Dollar is outperforming across the board as markets enter into US session, which trade war risks continue to dominate market attention. With the July 9 tariff truce deadline fast approaching, The Trump administration shifted to a confrontational stance, offering “take-it-or-leave-it” tariff deals. According to Treasury Secretary Bessent, failure to reach agreements would result in tariffs snapping back to April 2 levels, some of which are steep enough to disrupt bilateral trade flows.

Of particular concern is Trump’s new threat to slap a 10% tariff on any nation aligning itself with the “anti-American policies of BRICS.” While the US stopped short of naming targets, the implication is clear: countries like Australia and New Zealand, which maintain extensive trade ties with China and India, are now in the crosshairs. That warning rattled regional FX markets, sending AUD and NZD lower against Dollar.

Diplomatic activity is intensifying. European Commission President Ursula von der Leyen reportedly had a “good exchange” with US President Donald Trump over the weekend, and a Commission spokesperson confirmed the EU remains committed to reaching a trade deal before the deadline. Japan has taken a more guarded approach, confirming that its negotiator held “in-depth exchanges” with US Commerce Secretary Lutnick. Tokyo reiterated its desire to reach a deal while protecting national interests. Meanwhile, Thailand submitted a new proposal offering to cut tariffs on many US goods to zero in a bid to avoid retaliatory measures, highlighting the growing pressure smaller economies face to align with US demands.

In FX markets, Dollar is leading gains, followed by Sterling and Loonie, while Kiwi, Aussie, and Yen are underperforming. Euro and Swiss franc are trading near the middle of the pack.

Focus now shifts to RBA in the upcoming Asian session, with a rate cut to 3.60% fully priced in. What matters more is whether Governor Michele Bullock signals an accelerated easing path, as inflation cools and domestic demand weakens. Given the current risk environment, any dovish tilt would likely amplify AUD’s downside pressure.

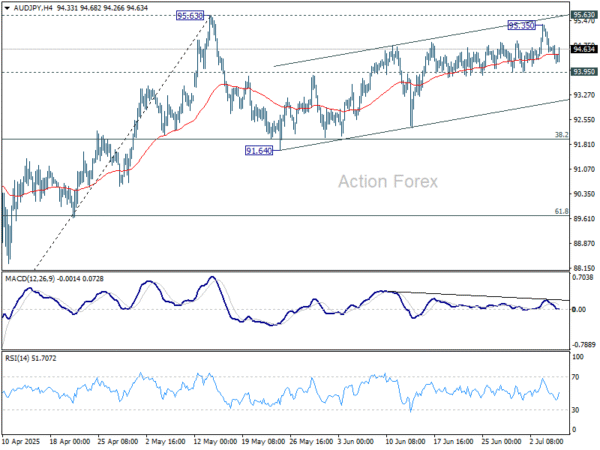

Technically, AUD/JPY’s choppy rise from 91.64 is seen as the second leg of the corrective pattern from 95.63, and should be close to completion. Firm break of 93.95 support will argue that the third leg has started, and target near term channel support (now at 93.12), ad then 91.64 support.

In Europe, at the time of writing, FTSE is up 0.11%. DAX is up 0.79%. CAC is up 0.27%. UK 10-year yield is down -0.005 at 4.557. Germany 10-year yield is up 0.021 at 2.628. Earlier in Asia, Nikkei fell -0.56%. Hong Kong HSI fell -0.12%. China Shanghai SSE rose 0.02%. Singapore Strait Times rose 0.45%. Japan 10-year JGB yield rose 0.003 to 1.438.

Eurozone retail sales fall -0.7% mom in May, EU down -0.8% mom

Eurozone retail sales volumes declined by -0.7% mom in May, slightly better than expectations for a -0.8% mom fall but still signaling weak consumer activity across the bloc. The decline was broad-based, with food, drinks and tobacco sales down -0.7% mom, non-food products (excluding fuel) off by -0.6% mom, and automotive fuel volumes sliding -1.3% mom.

Across the broader EU, retail volumes fell by 0.8% mom. National data showed particularly sharp declines in Sweden (-4.6%), Belgium (-2.5%), and Estonia (-2.2%), while Portugal, Bulgaria, and Cyprus bucked the trend with modest gains.

Eurozone Sentix rises to 4.5, recovery gaining momentum, ECB may pause cuts

Eurozone’s Sentix Investor Confidence Index rose from 0.2 to 4.5 in July, its highest since February 2022. The improvement was broad-based: Current Situation Index climbed from -13.0 to -7.3, and Expectations strengthened from 14.3 to 17.0. This marks the third consecutive gain across all components—fulfilling what Sentix calls the “triple rule” for identifying an economic turning point.

