(Bloomberg) — It’s the kind of geopolitical flashpoint that might once have triggered a full-blown market meltdown: Israeli warplanes struck Iranian nuclear sites, Tehran vowed revenge — then followed through. Oil spiked.

Most Read from Bloomberg

Yet in a year where crises have come in waves, traders from London to New York opted to hold their breath rather than flee en masse.

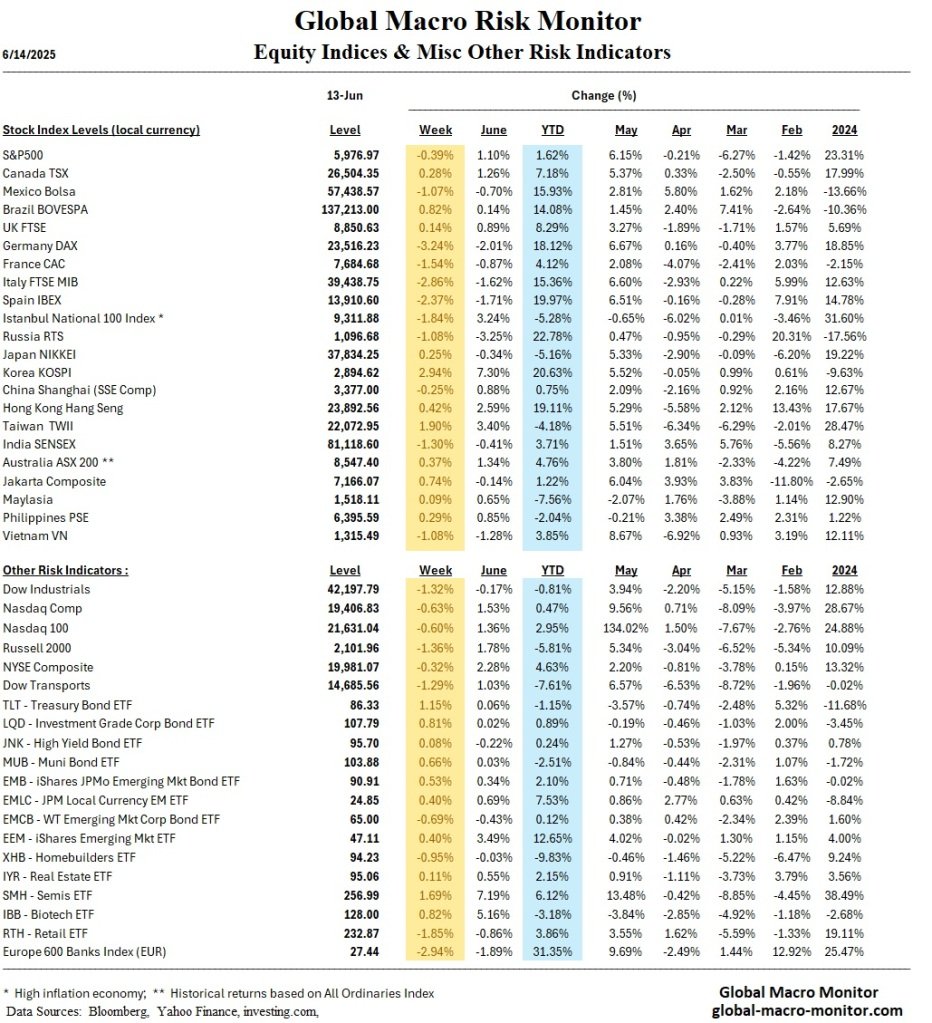

Yes — gold climbed, stocks slid and bonds seesawed, but there was no big stampede. The S&P 500 finished the week down modestly and remains less than 3% below its record high. Crude gave back some of its early gains.

That relative calm — for now — followed a familiar playbook: Markets are shocked, prices stumble, then the habitual dip-buyers swoop in. It’s a routine that has been all but cemented after months of crises that never quite landed. That got fresh impetus this week when readings on inflation and consumer sentiment came in better than estimated.

