- The EUR/USD weekly forecast is slightly subdued amid risk aversion.

- A hawkish Fed and Middle East conflict continue to weigh on risk assets.

- Tariff concerns are mounting as the July 9 deadline looms large.

The EUR/USD weekly forecast remains mildly subdued as the week closed with a slight negative change. The US dollar maintained its strength as global risk aversion rose amid the Iran-Israel conflict.

–Are you interested in learning more about next cryptocurrency to explode? Check our detailed guide-

The Middle East situation continues to deteriorate the risk sentiment, weighing on risk-sensitive assets. The Iranian regime refused to drop the nuclear program while President Trump allowed two weeks for Iran to come to the negotiations before the decisive US military action. Meanwhile, both countries continue bombing for more than eight days.

The Federal Reserve kept interest rates unchanged as anticipated, with a slight hawkish shift in tone that surprised the market. So, the greenback gained ground partially. The Fed Chair Powell noted the inflation is still above targets and the risk of reacceleration also persists amid Trump tariffs. However, he reaffirmed that the central bank will cut rates twice by the end of 2025. Meanwhile, the next rate cut is linked to cooling inflation and labor market data.

On the other hand, the European Central Bank’s meeting in June’s first week revealed an end to the easing cycle after delivering eight consecutive rate cuts. President Lagarde said that they are well-positioned and need no more rate cuts. In the last week, different ECB officials hit wires, with some carrying an optimistic tone while some showed concerns about Eurozone growth.

On the tariffs front, the looming deadline of July 9 continues to temper the global risk sentiment. The trade negotiations of the US and the Europe remain in air, with no evident progress. President Trump said that Europe is not offering a fair deal. The situation with Japan and Canada is also the same. It means the tariff-related headlines will soon dominate the markets.

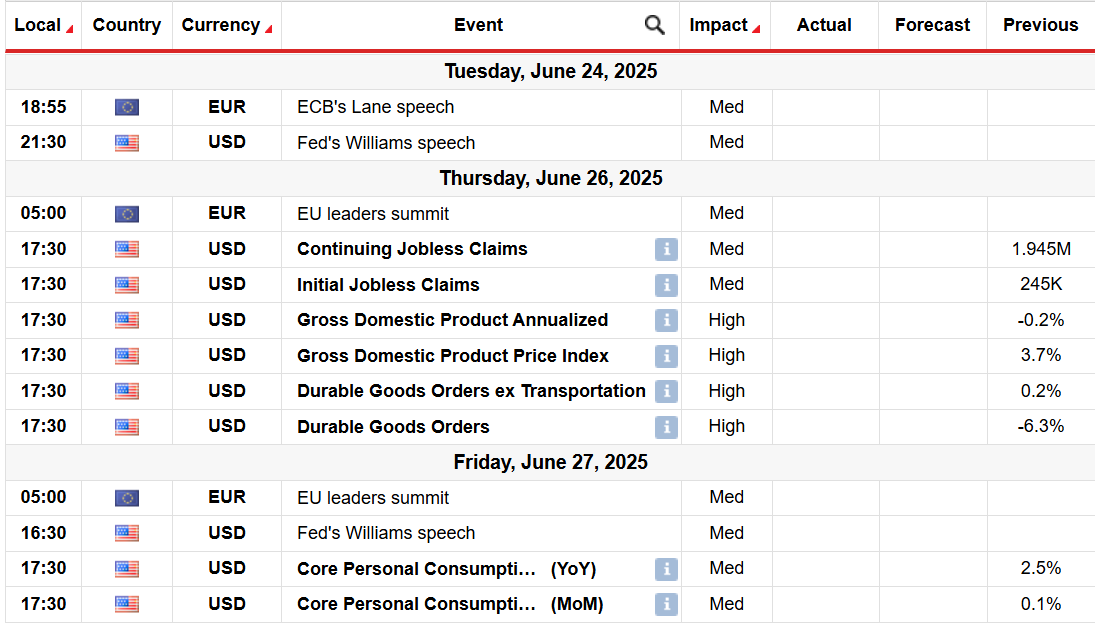

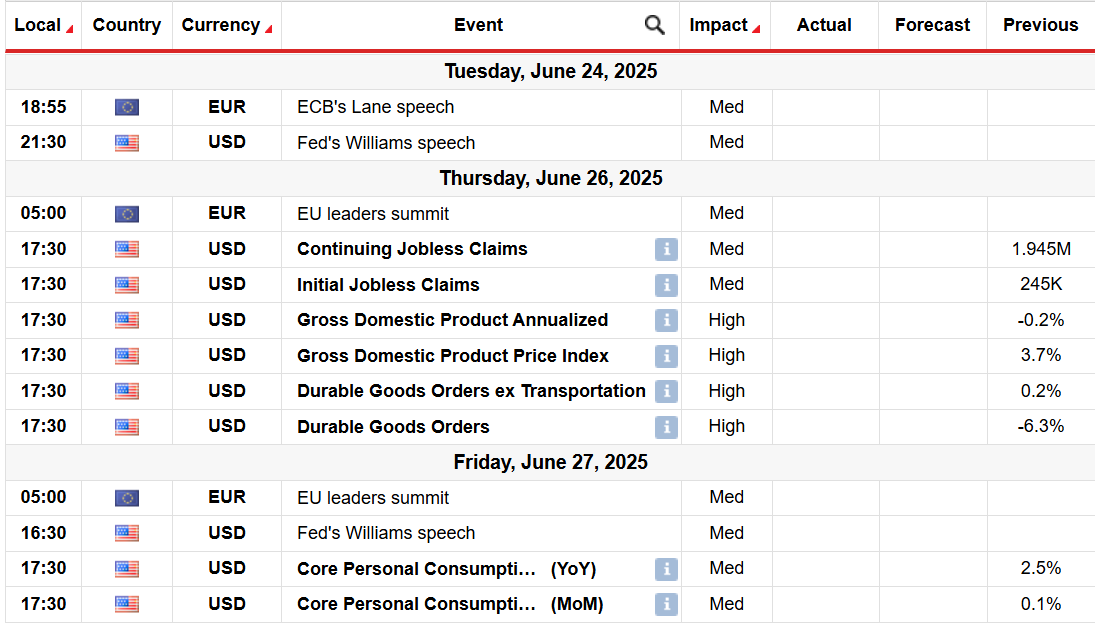

Key Events for EUR/USD Next Week

The next week brings key data from both sides. The PMI readings from the EU and the US are due next week. Moreover, the US Core PCE, an important gauge for inflation, is also due on Friday. Other major events include US GDP and Durable Goods Orders.

Apart from these data, some speeches from the ECB and Fed are due too that may provide impetus to the market.

EUR/USD Weekly Technical Forecast: Pullback Within Uptrend

The EUR/USD daily chart shows a mild pullback from multi-month highs towards the dynamic support of the 20-day SMA. This support is solid enough to keep the bullish trend intact. Meanwhile, the daily RSI is also at the 59.0 level, suggesting an upside bias.

–Are you interested in learning more about forex indicators? Check our detailed guide-

Alternatively, closing below the 20-day SMA can gather selling traction. The pair may head to 1.1450 ahead of 1.1400. However, the path of least resistance lies on the upside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.