The Ant Group international arm’s decision to apply for a stablecoin licence in Hong Kong is an early boost for the city’s digital assets aspirations, as it plays catch-up with rival Asian financial centres.

The company, which operates China’s ubiquitous Alipay mobile payments system, said on Thursday it would apply for a licence to issue stablecoins in Hong Kong, after the regime allowing for the licensing of fiat-referenced stablecoin issuers takes effect in August.

Institutions that participated in a Hong Kong Monetary Authority stablecoin sandbox are also expressing interest in obtaining a licence.

Dominic Maffei, Standard Chartered’s head of digital assets in Hong Kong, told The Banker that the lender’s joint venture with Animoca Brands, a Web3 company, and Hong Kong Telecom was “doubling down on the launch”, with more details being announced “in due course”.

Payments company RD Technologies, which also participated in the sandbox, told The Banker it plans to apply for a stablecoin issuer licence as it awaits further guidance from HKMA.

Ant International has announced it will also apply for stablecoin licences in Singapore, where it is based.

The Hong Kong licensing regime aims to open a new market for the financial hub, but with the existing presence of US dollar-denominated coins and other jurisdictions looking to enter this space, Hong Kong will need to find its own niche.

US dollar-denominated coins like USDT have been particularly popular with retail users in emerging markets looking to hold a US dollar-equivalent currency that can be used in cross-border remittances, for example, says Henri Arslanian, co-founder of crypto asset management firm Nine Blocks Capital Management. Further, the US has already taken legislative steps to regulate this space.

“With the US now moving forward with its Genius Act and regulating stablecoin issuers, the big question is what niche role Hong Kong dollar stablecoins may play,” Arslanian says.

Hong Kong also has competition in the region. The Monetary Authority of Singapore has granted licences to Circle Internet Singapore and Paxos Digital Singapore in 2023. Japan has approved the use of stablecoins, with Circle issuing its USDC currency. And South Korea’s government has begun discussing the Digital Asset Basic Act, which would introduce licensing for stablecoins.

Yet, Hong Kong’s position as an established multi-currency payments centre, particularly for the renminbi, could be advantageous. Stablecoins from Hong Kong could end up being more freely usable forms of the Chinese currency, says Martin Chorzempa of the Peterson Institute for International Economics. “It could establish a foothold with its currency among blockchain-based payment systems, as well as potentially handling payments involving dollar stablecoins, while being connected to legacy financial infrastructure allowing easy on- and off-ramps.”

The government’s strategy to focus on digital assets in 2022 has made it a key player in the region, says Douglas Arner, professor at the University of Hong Kong, with the institutional digital assets teams for the likes of Standard Chartered and HSBC based in the jurisdiction.

The flexibility of Hong Kong’s stablecoin framework compared to Mica could offer issuers greater profitability

And compared with the EU’s Markets in Crypto Activities framework, says Monsur Hussain of Fitch Ratings, Hong Kong’s framework offers fiat-referenced stablecoin issuers “a little more flexibility” in how the reserves are held, including being denominated in foreign currencies. Under Mica, a minimum proportion of reserves — up to 60 per cent for significant asset referenced token stablecoins — that must be held as deposits in EU banks.

This could enable Hong Kong issuers to capture greater spread on returns on reserve assets and see greater profitability, says Hussain.

Hong Kong enters the stablecoin space as the sector shows sustained growth. The global market capitalisation of stablecoins hit $238bn in April 2025, according to CoinDesk Data, after 19 consecutive months of growth.

The Hong Kong government passed the Stablecoin Ordinance in May, with the HKMA first seeking industry feedback on stablecoins in early 2022, before launching the stablecoin sandbox in July 2024.

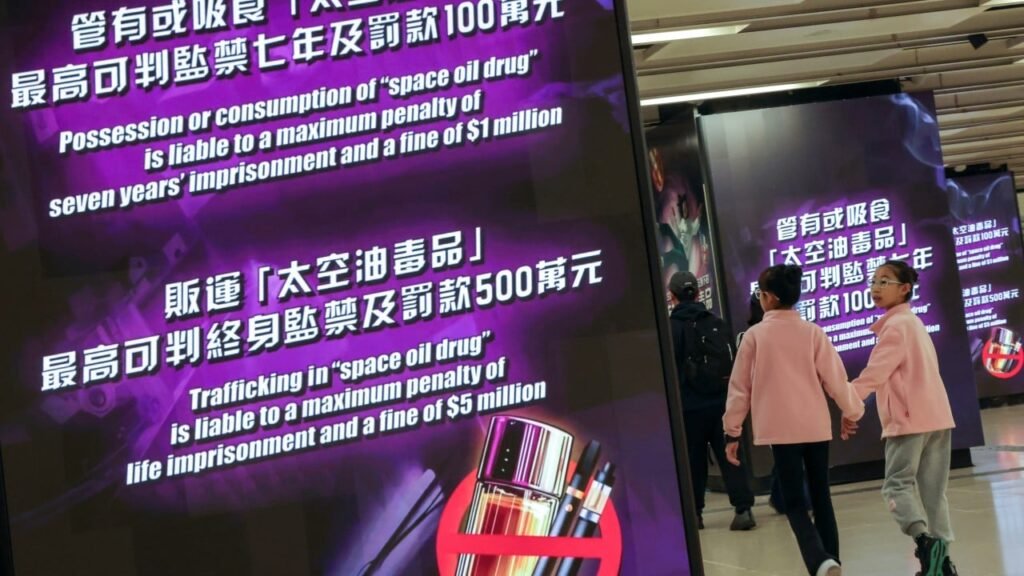

In addition to meeting requirements around anti-money-laundering practices, auditing and risk management, Hong Kong’s stablecoin bill also outlines how organisations issuing stablecoins must also satisfy requirements around reserved assessment management with the proper segregation of client assets.

Payments, including domestic, cross-border and remittances, are the most likely use for the stablecoins. Ananya Kumar from the Atlantic Council GeoEconomics Center says it can also be used as a store of value, especially in volatile economic conditions.

An RD Technologies spokesperson says the company envisions expanding into multiple currencies, looking at adding the US dollar, euro and renminbi to support businesses operating out of Hong Kong.

Jehan Chu, co-founder of Kenetic Capital, says Hong Kong will probably prioritise licences for companies with strong AML and experience of working within the financial centre. “HKMA can’t afford to mis-step out of the gate,” he says.