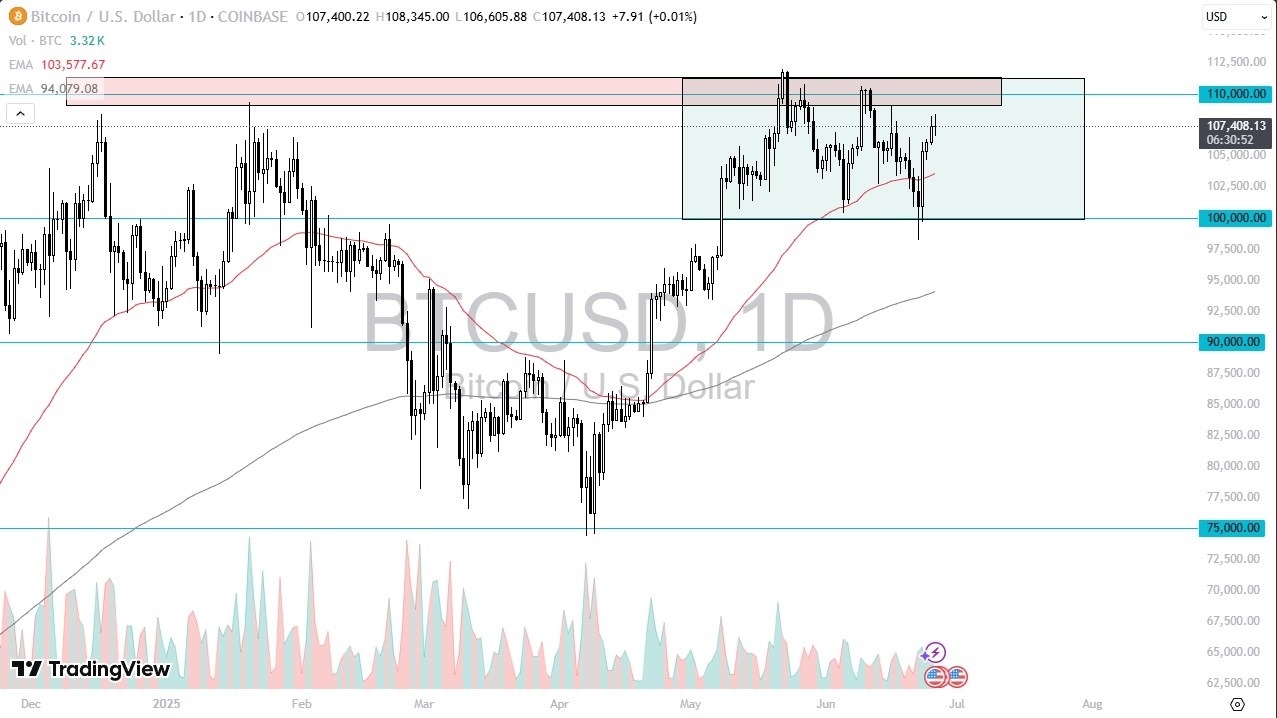

- Bitcoin has been pretty quiet during the session here on Thursday as we try to sort out where to go next as market participants are pretty bullish over the last several days, but now we are trying to work off some of that froth.

- We have been consolidating for a while and therefore it’s I think still another situation where we are testing what would be the massive resistance that starts at $110,000 level.

- The $110,000 level of course had been pierced, and we did see a little bit of momentum to the $112,000 level.

So, I think that’s really where we need to see the market break above to truly take off. This is something that I expect to see eventually, but it may take some time to get it going.

Short-Term Pullbacks are Possible

Short-term pullbacks at this point in time, I still believe offers a bit of a buying opportunity, especially near the 50-day EMA and most certainly at the $100,000 level, which has been at the bottom of this overall range. The 50-day EMA is right here at $104,000. And with that being said, I think you’re just going to wait for a little bit of value in the Bitcoin market and take advantage of it.

If we break out, then momentum should just carry you the rest of the way higher. If we do get that breakout, it is roughly a $10,000 range that we’re breaking out of. So that extrapolates to a move maybe to $120,000 to $121,000 and obviously beyond enough time given. I have no interest in this market anytime soon, and to be honest, it would take a lot of negativity in various markets for me to be looking to do so. Bitcoin should continue to find a bid in this environment overall.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.