Representative image

| Photo Credit: Reuters

The rupee depreciated 9 paise to close at 85.68 (provisional) against U.S. dollar on Wednesday (July 2, 2025), on weak domestic equity markets and a rise in crude oil prices.

Forex traders said a slight recovery in the U.S. dollar too weighed on the rupee as market players await the conclusion of India-U.S. trade deal, which is at its final stage.

At the interbank foreign exchange, the domestic unit opened at 85.59 against the greenback and touched an intra-day high of 85.57 and a low of 85.75 against the greenback during the day.

At the end of Wednesday’s (July 2, 2025) trading session, the local unit was at 85.68 (provisional), down 9 paise over its previous closing price.

On Tuesday (July 1, 2025), the rupee appreciated 17 paise to close at 85.59 against the U.S. dollar.

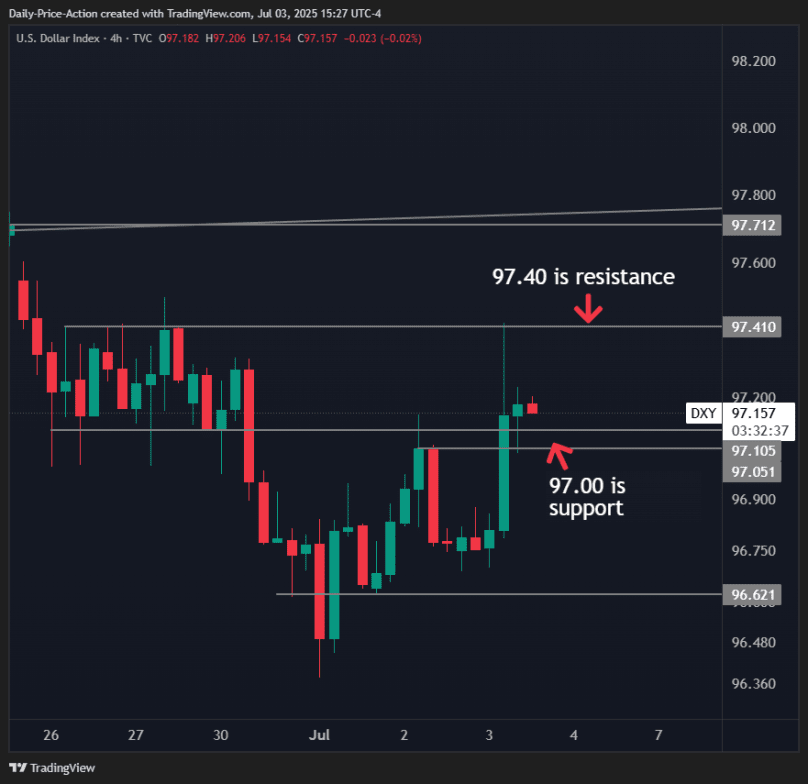

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.14% to 96.95.

Brent crude, the global oil benchmark, went up by 0.92% to $67.73 per barrel in futures trade.

“We expect the rupee to decline on trade tariff uncertainty as the July 9 deadline is approaching. Incoming statements by US President Donald Trump regarding tariffs is keeping the markets on the hook,” said Anuj Choudhary – Research Analyst at Mirae Asset Sharekhan.

Hectic negotiations between India and the U.S. entered the sixth day on Tuesday (July 1, 2025) in Washington, with the talks reaching a crucial stage and New Delhi demanding greater market access for its labour-intensive goods.

The Indian team, headed by special secretary in the Department of Commerce Rajesh Agrawal, is in Washington for negotiations on an interim trade agreement with the U.S.

The two sides are looking at finalising the talks before the July 9 deadline.

The 10-year U.S. bond yields are also off their lows. However, improved global risk sentiments amid ceasefire between Israel and Iran may support the rupee at lower levels, Mr. Choudhary said, adding, “USD-INR spot price is expected to trade in a range of 85.45 to 86.05.”

In the domestic equity market, the 30-share BSE Sensex declined 287.60 points, or 0.34%, to 83,409.69, while the Nifty fell 88.40 points, or 0.035%, to 25,453.40.

Foreign institutional investors (FIIs) purchased equities worth ₹890.93 crore on a net basis on Wednesday (July 2, 2025), according to exchange data.

Published – July 02, 2025 04:46 pm IST