aapl

Markets absorbed a historic Fed split and shifting interest rate expectations just as Apple and Amazon prepare to release closely watched…

•

Last updated: Thursday, July 31, 2025

Quick overview

- The Federal Reserve held interest rates steady but experienced a rare split among its members, with two dissenting for a rate cut.

- Market expectations for a September rate cut have shifted significantly, dropping from 68% to 49% after Fed Chair Powell’s comments.

- Attention is now on Apple and Amazon as they prepare to release earnings, with analysts forecasting modest growth for both companies.

- In the cryptocurrency market, Bitcoin rebounded strongly after a brief dip, while Ethereum is gaining momentum ahead of its upcoming upgrade.

Live AAPL Chart

[[AAPL-graph]]

Markets absorbed a historic Fed split and shifting interest rate expectations just as Apple and Amazon prepare to release closely watched earnings results.

Fed Holds, But Rare Split Fuels Debate

The Federal Reserve left interest rates unchanged in its latest policy decision, but an unexpected split within the committee shifted the tone dramatically. For the first time in over 30 years, two voting members—Governors Michelle Bowman and Christopher Waller—dissented, favoring an immediate 25-basis-point cut. Nine members supported the hold, while one voter was absent.

Chair Jerome Powell highlighted growing cracks in the labor market, particularly the slowing pace of private-sector job creation. Although June’s job gains appeared strong on the surface, Powell noted they were mostly government-led—a dynamic that makes this Friday’s payroll data even more significant. Despite early signs of consumer softening, Powell said the economy remains solid overall, and inflation is still above the 2% goal.

September Cut Odds Recalibrate Sharply

Powell refused to endorse any imminent easing, emphasizing that two more jobs and inflation reports would shape the Fed’s September decision. Following his remarks, futures markets pulled back expectations: the probability of a September rate cut dropped from 68% to 49%, and October’s odds slipped to 69%.

The U.S. dollar climbed broadly on the shift, finishing the session stronger against nearly all major peers, with several currency pairs ending the day near key extremes.

Canada Joins the Chorus of Caution

The Bank of Canada also opted to keep interest rates unchanged. Governor Tiff Macklem cited persistent trade policy uncertainty—especially around U.S. tariffs—and said volatility would likely linger even if a formal deal is reached. The BoC is now adopting a meeting-by-meeting approach.

Key Market Events Today

Meanwhile, markets are turning their focus toward the Bank of Japan’s two-day meeting ending July 31. The central bank is widely expected to leave its short-term rate at 0.5%, with no major shift anticipated until at least the autumn. The BOJ will also update forecasts for real GDP and core CPI.

All Eyes on Apple and Amazon Earnings

With rate drama unfolding, attention now turns to two of the market’s biggest movers: Apple and Amazon. Both are set to report earnings as investors weigh Big Tech’s resilience in a higher-rate world.

Apple (AAPL) Q2 Earnings Preview

Apple is expected to post modest growth for Q3 FY25, with earnings per share projected at $1.42–$1.43, up slightly from $1.40 a year ago. Revenue is forecast in the $88.92–$89.18 billion range, consistent with Apple’s guidance of “low to mid-single-digit” year-over-year growth. Margins could be pressured, however, with a $900 million drag anticipated from recent tariffs, bringing gross margins to around 45.5%–46.5%.

Amazon (AMZN) Q2 Snapshot

Analysts expect Amazon to report $162.1 billion in revenue—a 9.5% increase from last year—along with earnings per share of $1.33, up 5.6% year-over-year. After a 44% rally off April lows, the stock is nearing previous highs, and the company’s performance may serve as a bellwether for broader e-commerce and cloud trends in Q3.

Last week, markets were slower than what we’ve seen in recent months, with gold retreating and then bouncing to finish the week unchanged. EUR/USD slipped toward 1.16, while S&P and Nasdaq continued higher. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

