Image for representation only

| Photo Credit: Reuters

The rupee depreciated 2 paise to 86.40 against the U.S. dollar in early trade on Wednesday (July 23, 2025), amid outflow of foreign funds and higher crude oil prices.

According to forex traders, positive sentiment in domestic equity markets capped a sharp fall in the rupee even as the American currency strengthened after the U.S. announced a trade deal with Japan.

At the interbank foreign exchange, the domestic unit opened weak at 86.46 and recovered slightly to trade at 86.40 against the greenback in initial deals, 2 paise lower from its previous closing level.

At the end of Tuesday’s trading session, the local unit settled at 86.38, down 7 paise over its previous close. This was the rupee’s fifth straight session of decline since July 16 when the unit had lost 16 paise and ended at 85.92 against the dollar.

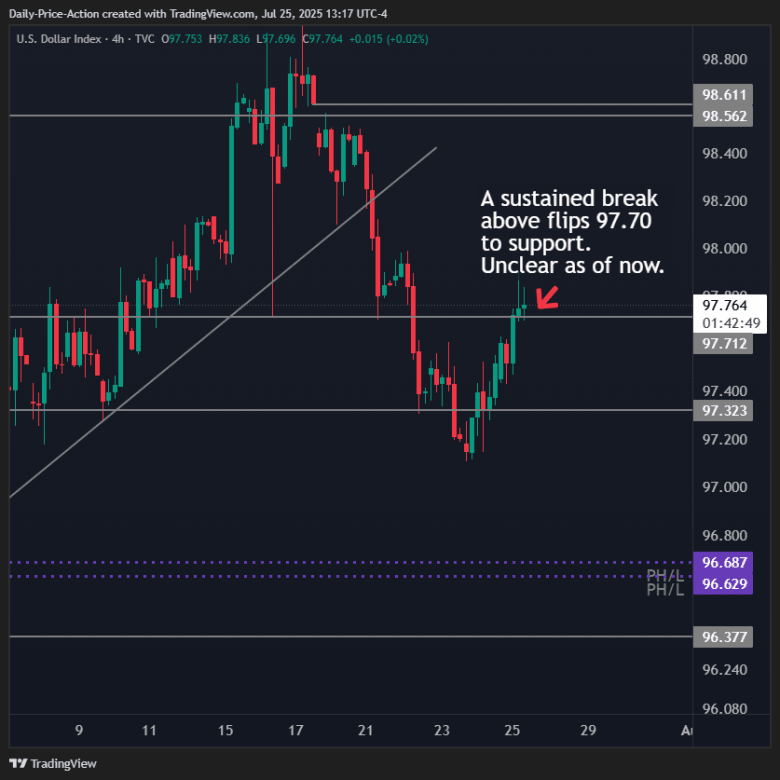

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.04 per cent to 97.15, after the US announced a trade deal with Japan.

Brent crude, the global oil benchmark, went up by 0.29% to $68.79 per barrel in futures trade.

Analysts said investors are keeping a close watch on the outcome of India-US trade talks ahead of the August 1 deadline as Indian exporters are staring at higher tariffs in American market.

If the discussions fail or get delayed, Indian exporters could face fresh pressure — adding to the rupee’s challenges.

The US team will visit India in August for the next round of negotiations for the proposed bilateral trade agreement between the two countries.

India and the US teams concluded the fifth round of talks for the agreement last week in Washington.

Meanwhile, in the domestic equity market, Sensex advanced 209.09 points or 0.25% to 82,395.90, while Nifty rose 60.45 points or 0.24% to 25,121.35.

Foreign institutional investors (FIIs) offloaded equities worth ₹3,548.92 crore on a net basis on Tuesday, according to exchange data.

Published – July 23, 2025 10:20 am IST