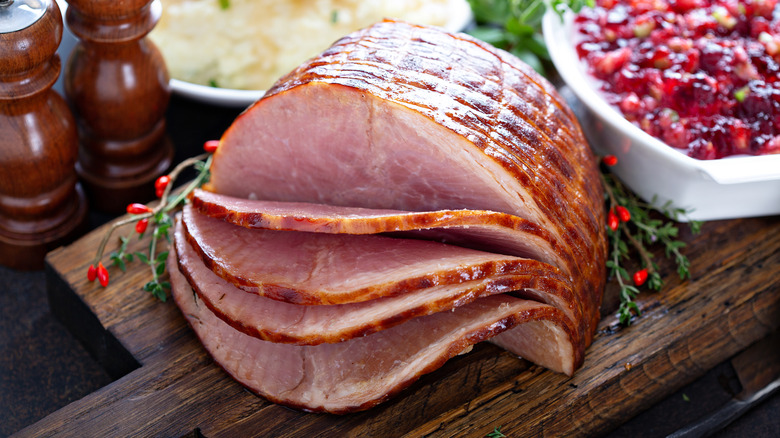

For many American families, the holiday dinner table wouldn’t be complete without a ham. And for decades, if you wanted a particular kind of cured pork, you bought a Smithfield ham. Known for its smoky, savory flavor and traditional Southern roots, Smithfield has been a beloved household name, especially around Thanksgiving, Christmas, and Easter. But what many consumers don’t realize is that this iconic American brand is no longer American-owned. It has been under Chinese ownership since 2013.

While the practice of curing ham in Smithfield, Virginia, had existed for centuries, the creation of Smithfield Foods as a formal company began in 1936. Founded by Joseph Luter, the company was originally a small, family-run business focused on processing and packaging pork products. Virginia is known for its ham, so to protect the integrity of the pork products made there, the state has passed laws to define what could be legally considered a “Smithfield ham.” Even today, you can see a ham from 1902 — or view the oldest ham in the world live on a webcam – at the Isle of Wight County Museum in Smithfield.

Smithfield Foods’ legacy as the leader of ham-making was tied to both the quality of the pork and the care taken in its preparation. Over the decades, the company expanded into one of the largest pork producers in the United States. So when Smithfield Foods was acquired by WH Group — a Chinese conglomerate producing the most pork in the world — for $4.7 billion, it was a big freaking deal.

The complexities of a global food system

At the time, WH Group’s purchase of Smithfield Foods was the largest acquisition of a U.S. company by a Chinese firm. To get an idea of how massive this deal was, consider this: The Chinese company now owns one in four pigs raised in the United States. The purchase raised eyebrows and concerns, particularly around food recalls and safety, national security, and foreign ownership of U.S. agricultural assets. Naturally, the people of Smithfield were also shocked. “Nobody saw it coming,” a local told PBS in a report on the deal. Senators questioned if the Chinese government was behind it all.

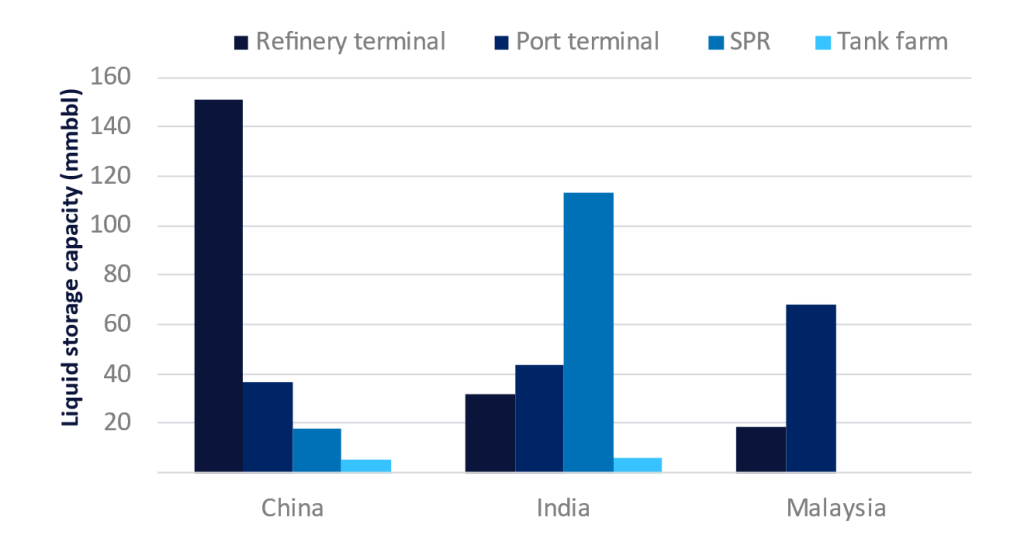

One of the driving forces behind the acquisition was China’s growing demand for pork and its desire to import meat products from the U.S. But many scientists, economists, and even investors warn that food is becoming the oil of the 21st century, a resource whose scarcity and demand could spark global unrest.

So far, Smithfield’s operations remain largely domestic. Its farms, production facilities, and most of its workforce stayed in the United States. WH Group promised not to move local jobs overseas, and they pledged to maintain Smithfield’s quality standards. (It’s worth remembering that American hog farms are notoriously toxic production facilities and have been the source of numerous pork recalls that have affected millions.) For better or worse, Smithfield embodies the complex realities of a global food system — a network that somehow connected a small town in Virginia to boardrooms in China and dinner tables around the world.