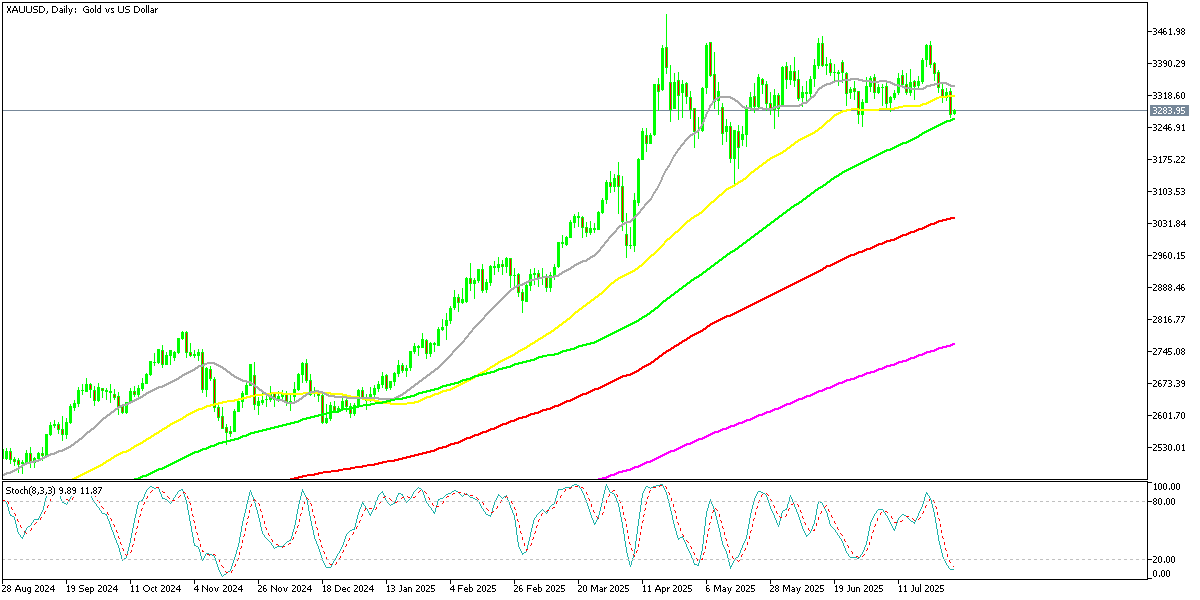

Gold Returns Below $3,300

Gold rebounded off its 20-week moving average near $3,150, climbing nearly $50 to finish around $3,438/oz. Still, after failing to hold above $3,400 post-U.S.-Japan trade talks, gold appears stuck in a consolidation phase below the $3,500 resistance. Traders await fresh inflation clues or remarks from the Fed to trigger the next move.

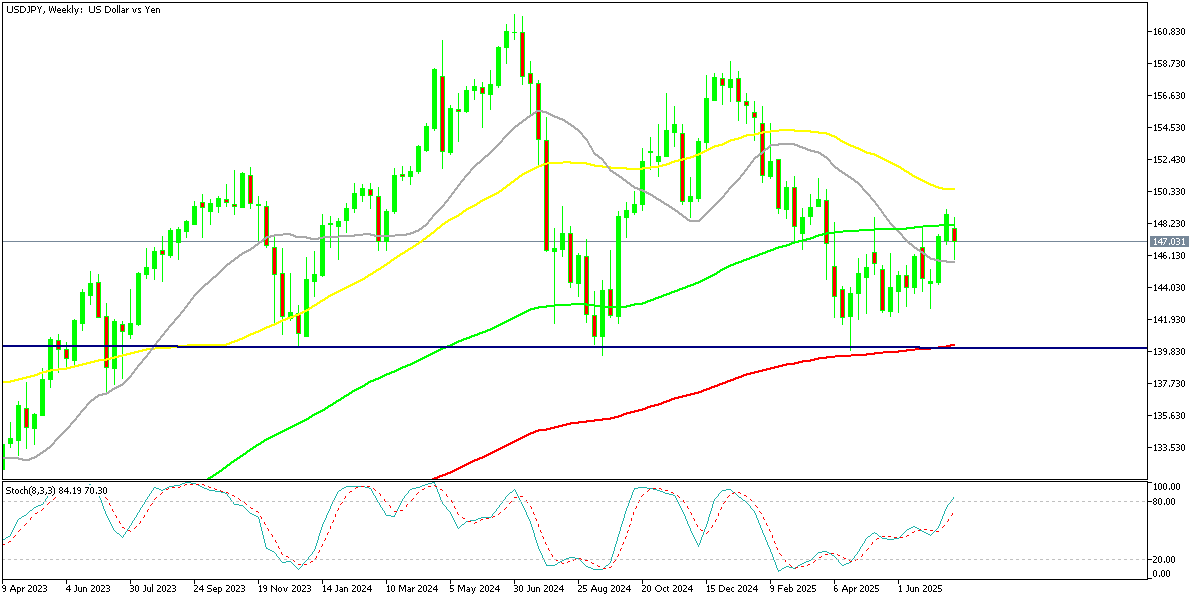

USD/JPY Returns Below the 100 Weekly SMA After Japanese Elections

USD/JPY Breakout Challenges BoJ Forecasts

The U.S. dollar surged past the 148 yen threshold, surprising many who expected further yen strength. This rally also took the pair above the 100-week moving average, a significant technical barrier often viewed as a long-term resistance level.

Fueling the move is a wave of Japanese capital seeking returns abroad, which is complicating the Bank of Japan’s policy outlook. If the pair manages to close the week firmly above this level, it could reinforce sentiment in favor of the dollar and reignite discussions around the policy gap between the Federal Reserve and the Bank of Japan.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Rebounds Strongly After Brief Breakdown

Bitcoin momentarily slipped under $113,000 earlier in the week but quickly reversed course, bouncing back above $120,000 with notable force. The dip triggered strong buying interest as the cryptocurrency tested its 50-day moving average, while further support held at the 20-week SMA.

Market participants appear to be treating these pullbacks as opportunities to reenter, especially amid ongoing uncertainty in traditional markets. Bitcoin’s recovery suggests continued appetite for digital hedges in times of macro volatility.

BTC/USD – Weekly chart

Ethereum Inches Closer to $4,000

Ethereum has recently outshone Bitcoin, rising 20% since April and breaking decisively above its 100-week moving average. The rally is being fueled by growing optimism over the upcoming “Pectra” upgrade, which is expected to significantly improve Ethereum’s scalability and transaction efficiency.

This upgrade has caught institutional attention, with increased inflows supporting the bullish momentum. Now targeting the $4,000 level, Ethereum is regaining favor as a high-conviction bet in the crypto space.

ETH/USD – Daily Chart

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank’s local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.