has only been operating as a standalone entity for less than a year, I see the company’s growth as quite impressive and am optimistic that it can continue to scale as Nvidia releases subsequent GPU architectures in the coming years.

Image source: Getty Images.

Nebius has much more than data centers going for it

Beyond the core infrastructure business, Nebius operates across three subsidiaries: Avride, Toloka, and TripleTen.

Avride develops autonomous vehicles and delivery robots. The company currently has a fleet of delivery robots operating in Tokyo thanks to a partnership with Rakuten (which some call the “Amazon of Japan”).

In addition, Avride is working closely with Hyundai and Uber Technologies to help develop a fleet of robotaxis, which are expected to launch later this year in Dallas. I see some similarities in Nebius’ foray into the autonomous vehicle and the delivery opportunities to Amazon’s investments in robotaxi company, Zoox.

Toloka is a data-labeling platform similar to Scale AI. Companies such as Anthropic, Amazon, Shopify, and Microsoft are customers of Toloka and use the company’s software across various generative AI applications.

TripleTen is an online education platform that offers boot camps across a variety of in-demand services such as cybersecurity, data science, and software engineering.

While Toloka and TripleTen do not directly compete with Amazon per se, AWS does offer some overlapping features through products such as Amazon Mechanical Turk and Amazon SageMaker.

Is Nebius stock a buy right now?

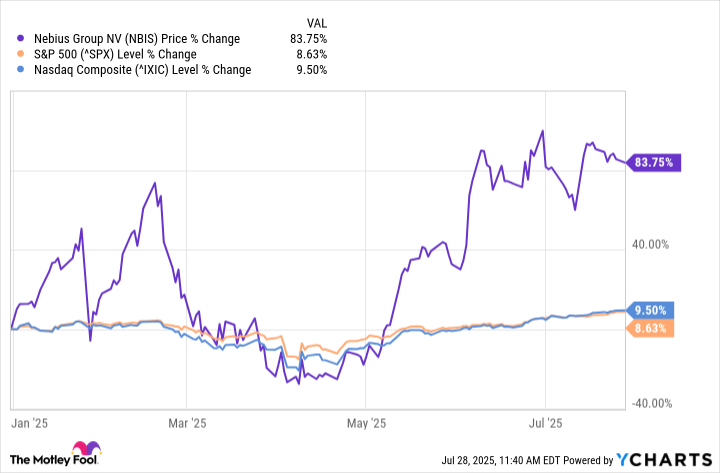

As of July 28, shares of Nebius have soared by 84% so far this year — absolutely trouncing the returns seen in the S&P 500 and Nasdaq Composite.

If you take these returns at face value, you might think that Nebius stock has too much momentum behind it right now. In my view, there is more than meets the eye with Nebius’ share price action, though.

As the chart above illustrates, Nebius stock plummeted earlier this year as the broader technology industry experienced a hefty drawdown on the heels of tariff-driven uncertainty.

However, following the CoreWeave initial public offering (IPO) in late March combined with renewed investor enthusiasm following some positive first-quarter earnings back in May, Nebius stock started to witness a sharp rebound.

My main point here is that both the extreme selling and buying of Nebius stock this year appears to be rooted more in broader macro elements than anything specifically tied to the company. I don’t think these dynamics will last much longer, though. Goldman Sachs recently initiated a buy rating on Nebius, placing a $68 price target on the stock, which implies 33% upside from current trading levels.

To me, Nebius could be seen in a similar light as Amazon. While both companies operate critical cloud-based applications, each is also seeking to disrupt AI across various other infrastructure platforms. I see Amazon and Nebius as ubiquitous businesses building uniquely positioned ecosystems across different pockets of the AI infrastructure landscape.

Given Nebius’ various businesses are still in the early stages of scaling, I think the company has much more room to run in the long term. For this reason, I see Nebius stock as a no-brainer right now.

Adam Spatacco has positions in Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Amazon, Goldman Sachs Group, Microsoft, Nvidia, Oracle, Shopify, and Uber Technologies. The Motley Fool recommends Nebius Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.