The airstrikes disrupted this trading pattern Friday, without shattering it. And in the end, another Wall Street phenomenon proved equally important in salvaging the week: momentum. From risk premiums in corporate bonds to crypto and stock-market breadth, trends have stayed largely positive — evidence that money managers remain concerned that missing market rebounds this year is a bigger risk than succumbing to the dip.

Now, attention turns to the weekend. With fresh escalation underway, markets are bracing for signals from the Middle East and Washington that could shape next week’s mood — and test how durable the rally reflex really is.

“This has been a year where fading bad news paid off, and the FOMO theme has been growing louder,” said Max Gokhman, deputy chief investment officer at Franklin Templeton Investment Solutions. “When that momentum becomes blind euphoria it can cause bulls to hit a brick wall at full speed, but we aren’t there yet.”

Of course, anxiety abounds, as it has throughout a turbulent year. Israel warned its attacks may go on for weeks, while Iran has vowed to respond forcefully.

Retail buying is also slowing, money is edging into cash and gold, and bonds offered little comfort: the 10-year yield ended higher on Friday, a reminder that traditional havens are no sure thing as fiscal clouds gather.

And the kicker: President Donald Trump has promised sweeping tariffs within two weeks, a potential supply-side disruption that could collide with an oil market already on edge.

“If the stock market can muscle through this, that will only increase the FOMO. It may well engender the perception that the rally is ‘bullet proof,’” said Michael Purves, founder and CEO of Tallbacken Capital Advisors. “This increases the ultimate downside risk.”

By the Friday close, commodities ended up bearing the brunt of the pressure from the ongoing conflict, with oil climbing about 8% and gold testing a record high. The S&P 500 ended the week just 0.4% lower and 10-year Treasuries traded down about 10 basis points. The Cboe Volatility Index, or VIX, ended the week just above 20 as measures for bonds and currencies closed lower.

One factor in the relative resilience may come from the sheer volume of shocks investors have already absorbed in 2025 — from inflation and bond convulsions to tariffs and geopolitics. While each has caused brief selloffs, the snapbacks have been fast enough to sharpen, not dull, the momentum impulse among investors.

A Societe Generale SA index tracking cross-asset momentum has this month staged one of its sharpest reversals on record, with nine of 11 components emitting bullish signals. Trends derived across fixed income, equities and currencies were all flashing green when the conflict broke out. Price action like that is hard for Wall Street’s risk traders to ignore, according to SocGen’s Manish Kabra.

“We look at the VIX and MOVE indexes, they’re showing an element of complacency in there that’s a bit surprising because of all these events that occurred,” said Phillip Colmar, global strategist at MRB Partners. “If we hadn’t gone through the April fiasco, I think that the markets would be nervous right now and more negative.”

Indeed, buoyant positioning is extreme enough to give some Wall Street naysayers pause. Fear of missing out has driven extreme readings in the exchange-trade funds universe, among other places, with high-beta ETFs drawing significantly more inflows than low-beta counterparts, according to Bloomberg Intelligence’s Athanasios Psarofagis.

“Just as there was overreaction to the downside from the initial tariff news, the rebound appears a bit too hopeful in our view,” said Nathan Thooft at Manulife Investment Management in Boston, which oversees $160 billion. “There are still a number of uncertainties that could lead to higher market volatility in the coming months. With that said, we do believe worse-case scenarios regarding tariffs are off the table.”

Building a case that the Trump trade war is poised to launch the US into a recession anytime soon has gotten harder amid a parade of positive economic reports. Data this week showed both consumer and producer inflation was lower than forecast in May. On Friday, the University of Michigan said its preliminary consumer sentiment index rose, topping all expectations in a Bloomberg survey of economists.

“A steady stream of favorable, or at least neutral, headlines may keep the ‘buy the dip’ party going,” said Michael Bailey, director of research at FBB Capital Partners. “The barely noticeable rise in the VIX today suggests that investors view the Israel-Iran conflict as a fairly contained geopolitical event, helping to keep the new bull market alive.”

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.