Société Générale’s Albert Edwards, famed for calling the dot-com bubble leading up to the 2000 crash, is again warning investors of a potentially painful plunge ahead.

In his latest note to clients this week, Edwards said US stocks and home prices are in an “everything bubble” that he thinks could soon pop.

Stock valuations are indeed steep. The Shiller cyclically-adjusted price-to-earnings ratio sits at 38, one of its highest levels ever, and both the trailing and forward 12-month PE ratios of the S&P 500 are historically high.

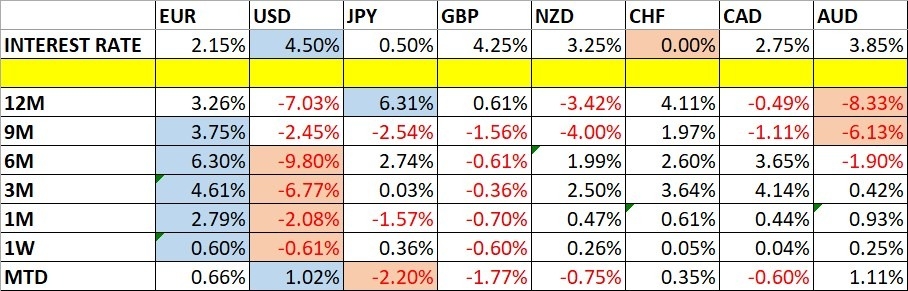

To Edwards, this doesn’t sit well with the fact that long-term interest rates have been on the rise. Rising long-end government bond yields tend to weigh on stock-market valuations as investors can find attractive returns without taking on the high level of risk in the stock market.

Societe Generale

Yet US stocks have seen a robust rally in recent years, gaining 78% since October 2022 lows. The market’s high valuations have kept future estimated equity-market yields low. When stocks are more cheaply valued, they can expect higher future returns, and vice versa.

Societe Generale

“It is notable how the US equity market has been able to sustain nose-bleed high valuations despite longer bond yields grinding higher,” Edwards wrote. “I don’t expect it’ll be able to ignore it much longer.”

On housing, Edwards said that the home price-to-income ratio in the US has been virtually flat over the last few years following the pandemic bump, while the ratio has dropped in countries like the UK and France.

Societe Generale

“The US is the only market in which house price/income ratios have NOT de-rated since 2022 as bond yields have risen. Is the US housing market also exceptional relative to Europe? No, it’s nonsense and, in time, investors will come to claim they knew that all along,” Edwards wrote.

Related stories

Business Insider tells the innovative stories you want to know

Business Insider tells the innovative stories you want to know

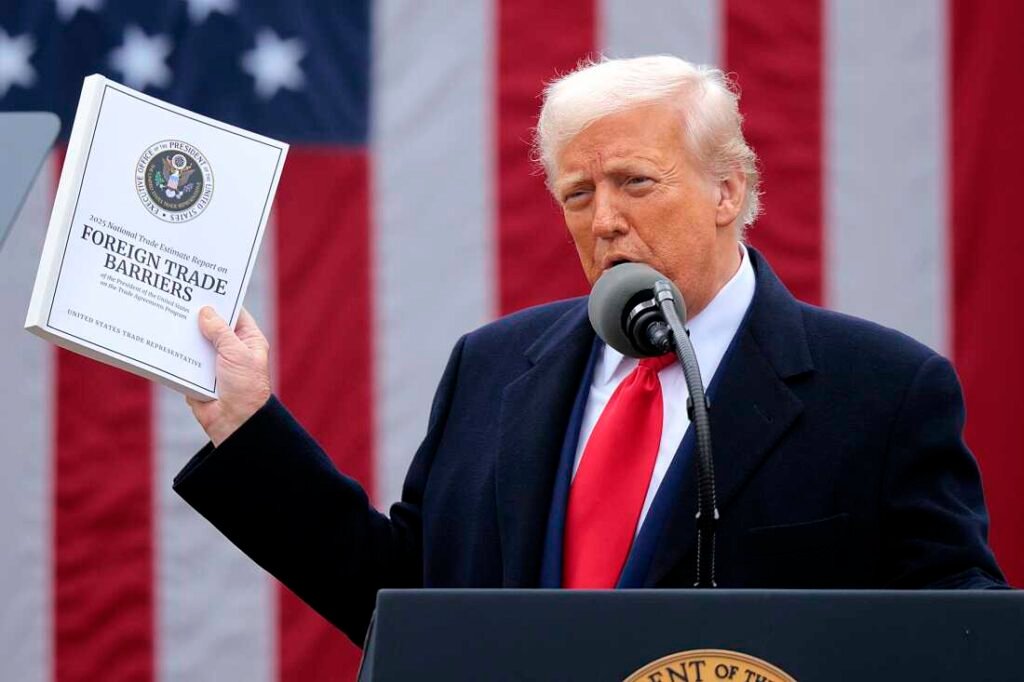

As for what could cause the potential bubbles in US stocks and home prices to burst, Edwards said to watch Japan.

“In the wake of the ruling party coalition losing its Upper House majority, concerns in the bond market about the risks of further fiscal easing and high inflation are growing,” he wrote.

Higher inflation in Japan could mean higher interest rates and a further unwinding of the Japanese yen carry trade, in which foreign investors borrowed cheaply in yen and converted to dollars to buy higher-yielding US assets. In 2024, the Bank of Japan unexpectedly hiked rates, roiling global markets as investors liquidated assets they had bought with borrowed yen.

In May, Edwards warned rising interest rates in Japan could cause a “global financial Armageddon.”

Edwards publishes his notes, which regularly express a bearish outlook, under Société Générale’s “alternative view,” separate from the bank’s house view.

“A lot of clients who totally disagree with me like to read my stuff,” he told Business Insider in May. “It’s a reality check.”