“The July data indicate a sustained upturn,” Sentix noted, adding that the recovery is now gaining in breadth. This aligns with recent data showing stabilization in business activity and firming consumer sentiment, suggesting that the bloc may be entering a more durable phase of expansion after years of stagnation.

Meanwhile, the improving sentiment is likely to narrow ECB’s scope for further rate cuts. Sentix’s policy barometer, released alongside the economic index, suggests that monetary policy will remain in a “comfort zone” rather than pivot toward aggressive easing.

Japan real wages post sharpest drop Since 2023 as bonuses shrink

Japan’s real wages fell -2.9% yoy in May, a sharp acceleration from April’s -2.0% drop yoy and the steepest decline since September 2023. This also marks the fifth consecutive monthly fall in inflation-adjusted income, as households remain squeezed by rising prices and underwhelming nominal pay growth. Consumer inflation, used to deflate nominal wages, stood at 4.0% yoy, driven by higher food costs, particularly rice.

Nominal wages rose just 1.0% yoy, well short of the 2.4% yoy forecast and down from 2.0% yoy in April. While base salary growth held at 2.0% yoy and overtime pay rose 1.0% yoy, a sharp -18.7% yoy plunge in special payments—largely one-off bonuses—dragged down the overall figure. May marked the 41st consecutive monthly rise in nominal wages, but the pace failed again to keep up with price growth.

Government officials cautioned that the wage data may not yet reflect the full impact of spring labor negotiations, especially as many small firms surveyed lack unions and implement pay increases more slowly than large corporations. Nonetheless, the prolonged real wage squeeze could weigh on consumer spending and affect BoJ’s plans to gradually normalize policy.

USD/CAD Mid-Day Outlook

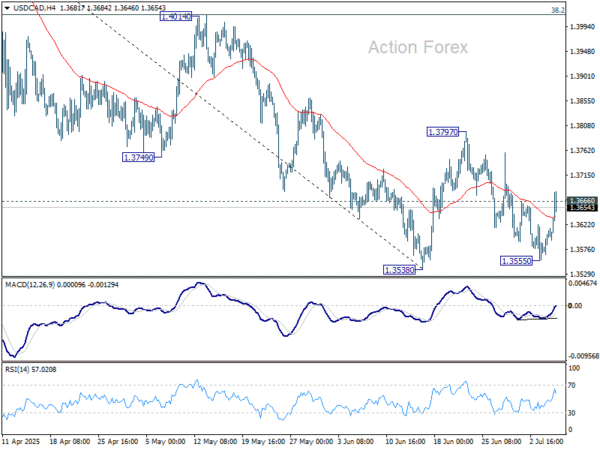

Daily Pivots: (S1) 1.3575; (P) 1.3596; (R1) 1.3625; More…

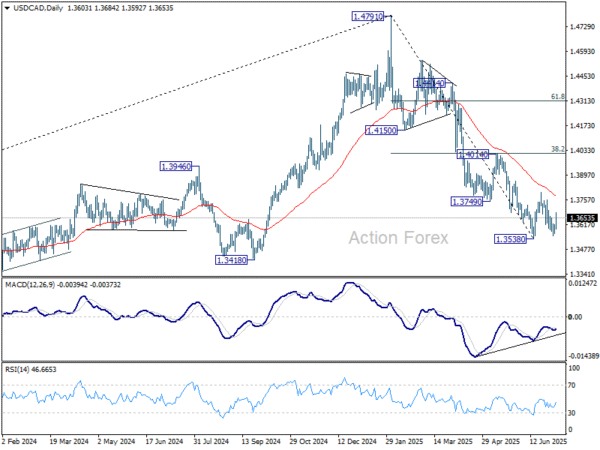

USD/CAD’s breach of 1.3666 resistance suggests that fall from 1.3797 has completed at 1.3555. Corrective pattern from 1.3538 is in the third leg. Intraday bias is back on the upside for 1.3797 resistance and possibly above. On the downside, firm break of 1.3538/55 support zone will confirm resumption of whole decline from 1.4791.

In the bigger picture, price actions from 1.4791 medium term top could either be a correction to rise from 1.2005 (2021 low), or trend reversal. In either case, further decline is expected as long as 1.4014 resistance holds. Next target is 61.8% retracement of 1.2005 (2021 low) to 1.4791 at 1.3069.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y May | 1.00% | 2.40% | 2.30% | 2.00% |

| 05:00 | JPY | Leading Economic Index May P | 105.3 | 105.3 | 104.2 | |

| 06:00 | EUR | Germany Industrial Production M/M May | 1.20% | -0.60% | -1.40% | |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Jun | 713B | 704B | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jul | 4.5 | 1.1 | 0.2 | |

| 09:00 | EUR | Eurozone Retail Sales M/M May | -0.70% | -0.80% | 0.10% | 0.30% |