- The EUR/USD forecast is neutral as markets experience risk aversion.

- ECB-Fed divergence may continue to support the euro.

- The confluence zone at 1.1500 may help euro buyers stay bid.

The EUR/USD forecast has turned neutral despite a broad upside trend, as Israel’s attack on Iran triggered a strong risk-aversion sentiment in the global financial markets.

–Are you interested to learn more about crypto signals? Check our detailed guide-

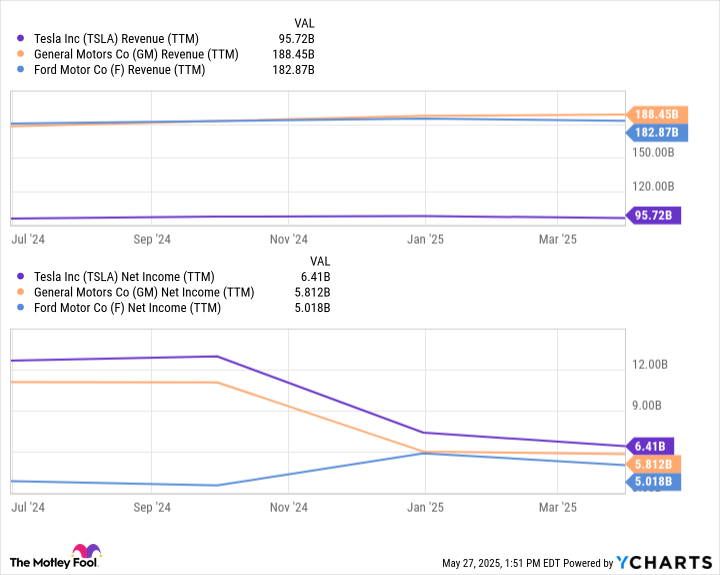

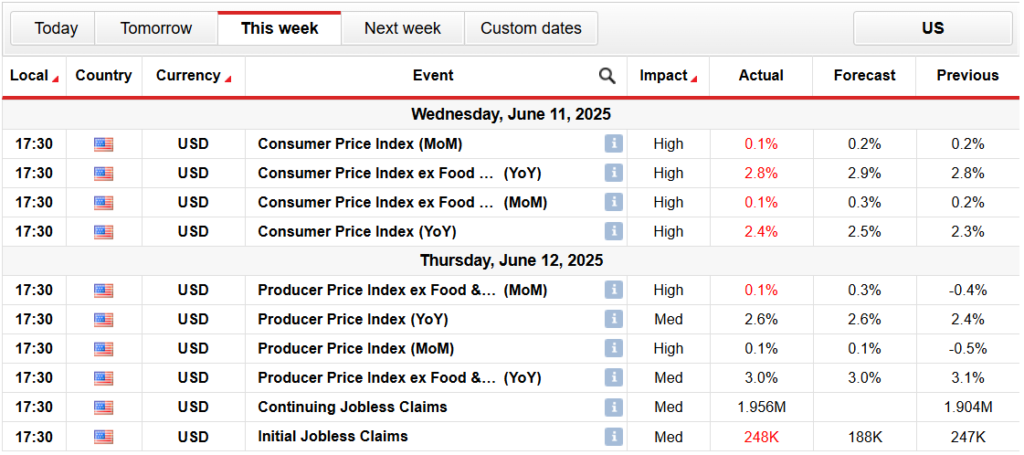

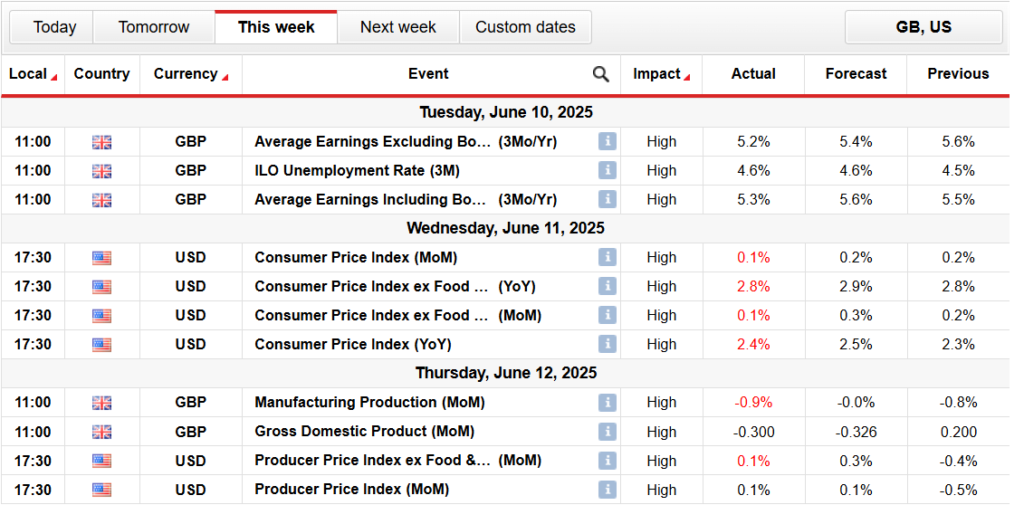

On Thursday, the EUR/USD pair marked a fresh 2025 high around 1.1635 due to downbeat US PPI data. Earlier this week, the US CPI data also missed expectations. The subdued inflation data weakened the US dollar, resulting in a strong upside push to the euro.

The ECB members also left some hawkish comments about the monetary policy earlier this week. They hinted at an end to the easing cycle after delivering a 200 bps rate reduction in eight meetings. However, the economic outlook is not particularly healthy, and concerns about growth still linger. Today’s Eurozone inflation data also met expectations. The German CPI came at 2% target of the ECB, while the French CPI slipped 0.6%.

However, the risk-off sentiment stemming from the Iran-Israel conflict weighed on the currency pair. The price has slipped more than a hundred pips since the day started. As the Israeli PM said, the operation will continue as long as it takes. It means the coming week may also see a deterioration in the risk sentiment. Hence, the euro is likely to experience further weakness.

Key Events Ahead

- Prelim UoM Consumer Sentiment

- Prelim UoM Inflation Expectations

EUR/USD Technical Forecast: Confluence Zone to Protect Losses

The EUR/USD 4-hour chart shows an interesting scenario. The price has pulled back to the the 1.1500 area, where the previous swing high was formed and broken. The same area coincides with the 20-period SMA. This is also a round number, which may serve as psychological support.

–Are you interested to learn more about forex robots? Check our detailed guide-

Now, it is essential to observe whether the price bounces from this confluence or consolidates around it and then resumes the downside move. Breaking below the 20-period Simple Moving Average (SMA) and sustaining this level may gather selling momentum and test the support at 1.1440, ahead of 1.1400.

On the flip side, staying above the 20-period SMA can be a positive sign and may push towards 1.1550 area. The RSI has sharply moved from overbought zone to 50.0 level. Staying above the 50.0 level is another sign of bullish continuation.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.