Diversifying your portfolio is one of the most basic pieces of investing advice that financial planners emphasize, but 47-year-old Etienne Breton has generated a seven-figure net worth and potentially secured early retirement in doing the opposite: going all-in on shares of software company Palantir.

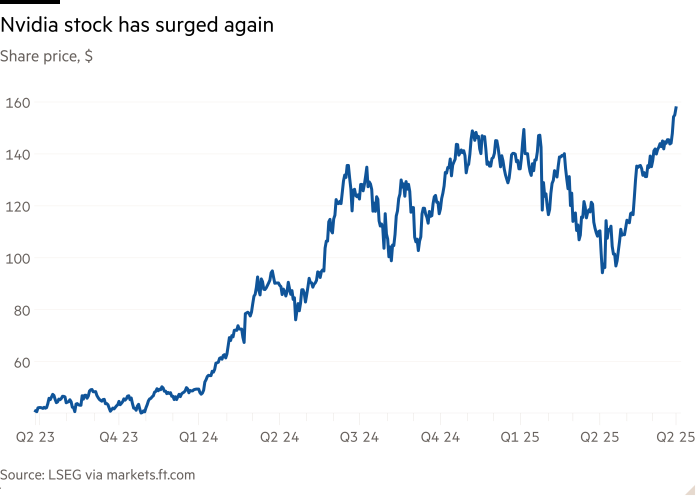

Up over 80% in 2025, Palantir is one of the hottest stocks in the market right now thanks to a combination of AI momentum, the Trump trade, and an army of bullish retail investors.

But Breton certainly isn’t just chasing a recent trend. He started buying Palantir in late 2020, shortly after the company went public — and kept adding to his position even as the stock floundered through much of the early 2020s.

Now, his position has grown to 17,800 shares with another 2,000 on margin for a total investment value of almost $2.5 million, brokerage statements viewed by Business Insider show.

A single-stock strategy

Palantir is the only stock Breton owns.

“I tried to identify very extraordinary companies. I didn’t want to diversify,” Breton said.

Two decades prior to buying Palantir, Breton had dabbled in the stock market for a short period, but sold out after the 9/11-induced stock market plunge.

His reentry into the market during the pandemic was well-timed.

“I saw someone selling all of their stocks because of the crash, so I did the exact opposite and opened an account,” Breton told Business Insider.

Breton quickly landed on Palantir after learning about the company from a YouTube video. As a technical expert at a manufacturing company, Breton was drawn to the company because Palantir’s offerings seemed like they could solve many of the issues he was seeing at his job, such as data silos and supply chain difficulties.

In a leap of faith, Breton went all-in.

“I sold my real estate and put almost everything I had into the stock,” he said. Breton began buying around $10 a share and continued building his position aggressively as the stock fell to as low as $6 in 2020.

Breton kept a running tally of his Palantir purchases on his garage wall.

Etienne Breton

By the time the share price returned to $10, it was mid-2023, and according to Breton, he held 10,000 shares at an average price of $8.83.

In April 2023, Palantir launched its Artificial Intelligence Platform (AIP). It was the big break Breton had been waiting for. From there, the stock began to slowly rebound, eventually snowballing into the mega-cap tech giant it is today.

Palantir options

Since 2023, Breton has also engaged in a variety of options strategies to generate income on his underlying shares and continue buying Palantir.

Related stories

Business Insider tells the innovative stories you want to know

Business Insider tells the innovative stories you want to know

“I began selling covered calls seriously, but not on my core position. I used margin to buy thousands more shares and sell aggressive covered calls using a ladder strategy,” Breton said.

That means he borrowed money to buy more Palantir shares, then sold call options on the shares, collecting a cash premium in exchange for agreeing to sell the stock at a certain price in the future. Laddering, or spreading the contracts across different prices and expiration dates, helped Breton create a steady stream of income.

Now, Breton is still slowly adding to his Palantir position with the premiums he receives on his covered calls.

Breton’s aware of the risk that comes with having much of his net worth tied up in Palantir, so he’s also buying Long-Term Equity Anticipation Securities (LEAPs), which are options with expiry dates a year or more in the future. This strategy allows him to earn income on his underlying shares and still benefit from potential upside.

One contract he showed Business Insider indicated that he had sold a $185 call and a $130 put expiring in December 2027, while also buying a $45 protective put. This setup is known as a strangle with downside protection: As long as Palantir stays between $130 and $185 through December 2027, both of those sold options expire worthless, and he keeps the full premium.

If Palantir trades above $185, Breton would give up any additional upside beyond that. If Palantir stock plummets, the protective put caps his loss and allows him to sell his shares at a minimum of $45. Breton also collects an upfront premium for selling the options.

Breton doesn’t have plans to sell the underlying Palantir shares, although he would be open to investing in a new stock with the money he earns on the premiums.

“I’m now planning my retirement, which is approaching much sooner than I ever expected,” Breton said. But he’s not too eager to walk away from work just yet.

“I have a nice career, so I don’t want to stop all of that,” he added. “I’ll just take my time and maybe explore some business projects.”