Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

One of Hong Kong’s biggest property developers is in talks to refinance billions of dollars in bank loans following years of ambitious debt-fuelled expansion, adding to pressures in the Chinese territory’s struggling real estate market.

New World Development borrowed money for projects that people inside and outside the company have characterised as “aggressive”. They include a HK$20bn (US$2.6bn) retail and office space near Hong Kong’s airport and several mainland Chinese developments, including a $1.3bn mixed-use complex in Shenzhen.

This week the company said it was “actively engaged with its creditors in relation to the refinancing of its existing loans”. It is also under pressure to repay bondholders, with net debt at HK$124.6bn as of the end of last year. Interest expenses exceeded operating profits in the second half of last year, a sign of financial distress.

The refinancing talks are being closely watched by financial institutions and investors because of New World’s size — with assets totalling HK$427.6bn — and the exposure for major lenders.

Bank loans to New World account for 7 per cent of all commercial real estate loans in Hong Kong, according to Barclays analysts, who said in a note that the company’s “systemic importance” to the city was almost twice that of collapsed developer Evergrande to mainland China.

Failure in the negotiations would further hit sentiment in the city’s already faltering real estate market and risk contagion into the weak mainland Chinese property market.

One of the latest warning signs was the company’s deferral of interest payments due this month for perpetual bonds. While it was able to make other interest payments due this month to bondholders, market concerns over a possible default remain. Shares are down 22 per cent on the year, and its market capitalisation has fallen to HK$14bn.

Adrian Cheng, a grandson of New World’s founder, stepped down as chief executive in September, on the same day his company reported its first annual loss in two decades of nearly HK$20bn.

“New World Development’s leverage is high, and its capital structure is not sustainable,” said Zerlina Zeng, head of Asia strategy at CreditSights, the credit research unit of Fitch Solutions. “The company has taken a lot of debt to expand in mainland China, which didn’t bear much fruit due to the property downturn there.”

New World is one of Hong Kong’s largest conglomerates, and the family behind it has interests spanning retail, travel and luxury. A visitor to the city might stay in the Cheng family’s Rosewood hotel, eat lunch in New World’s Victoria Dockside complex and buy a souvenir from jeweller Chow Tai Fook, the family’s first business.

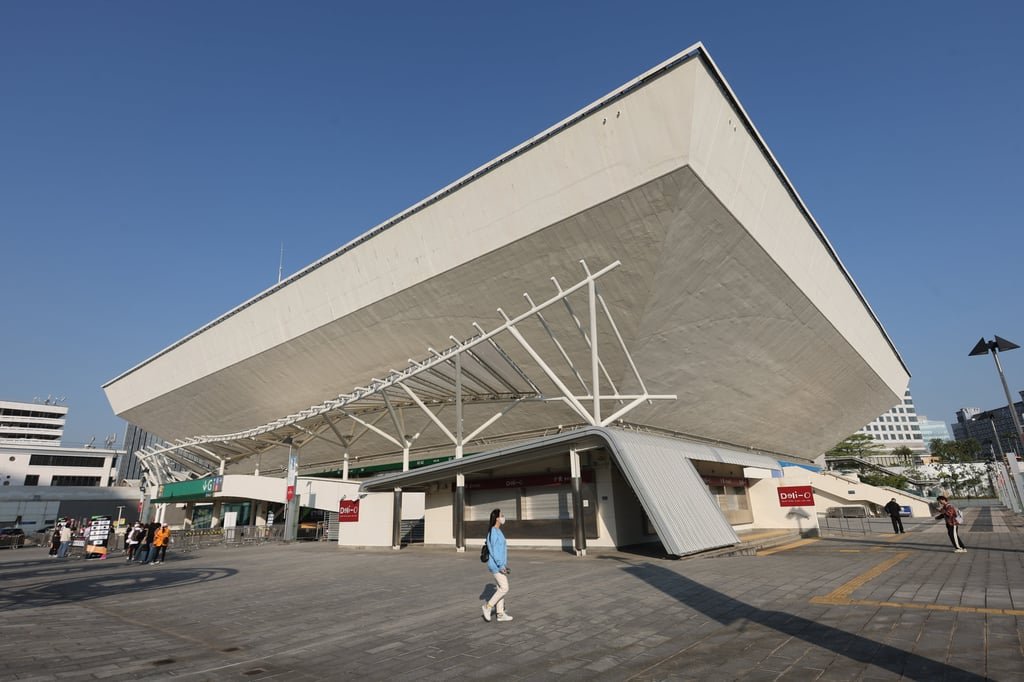

Epitomising New World’s woes is 11 Skies, billed as Hong Kong’s answer to Singapore’s success in turning Changi airport into a retail destination. The 3.8mn-sq-ft complex next to Hong Kong airport’s second terminal, which includes a mall and offices, was meant to attract travellers and locals.

But the property has been hampered by a delay in the expanded terminal’s completion and a softening of Chinese tourism into Hong Kong as consumers in the mainland curb spending in the wake of a property crash. K11, New World’s premium mall brand, has struggled in mainland China with weak consumer sentiment.

Cheng previously told the Financial Times that the company had to face challenges including “high interest rates” and “uncertain market conditions”, but he believed “this game of patience, paired with consistency and dedication, will eventually get us to our goals”.

Since Cheng’s departure, New World has gone through two chief executives. The ongoing refinancing talks involve HK$87.5bn in bank loans, Bloomberg has reported.

“Bondholders don’t have much clue on what’s going with NWD’s bank loan refinancing or other refinancing plans,” said Zeng. “They stopped talking with bondholders . . . we couldn’t get hold of NWD since November last year.”

New World told the Financial Times: “We do not comment on market rumours, and do not have any comments other than what we have already disclosed to the market.”

The company has pledged key assets, including Victoria Dockside, as collateral in talks with banks to transform unsecured loans into secured ones, according to people familiar with the matter. It has sold several completed residential projects at a discount in recent months.

Hong Kong authorities are keen to avoid a property crisis that could drag down real estate prices and affect the wider economy. The city’s de facto central bank has informally guided lenders over the past year to be more flexible on distressed property loans, according to people familiar with the discussions.

“It is the HKMA’s long-standing supervisory policy that banks must ensure appropriate and timely loan classification and provisioning at all times,” the Hong Kong Monetary Authority told the FT, adding that it did not see any concentration risk at the borrower level and that lenders were well capitalised.

Adrian Cheng now oversees the K11 Concepts brand, while his siblings lead different arms of the family empire, with Sonia looking after Chow Tai Fook Jewellery and Rosewood, Brian taking care of CTF Services, and Christopher as co-chief executive of CTFE.

The family’s private investment vehicle, Chow Tai Fook Enterprises, has not directly injected cash into New World, but it has selectively bought assets from the property group, including an equity interest in Hong Kong’s Kai Tak Sports Park in November and a stake in a Shenzhen office tower last June.