If you have $500 to invest and love dividends, you have plenty of stocks to choose from. But $500 won’t necessarily get you a diversified portfolio of individual stocks.

For that sum, you may be better off buying an exchange-traded fund (ETF) that prioritizes dividend income. Two of the best options for buy-and-hold investors today are the Vanguard Dividend Appreciation ETF (VIG 0.65%) and the Schwab U.S. Dividend Equity ETF (SCHD 0.07%). Each one appeals to a different kind of income investor.

The Vanguard Dividend Appreciation ETF is focused on growth over yield

Most dividend investors look first at a stock’s yield, but another important factor is the growth potential of the dividend over time. This is exactly the focus of the Vanguard Dividend Appreciation ETF. While the ETF’s yield is only around 1.8% as of this writing, the quarterly dividend has nearly doubled over the past decade, and that payout growth has been accompanied by a roughly 170% increase in the share price of the ETF.

Data by YCharts.

To achieve this result, the ETF follows the S&P U.S. Dividend Growers index, which looks at all U.S. companies that have increased their dividends for a decade or longer. The index then removes the highest yielding 25% of the list. What’s left is included in the index — and the ETF — weighted by market cap. The expense ratio is a very low 0.05%.

While the yield today may not excite you, that’s not what the Vanguard Dividend Appreciation ETF is trying to do. It is attempting to provide you with growth of capital and income. With $500, you can buy two shares of the ETF, which will start you along an investment journey that can lead to a very attractive retirement portfolio years from now.

Image source: Getty Images.

The Schwab U.S. Dividend Equity ETF mixes yield and quality

If you don’t have that much time before you retire and would like to generate a little more income in the here and now, then the Schwab U.S. Dividend Equity ETF might be a better choice. It is offering a nearly 4% yield as of this writing and also comes with a modest expense ratio of 0.06%. But the big question is: What backs the yield?

The Schwab U.S. Dividend Equity ETF tracks the Dow Jones U.S. Dividend 100 index. Its construction is a lot more complex than the index backing the Vanguard ETF. But in essence, the Dow Jones U.S. Dividend 100 index follows some of the core criteria you would likely follow if shopping for individual stocks.

Specifically, the index screens for companies that have increased their dividends for a decade or more (excluding real estate investment trusts). A composite score is created for the qualifying companies that looks at the ratio of cash flow to total debt, return on equity, dividend yield, and the company’s five-year dividend growth rate. The 100 companies with the highest composite scores are included in the index and the ETF (again weighted by market cap).

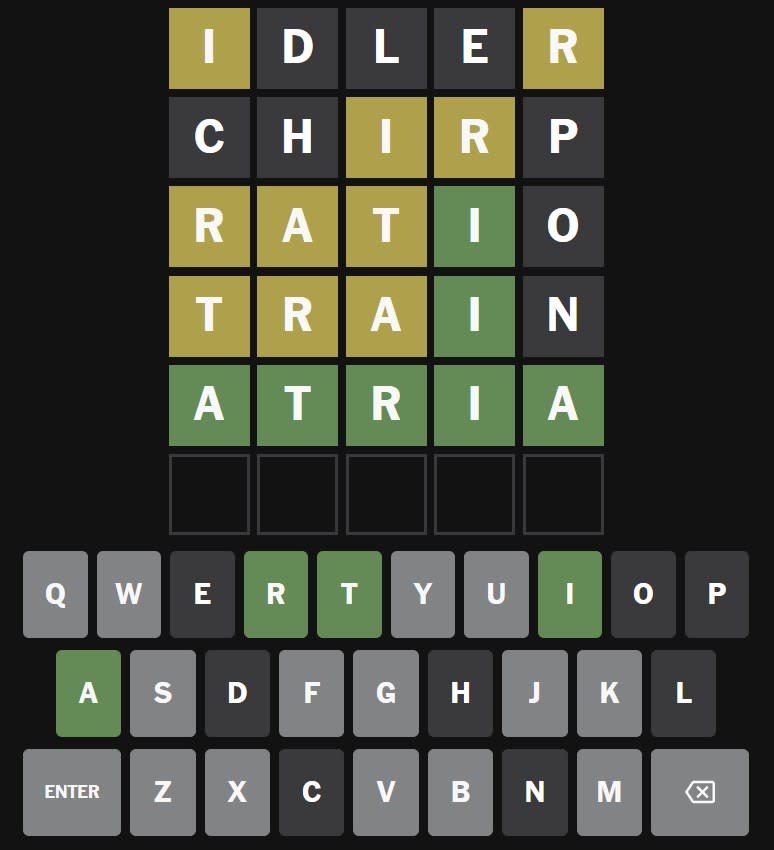

Data by YCharts.

The outcome of this has been a rising dividend, rising share price, and a generous yield. In fact, the dividend here has grown more quickly than that of the Vanguard Dividend Appreciation ETF over the past decade, but the price gain has been smaller.

A $500 investment will get you around 18 shares of the Schwab U.S. Dividend Equity ETF.

There are plenty of dividend ETFs, but only a few stand out

A lot of exchange-traded funds throw the word “dividend” into their names, but they are not all created equal. If you have more time on your side, the Vanguard Dividend Appreciation ETF is the kind of investment with which you can build long-term wealth. If you are more focused on generating income right now, you may prefer the Schwab U.S. Dividend Equity ETF.

That said, both of these dividend ETFs stand out from the pack as buy-and-hold choices for those whose investment time frame is “forever.”

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Dividend Appreciation ETF. The Motley Fool has a disclosure policy.