Crude oil prices rose sharply as Israel’s attack on Iran raised fears of a broader disruption of Middle East oil supplies. Relatively low gasoline prices in the U.S. have helped to keep inflation in check.

Brandon Bell/Getty Images North America

hide caption

toggle caption

Brandon Bell/Getty Images North America

Oil prices jumped and stocks tumbled Friday following Israel’s attack on Iran, which raised fears of a wider conflict in the Middle East.

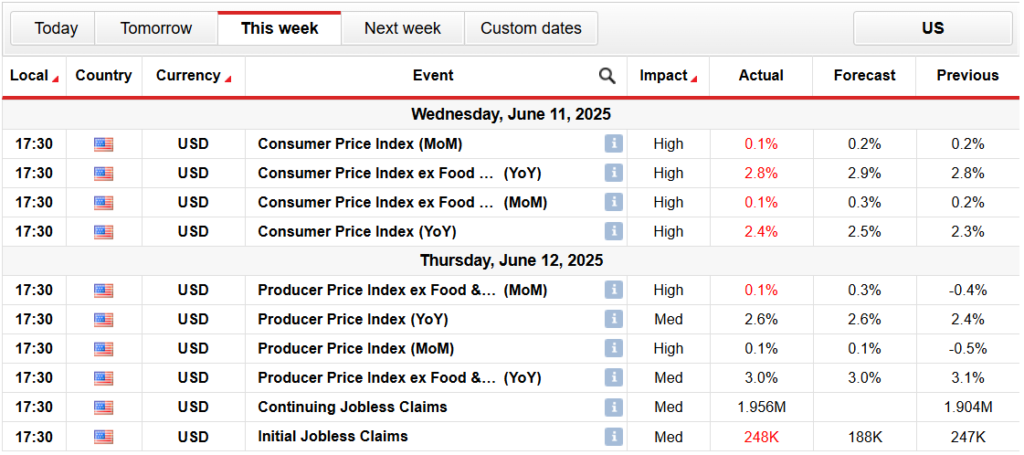

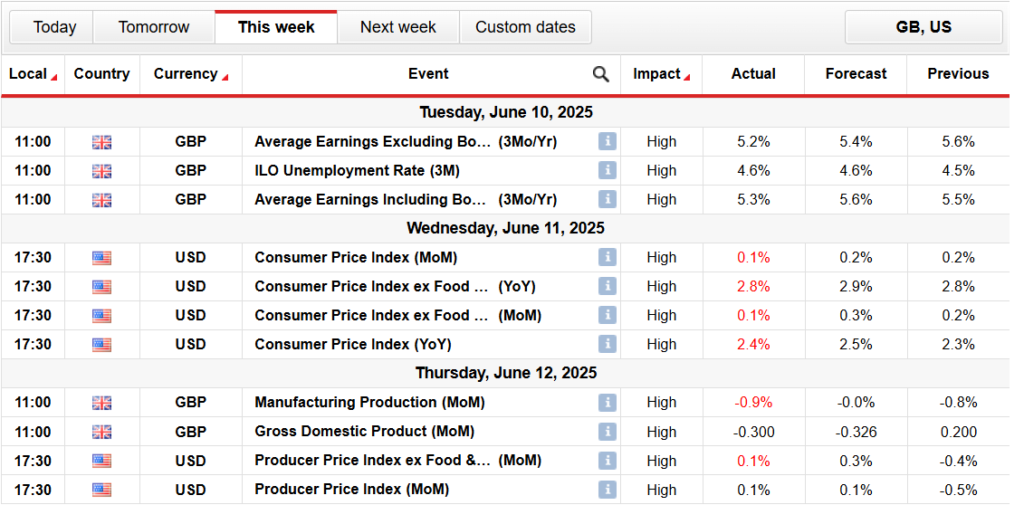

Crude oil prices saw their biggest increase since Russia’s invasion of Ukraine more than three years ago, pushing the U.S. benchmark close to $73 a barrel. If sustained, that could reverse the downward slide in gasoline prices, which has helped to keep inflation in check. The Labor Department said Wednesday that gas prices had fallen 12% in the last twelve months.

Stocks fell sharply Friday as investors weighed the potential fallout from the conflict. The Dow Jones Industrial Average fell close to 500 points, or 1.1% in the first two hours of trading.

Investors were rattled after Israel launched air strikes into Iran, targeting the country’s nuclear facilities, and Iran sent drones towards Israel to retaliate.

Ordinarily, nervous traders would seek shelter in U.S. government bonds, pushing bond prices up and yields down. That didn’t happen early Friday, however, perhaps signaling investors’ lingering worries over the high level of U.S. debt. This week, the Treasury Department reported that the federal deficit had topped $1.2 trillion, with four months still to go in the fiscal year.