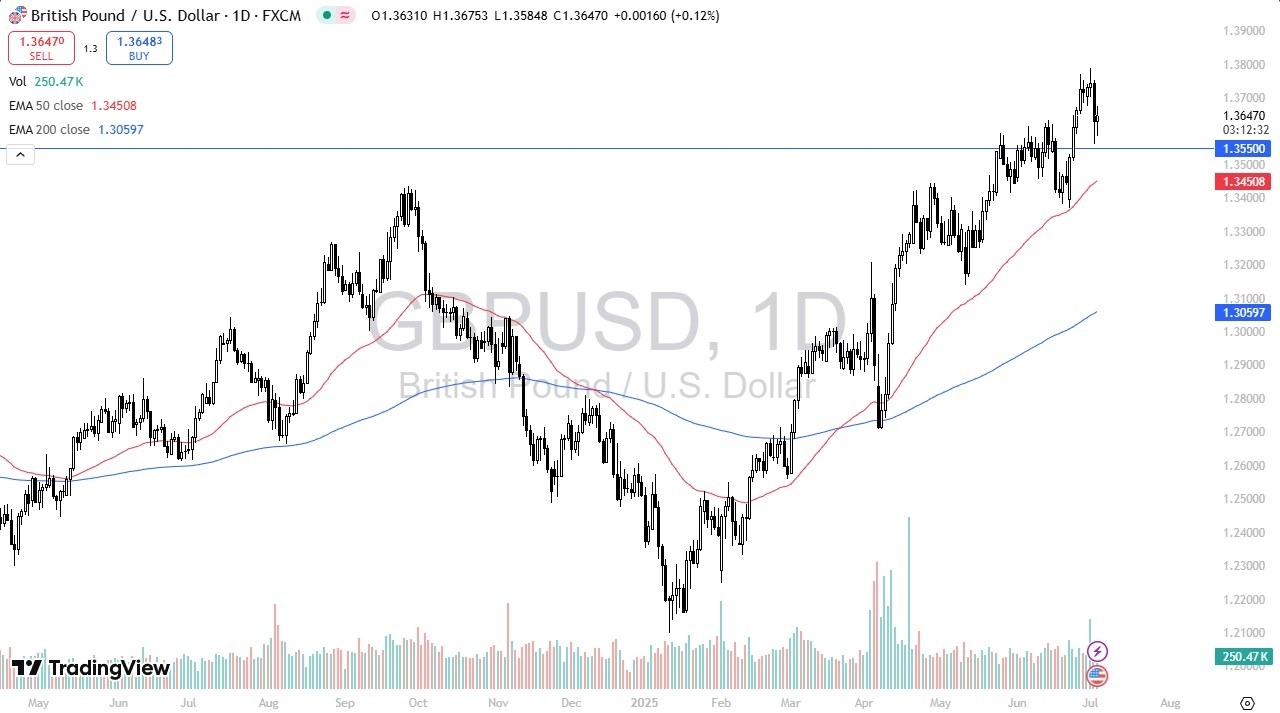

Potential Signal:

- I am a buyer of this pair at the 1.3670 level, with a stop loss at the 1.3570 level, aiming for the 1.3790 level and a symbol “consolidation play.”

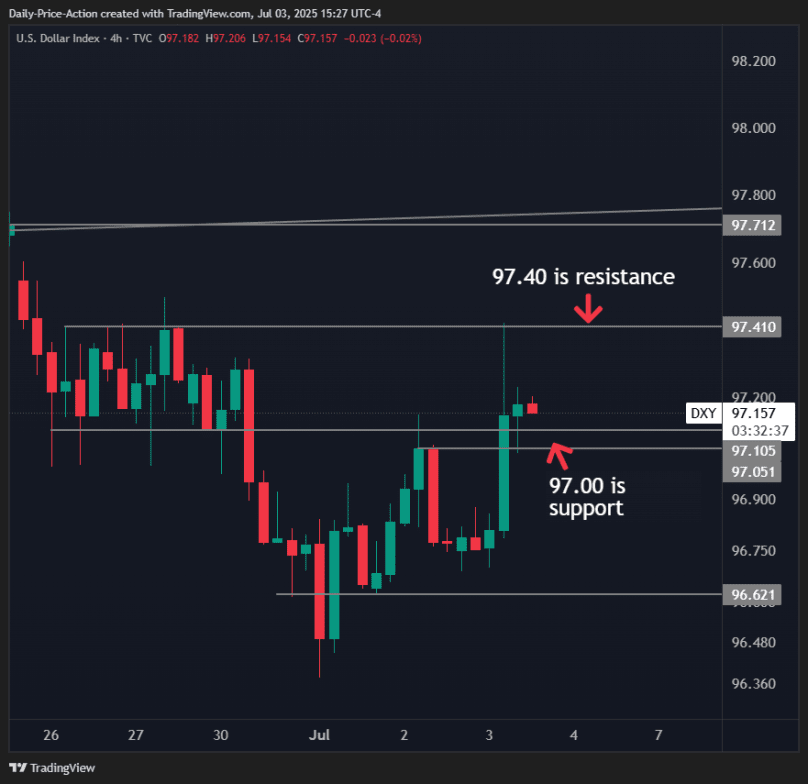

The British pound has fallen pretty significantly during the trading session on Thursday after the Non-Farm Payroll number came out quite shockingly high and therefore send the US dollar higher in general. The expected 111,000 jobs was nowhere near the actual 145,000 jobs for last month, so we started to see people running into the US dollar, or perhaps more likely than not, cover shorts against that currency. Nonetheless, we did of course see the usual turn around later in the day.

Technical Analysis

The technical analysis for the British pound is obviously very bullish, and what I find very interesting is that the market fell rather precipitously during the trading session on Wednesday but is stabilizing at this point in time on Thursday. The 1.3550 level seems to be offering a bit of a major support level, and I think a lot of people are paying close attention to that region. The fact that the candlestick was slightly positive, but essentially neutral before it’s all said and done. This tells me that the market is starting to get comfortable with the idea of being in this neighborhood.

Another thing that I found rather impressive was that the market plunged, only to turn around and bounce later in the day after the jobs number came out, which tells me also that traders are still looking to short the US dollar, which is interesting because the interest rate differential doesn’t widen too much between the GBP and the USD, but if the Federal Reserve starts to cut rates in September as everybody expects, it’s possible that the US dollar will really selloff. Furthermore, Pres. Donald Trump continues to ramble on through online channels that the interest rates in America need to be cut, and traders are banking on the fact that Jerome Powell might actually listen to him someday. This is obviously nonsense, but it is something that affects the overall attitude of the market. Regardless, this looks like a “buy on the dips” type of market.

Ready to trade the Forex GBP/USD analysis and predictions? Here are the best forex trading platforms UK to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.