- The AUD/USD weekly forecast indicates some bearish sentiment.

- Risk sentiment was poor following the passage of Trump’s tax-cut bill through the US Senate.

- The US economy added 147,000 jobs in June, above the forecast of 111,000.

The AUD/USD weekly forecast indicates some bearish sentiment as market participants prepare for an RBA rate cut.

Ups and downs of AUD/USD

The AUD/USD price had a bullish week but closed well below its highs. Initially, downbeat data at the start of the week helped support the Aussie. However, risk sentiment was poor after Trump’s tax-cut bill passed through the US Senate. At the same time, there was uncertainty ahead of Trump’s reciprocal tariff deadline.

–Are you interested in learning more about Forex indicators? Check our detailed guide-

Moreover, the US released an upbeat employment report on Friday. The economy added 147,000 jobs in June, above the forecast of 111,000. At the same time, the unemployment rate was unexpectedly low at 4.1%. As a result, Fed rate cut expectations eased, and the dollar strengthened.

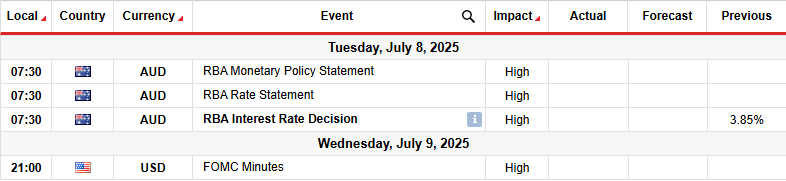

Next week’s key events for AUD/USD

Next week, market participants will focus on the Reserve Bank of Australia policy meeting. Economists in a Reuters poll this week said they expect the central bank to cut interest rates a third time since inflation has eased and the economy is slowing down. The move might weigh on the Australian dollar.

Meanwhile, traders will also pay attention to the FOMC policy meeting minutes. These might contain clues on the outlook for future rate cuts.

AUD/USD weekly technical forecast: Momentum fades after range breakout

On the technical side, the AUD/USD price is pulling back after breaking out of a consolidation area. It still trades above the 30-SMA, a sign that bulls are in the lead. At the same time, the RSI trades slightly above 50, suggesting strong bullish momentum.

–Are you interested in learning more about Best Bitcoin Exchanges? Check our detailed guide-

After making a sharp bullish move, the price stalled and began trading between the 0.6400 support level and the 0.6500 resistance level. The range held for some time until bulls gained enough momentum to push the price out of the consolidation.

However, while the price has made a higher high, the RSI has not. This indicates that momentum is waning from its previous high. Therefore, bulls might struggle to reach and break above the 0.6601 level. Meanwhile, if bears become stronger, the price will likely break below the SMA and return to the range area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.