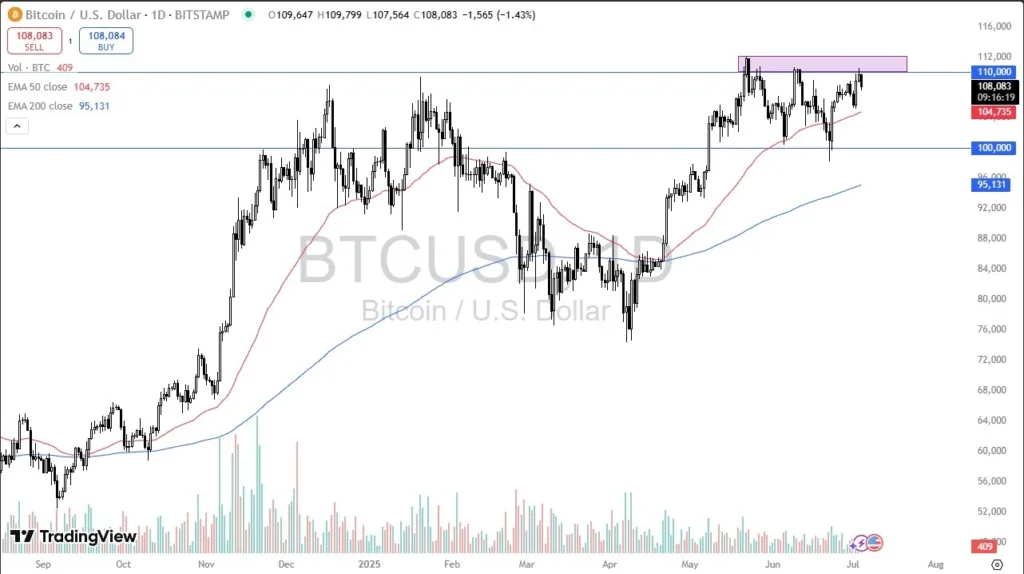

Uncertainty, volatility and relief led retail investors around the world to trade a record $6.6 trillion worth of stocks during the first half of 2025.

Don’t Miss TipRanks’ Half-Year Sale

Tariffs, market volatility, ongoing wars in Europe and the Middle East, and political tensions within the U.S. all conspired to get investors to buy and sell a record amount of equities in the year’s first half. According to data from Nasdaq (NDAQ), individual retail investors cumulatively bought $3.4 trillion worth of stocks over the first six months of 2025.

At the same time, the retail crowd sold $3.2 trillion worth of stocks, bringing the total traded to $6.6 trillion, a previously unheard-of sum. Among the most widely bought and sold securities between January and June were the stocks of chipmaker Nvidia (NVDA), electric vehicle maker Tesla (TSLA), and data analytics company Palantir (PLTR).

Bear to Bull

Even more dramatic, most of the buying and selling that occurred in the year’s first half happened in April and May after the tariff announcements from U.S. President Donald Trump rattled global markets and ignited fears of a global trade war and economic recession.

Those fears have since abated as the Trump administration has struck trade deals with countries such as the United Kingdom and China, and backed down on many of its retaliatory tariff threats. Nasdaq says that some retail investors found this past spring “the toughest investment climate” they ever experienced. Yet the initial concerns have now given way to bullish sentiment as tariff and trade war fears subside.

Is NVDA Stock a Buy?

The stock of Nvidia has a consensus Strong Buy rating among 40 Wall Street analysts. That rating is based on 35 Buy, four Hold, and one Sell recommendations assigned in the last three months. The average NVDA price target of $175.69 implies 10.26% upside from current levels.