Warren Buffett is known for generally making the right investing decisions at the right moment, and that’s helped Berkshire Hathaway beat the market for nearly 60 years. The billionaire, who doesn’t follow the crowd, made a couple of standout moves in recent times, and this may prompt you to ask whether he knows something Wall Street doesn’t.

The answer is… yes.

Image source: Getty Images.

Buffett’s Coca-Cola investment

Before diving into the details, a quick note about why investors often look to Buffett for advice. As chairman, he’s guided Berkshire Hathaway to a compounded annual gain of nearly 20% since 1965, and this is as the S&P 500 index delivered a 10% increase. Buffett’s done this by investing in quality companies trading for reasonable or even bargain valuations and holding onto them for many years. A perfect example of his strategy is his decision to buy Coca-Cola (KO 1.39%) in the late 1980s.

At that time, it was reasonably priced, trading for around 20x trailing-12-month earnings. Since then, Buffett has gained tremendously from the stock’s performance and dividend payments. Buffett says his dividend from Coca-Cola increased from $75 million in 1994 when he last purchased the shares to $704 million in 2022. The stock has soared in the quadruple digits since the start of Buffett’s purchases.

KO Total Return Price data by YCharts.

This and many other investments have helped Buffett grow the Berkshire Hathaway portfolio to $258 billion, so it’s not surprising that investors want to know about Buffett’s next steps — and potentially follow them.

Buffett’s recent moves

Now, let’s get back to Buffett’s latest standout moves. The billionaire throughout last year reduced his position by 67% in his top holding, Apple (AAPL 0.04%), and in the fourth quarter closed out his positions in two funds that track the S&P 500 — the Vanguard S&P 500 ETF and the SPDR S&P 500 ETF Trust.

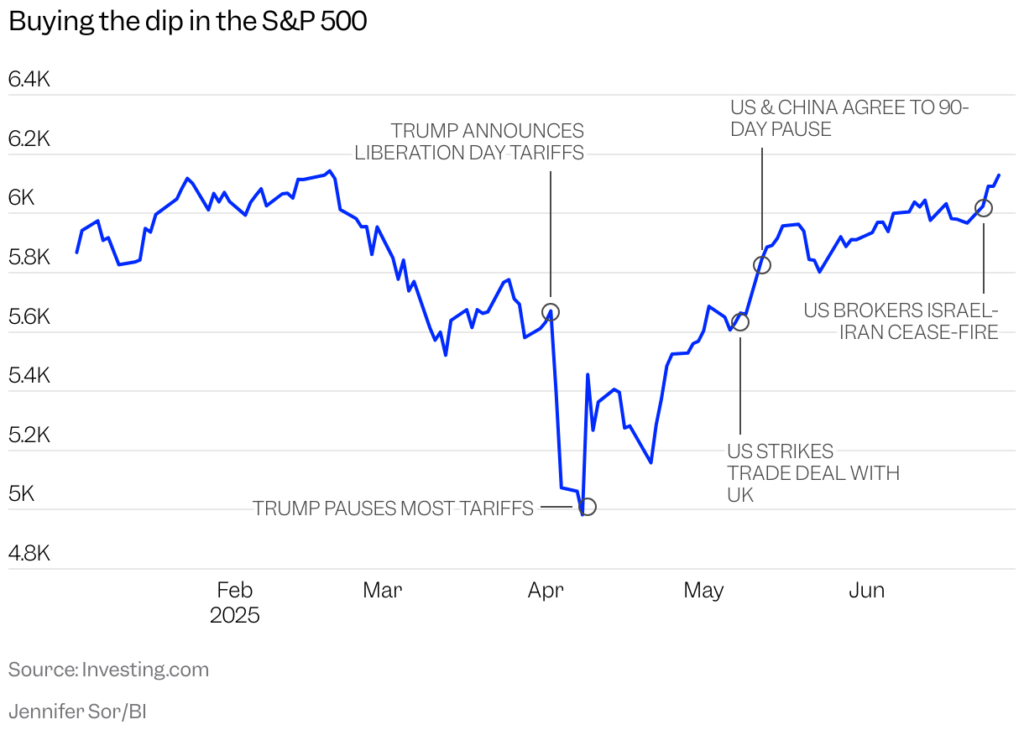

This happened as the overall market soared, with the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite each posting a gain last year.

With all of this in mind, what exactly does Buffett know that Wall Street doesn’t? Buffett likely knew that high valuations would catch up with the market sooner rather than later, and that could have prompted him to lock in some gains from his long-term holding, Apple, and even cut his exposure to the S&P 500.

It’s important to note that the S&P 500 Shiller CAPE ratio surged past the level of 36 last year, something it only did two other times since the late 1950s when the S&P 500 launched as a 500-company benchmark. The Shiller CAPE ratio is a sound valuation tool since it measures price and earnings per share over a 10-year period to smooth out bumps caused by various market conditions.

S&P 500 Shiller CAPE Ratio data by YCharts.

So, while most of Wall Street focused on the market’s momentum, Buffett might have been looking at something that, as mentioned, has always been key to his strategy: price. And as valuations soared, the billionaire knew a major pullback was ahead — and he prepared for it.

What’s weighed on the market

Buffett’s moves turned out to be wise, as indexes only needed a couple of uncertainties to push them into negative territory earlier this year. President Donald Trump’s plan to tax imports stirred up concern about the impact on the economy and corporate earnings, and mixed economic data added to that. Meanwhile, Apple shares plummeted amid fears that import tariffs would hurt growth — the company makes most of its iPhones in China.

Of course, Buffett doesn’t have a crystal ball, so he didn’t know that these particular troubles would arise, but he may have known that any headwind would prove challenging for the market due to the level of valuations. Though valuations have come down somewhat, they still aren’t at levels that have prompted Buffett to make significant purchases in Q1. His biggest moves included adding to his current positions in Constellation Brands and Pool Corp.

So, how can you use this Buffett wisdom to boost your own portfolio? The main message is avoid buying a stock for any price or rushing into the market just because indexes are rising. To follow in Buffett’s footsteps, consider each stock individually, focus on the earnings strength and competitive advantages of the particular company, and once you buy at a reasonable price, hold on for the long term. Each of these moves should help you maximize your potential for a stock market victory over time.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, and Vanguard S&P 500 ETF. The Motley Fool recommends Constellation Brands. The Motley Fool has a disclosure policy.