The rupee closed at 86.0650 against the U.S. dollar, nearly unchanged from its close of 86.08 in the previous session.

The South Asian currency hovered in a 85.9525-86.23 range on the day with traders pointing to exporter hedging, oil prices and broad-based dollar weakness among the cues that impacted its trajectory.

While “traders were biased towards buying dips (on USD/INR), the price action was somewhat confusing, leading to cutting of speculative positions,” a trader at a state-run bank said.

Meanwhile, the dollar-rupee forward premiums eased. The 1-year implied yield was down 5 basis points at 1.83%, weighed by an uptick in near-tenor U.S. Treasury yields and exporter hedging.

Live Events

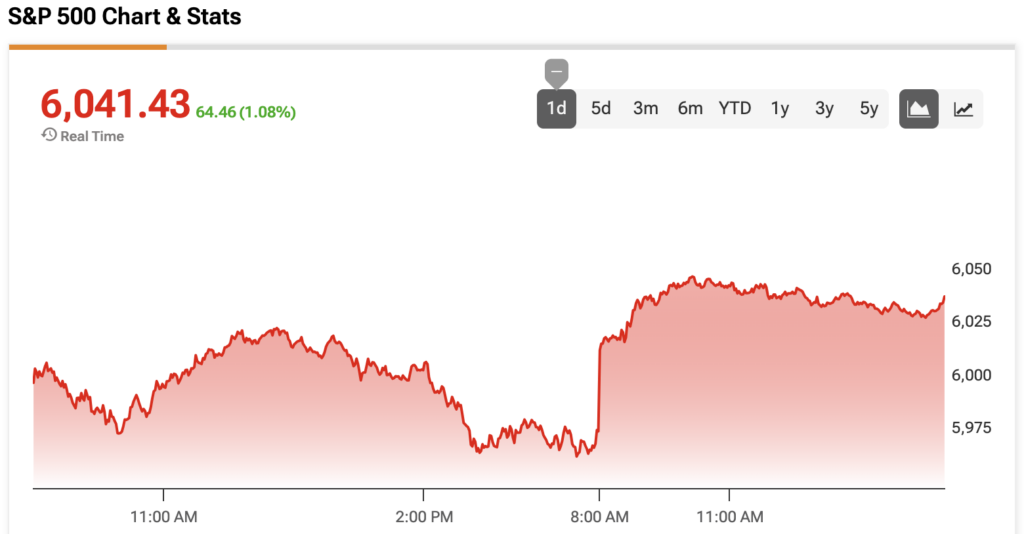

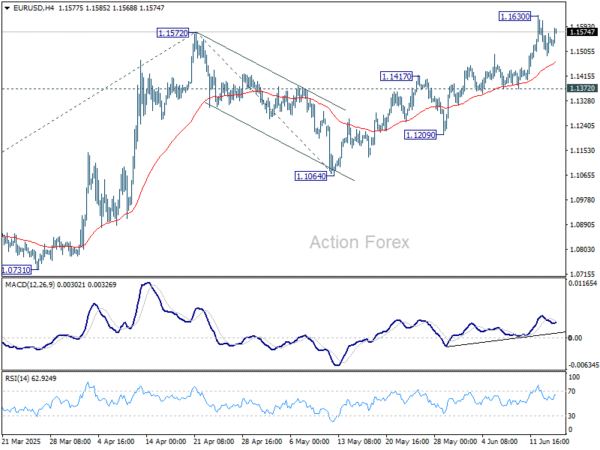

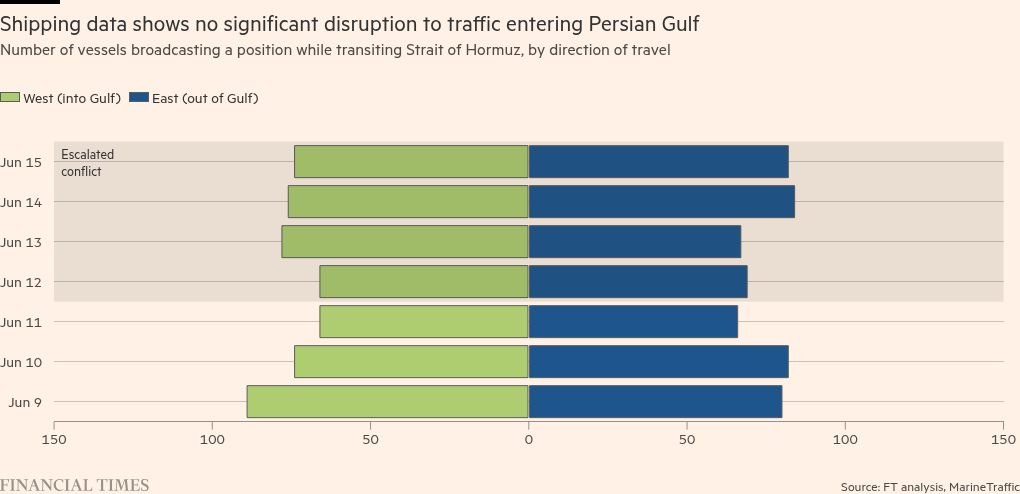

The dollar index was down 0.3% at 97.9 and Asian currencies were trading mixed. The offshore Chinese yuan rose 0.1% while the Thai baht declined by about 0.3%. Investors are keeping a close eye on signs that the ongoing Iran-Israel conflict may escalate into a broader regional conflict. “All eyes are now on the trio driving market sentiment- war, trade wars, and central bank moves,” said Amit Pabari, managing director at FX advisory firm CR Forex.

Pabari expects the rupee to remain volatile in the near-term and reckons that an intensification of hostilities in the Middle East could push the currency towards 86.50-86.80.

Meanwhile, India’s merchandise trade deficit narrowed to $21.88 billion in May, according to government data released on Monday.

India and the U.S. aim to sign an interim trade deal before July 9, an Indian trade ministry official said on Monday.