The trade war chaos that engulfed the early months of President Donald Trump’s second term looked set to return Monday as he threatened two major U.S. trading partners with higher duties — while a key negotiating deadline was pushed back.

Shortly after noon Monday, Trump published two letters addressed to Japan and South Korea threatening them with 25% duties, with higher ones for items deemed to have been transshipped through their countries.

Transshipping refers to offloading goods from one mode of transportation and reloading onto another. A 25% duty was essentially the level Trump announced for those two countries during his shock “Liberation Day” speech on April 2.

Later Monday afternoon, he posted letters threatening duties of as much as 40% on goods from Laos and Myanmar, along with ones of 30% for goods from South Africa and 25% for ones from Malaysia and Kazakhstan.

Trump would seek to impose the tariffs under the International Emergency Economic Powers Act. His ability to do so remains in place but is currently under court review.

Markets had already opened the week lower after mixed messaging over the past 72 hours from White House officials about the importance of a July 9 deadline Trump set in April after relenting on imposing the eye-watering country-by-country tariff levels he’d announced one week prior.

After the two letters went live on Truth Social, markets briefly took another leg lower, with the broad S&P 500 stock index falling as much as 1%.

During her regularly scheduled press conference Monday afternoon, White House Press Secretary Karoline Leavitt said Trump would sign an executive order extending the July 9 deadline to August 1.

It represents a return to the back and forth, on-again, off-again state of affairs that prevailed leading up to, and shortly after, Trump’s April 2 speech announcing extreme import duties on dozens of nations. The moment led to one of the worst market sell-offs on record. During some particularly chaotic moments, Trump changed tariff levels in the span of a few hours.

The president eventually relented on immediately imposing those duties in announcing the pause, and since then, stocks have slowly rallied back to all-time highs.

Heading into this week, the ground already looked set for the July 9 deadline to lose its significance. Asked Friday whether the U.S. would be flexible with any countries about the July 9 deadline, Trump said, “Not really.”

He continued: “They’ll start to pay on Aug. 1. The money will start to come into the United States on Aug. 1, OK, in pretty much all cases.”

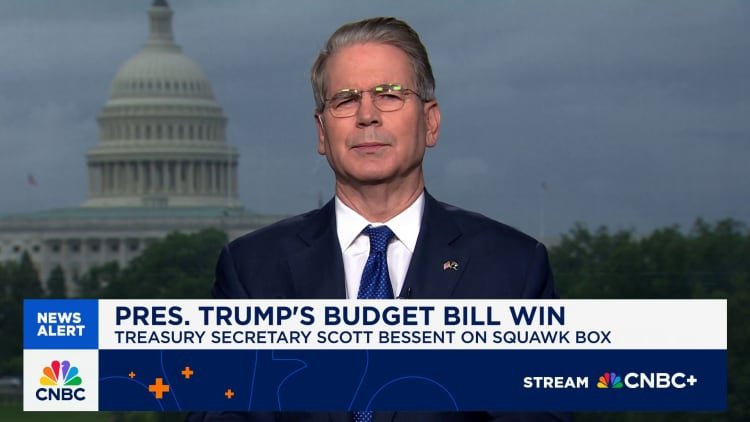

Treasury Secretary Scott Bessent attempted to clarify those comments Monday, telling CNBC: “President Trump has said … countries would not go back to the reciprocal rate until Aug. 1.”

While he expects to have “several” announcements in the next 48 hours, Bessent said, the president is more focused on the “quality” of deals, not the “quantity” — though he did not provide details on the nature of the proposed announcements.

So, what comes next?

Perhaps the clearest description of the state of play came from White House spokesman Kush Desai, who told The Wall Street Journal that any decisions around trade would come directly from Trump himself.

In other words, all deals and deadlines will remain in flux as long as the president says so.

To date, the president has announced limited new arrangements with the U.K. and China, as well as a brief statement on a pact with Vietnam. In a social media post Sunday, Trump wrote that “the UNITED STATES TARIFF Letters, and/or Deals, with various Countries from around the World, will be delivered starting” at noon Washington time Monday.

Trump was already threatening new tariff duties late Sunday, writing in a Truth Social post that an additional 10% tariff, on top of the existing across-the-board 10% baseline, would be imposed on any country aligning themselves with policies set by the BRICS bloc, comprising Brazil, Russia, China and India. The post came as leaders of the bloc met in Rio de Janeiro.

It was not immediately clear what Trump’s rationale is for that assertion.

Some on Wall Street were more optimistic that the return of uncertainty may not weigh as heavily on stocks this time around.

“Our base case remains that the uncertainty around tariffs won’t be enough on its own to bring the US economy to a crashing halt,” analysts with Capital Economics research group and consultancy wrote in a note to clients Monday. “If so, it’s unlikely to be enough to dampen investors’ enthusiasm for US equities.”

Yet the analysts also acknowledged that renewed chaos could prove a setback for officials at the Federal Reserve, who continue to insist on keeping interest rates high, despite repeated demands from Trump for a rate cut. Rates have remained elevated in anticipation of worsening inflation as a result of the import taxes. It’s something that will continue to make it expensive for the federal government, not to mention consumers and businesses, to borrow money, the analysts said.

“It’s been clear in recent weeks that many [Federal Reserve officials] are not confident about cutting rates until the inflationary effects of tariffs are clearer, and we doubt they’ll cut this year,” they wrote.