- The AUD/USD outlook indicates weak risk appetite ahead of the US payrolls.

- Traders are pricing a 91.5% chance of a rate cut in September.

- Australia’s inflation report increased pressure on the RBA to lower borrowing costs.

The AUD/USD outlook shows weak risk appetite ahead of this week’s US nonfarm payrolls report. At the same time, the Australian dollar remains subdued after last week’s downbeat inflation figures from Australia.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The upcoming US employment report will show the state of the labor market in June, reflecting the impacts of Trump’s tariffs. A softer-than-expected report would raise concerns about the US economy, further hurting risk appetite. However, it would also increase expectations for a Fed rate cut that would weigh on the dollar, allowing the Aussie to climb.

On the other hand, an upbeat report would boost the dollar by delaying the timing for rate cuts. Still, the move would be minimal. The Fed is currently more focused on the state of inflation. Already, the economy has proven resilient in the face of tariffs, and this trend is likely to continue.

Therefore, Powell is now more concerned about a spike in inflation. The Fed Chair said the central bank will cut rates if inflation remains cool. Traders are pricing a 91.5% chance of a rate cut in September.

Meanwhile, inflation in Australia came in at 2.1%, well below the forecast of 2.3%. The downbeat report increased pressure on the RBA to lower borrowing costs.

AUD/USD key events today

Traders are not anticipating any key releases from Australia or the US today. Therefore, the pair might consolidate ahead of the US nonfarm payrolls.

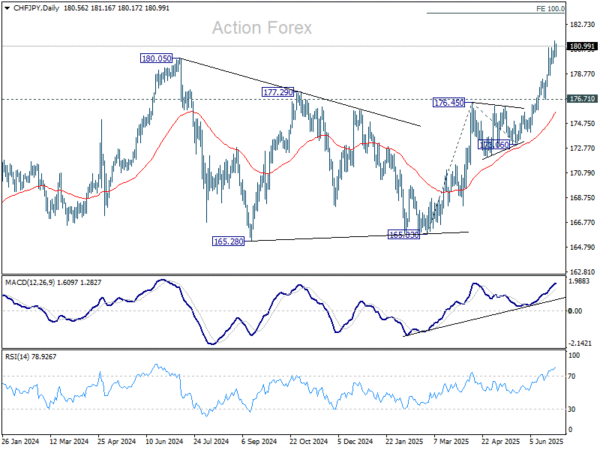

AUD/USD technical outlook: Bulls struggle to keep price above the 30-SMA

On the technical side, the AUD/USD price is pulling back after another attempt to break the 0.6550 resistance level. However, the bias remains bullish since the price trades above the 30-SMA, with the RSI above 50. Moreover, the pullback from recent peaks shows large bottom wicks, a sign that bulls are rejecting the move lower.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

If the retreat continues, it might reach the 30-SMA support line before pausing. A surge in bullish momentum would allow bulls to target a break above the 0.6550 resistance and new highs. Such a move would strengthen the bullish bias.

However, if the resistance holds firm, bears might take charge by pushing the price below the 30-SMA and the 0.6500 key support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.