Israel’s attack on Iranian nuclear and military targets caused the price of oil to surge more than 7% on Friday since Tehran is one of the world’s major producers of oil, despite sanctions by Western countries limiting its sales.

A wider war could slow the flow of Iranian oil to its customers and keep prices of crude and gasoline higher for everyone worldwide. But early Monday, those concerns appeared to abate slightly.

Oil prices were still volatile on the fourth day of the Israeli-Iran crisis, before giving back a bit of their gains. On Monday morning, the US benchmark crude oil was traded at $73.71 per barrel. Brent crude, the international standard, cost $74 per barrel, down from Friday but still 7% higher than the price before the missile fire started.

Military strikes between Israel and Iran are fuelling concerns that oil exports from the Middle East could be significantly disrupted. However, there is currently no indication that the oil flow is impacted, and concerns are running high.

Meanwhile, major oil companies are being rewarded on the stock market: BP and Shell both gained more than 1% in the Monday morning trade in Europe.

“Gains in oil majors and defence contractors have helped to push the FTSE 100 onto a positive footing in early trade,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown financial services company.

Shares in the FTSE 100’s top banks were also rising on inflation fears that could result in higher key interest rates. Standard Chartered rose nearly 3%, Barclays and Natwest were up by more than 1% by 11 am CEST.

Also strengthening the banking sector’s gains in London, Metro Bank shares soared by more than 14% following speculation that investment firm Pollen Street Capital would take over the lender, Sky News first reported over the weekend.

Investors in London also gained confidence after data for May showed a 6.1% year-on-year jump in retail sales in China, the world’s second biggest economy. However, it was coupled with lower-than-expected growth in industrial output, which still rose 5.8% from the previous year.

After 11 am in Europe, Britain’s FTSE 100 inched up 0.3% to 8,876.26. Germany’s DAX gained 0.2% to 23,572.39 and the CAC 40 in Paris edged 0.6% higher to 7,728.66.

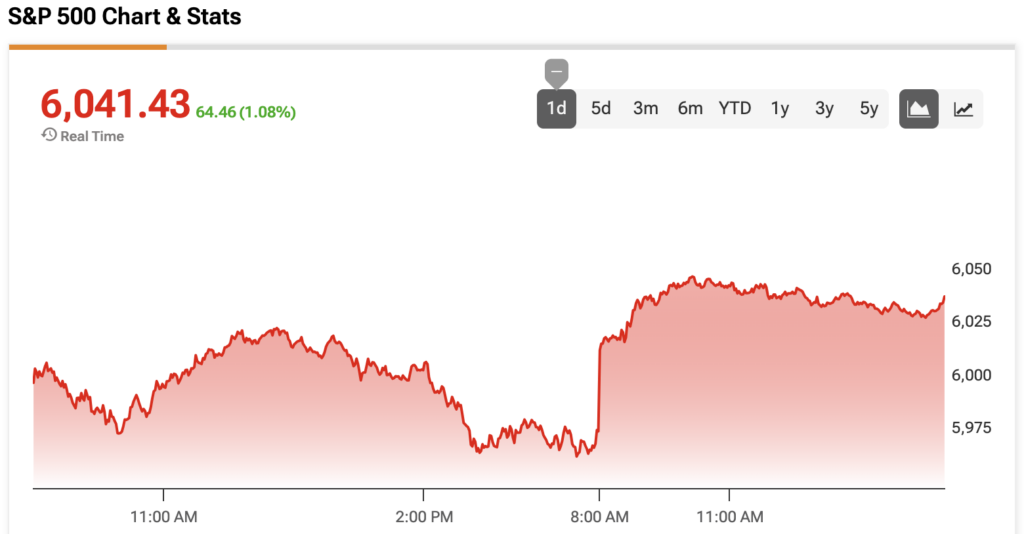

The futures for the S&P 500 and the Dow Jones Industrial Average were up 0.5%.

During Asian trading, Tokyo’s Nikkei 225 added 1.3% to 38,311.33, while the Kospi in Seoul gained 1.8% to 2,946.66.

Hong Kong’s Hang Seng surged 0.7% to 24,060.99 and the Shanghai Composite Index added 0.4% to 3,388.73.

The price of gold has climbed as it remains a safe haven asset. An ounce of gold added 1.4% on Friday, but gave back some of its gains on Monday morning, and was traded at around $3,437 an ounce.

Prices for US Treasury bonds are also on the rise when investors are feeling nervous, but Treasury prices fell Friday, which in turn pushed up their yields, in part because of worries that a spike in oil prices could drive inflation higher.

Inflation in the US has remained relatively tame recently, and it’s near the Federal Reserve’s target of 2%. However, concerns remain high that it could accelerate due to President Donald Trump’s tariffs.

A better-than-expected report Friday on sentiment among US consumers also helped drive yields higher. The preliminary report from the University of Michigan stated that sentiment improved for the first time in six months after Trump put many of his tariffs on pause, while US consumers’ expectations for future inflation eased.

In currency trading early Monday, the US dollar gained to 144.18 Japanese yen from 144.03 yen. The euro rose to $1.1582 from $1.1533.

What is expected for the week?

The Middle East conflict is set to be the focus of the G7 meeting of leaders of wealthy nations in Canada this week.

There are also hopes that Trump will sign more trade deals, which keeps trade optimism a bit higher.

“It’s a big week in terms of decisions on interest rates and the direction of monetary policy,” Streeter said.

“The Federal Reserve is expected to keep rates on hold this week but comments from chair Jerome Powell will be closely watched for future direction of policy.”

Meanwhile, there is a monetary policy meeting of the Bank of England this week, where “policymakers are expected to press pause on rate cuts,” Streeter explained, citing the potential impact of higher energy costs.

Meanwhile, the UK government’s infrastructure plans are going to be revealed in more detail this week. “The 10-year strategy, worth £725 billion (€850.8 bn), is the backbone of the Starmer administration’s plan to kickstart growth,” Streeter said.