New York

CNN

—

Wall Street traders hunting for profits might find that the most lucrative investments are in the peculiar market for precious metals.

Gold, silver and platinum prices have surged this year as investors have piled into precious metals in search of places to hide from trade war uncertainty.

President Donald Trump’s chaotic tariff plan has rocked markets, and investors have tried to minimize risk by putting some money in safe haven assets. While gold is historically considered a haven, demand for havens has spilled over into its wonky cousins like silver and platinum.

The metals craze is reflected in the numbers: Precious metals are trouncing the US stock market this year. Gold has soared 27.5%, silver is up 24% and platinum has surged a whopping 36%.

Meanwhile, after rising by 23% last year and 24% in 2023, the S&P 500 is up less than 3% so far this year; there is an unusual amount of jitters in the normally staid bond market; and the US dollar has broadly weakened after rising 7% last year.

As bonds have been volatile and the dollar has weakened amid tariff turmoil, weird investments like silver and platinum have emerged as a way to hedge against the tremendous uncertainty.

“These dynamics have further incentivized investors to diversify away from traditional financial instruments and toward tangible assets,” Ole Hansen, head of commodity strategy at Saxo Bank, said in a Friday note.

“Gold continues to be the primary haven,” Hansen added, “but with bullion demand showing signs of stalling as investors look for a fresh trigger to propel prices higher, we have instead in recent weeks seen heightened interest in silver (and) platinum.”

Silver and platinum prices have surged higher in recent weeks as investors have sought ways to diversify their portfolios. Supply constraints have also pushed prices higher, Hansen said, and the metals increasingly look like a “rational hedge against political and financial instability.”

“These commodities are viewed as politically neutral; unlike sovereign bonds or foreign currencies, they carry no counterparty risk and are not tied to any nation’s credit rating,” Hansen said. “While we remain cautious about predicting an imminent surge to new all-time highs, the macroeconomic backdrop is increasingly supportive of precious metals.”

Precious metal prices have also pushed higher as investors have picked up on budding rallies, building a momentum-driven trend, according to Steve Sosnick, chief strategist at Interactive Brokers.

Bank of America’s survey of global fund managers in May showed that gold was the most crowded trade for the second month in a row. That snapped the Magnificent Seven tech stocks’ 24-month streak as the most crowded trade.

During the first quarter of the year, gold posted its strongest quarterly return since 1986. The yellow metal is up 27.5% this year, following its 27% surge from last year.

Gold surged higher this year as investors fretted over the uncertain outlook for tariffs.

Spot gold prices in April briefly rose above a record high of $3,500 a troy ounce. Gold traded around $3,350 a troy ounce as of Wednesday.

Gold is considered a resilient investment and a hedge against inflation, with investors betting it will retain its value when prices rise.

While Wall Street has gold fever, the price of gold has also been boosted by central banks around the world, including in India and China, buying bullion to add to their reserves. Gold demand from central banks was a key driver of its price surge in 2024, according to the World Gold Council, a trade group.

Another factor driving gold prices higher has been a weaker US dollar, Sosnick said. When the dollar weakens, commodities like gold tend to perform well as it becomes cheaper for foreign investors to buy bullion.

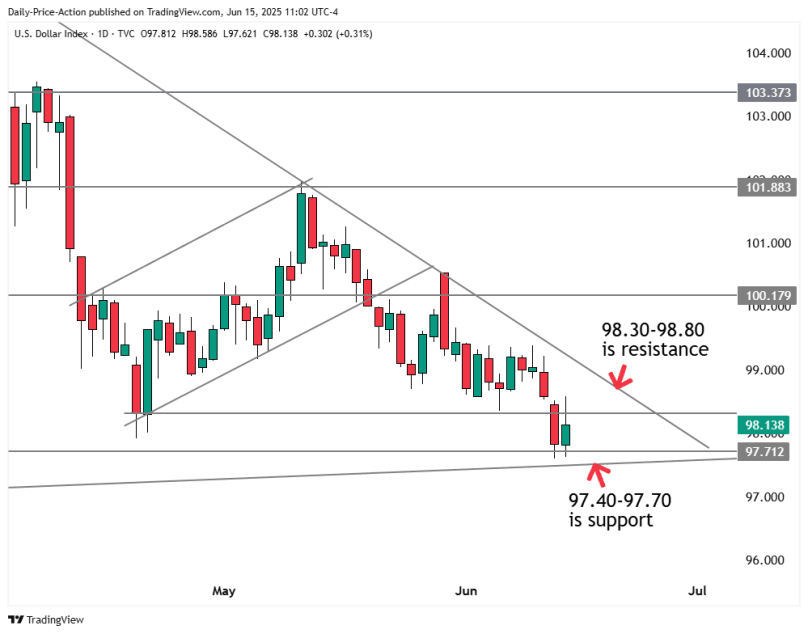

The US dollar index, which measures the dollar’s strength against six major foreign currencies, is down almost 9% this year.

“Gold continues to consolidate above $3,300, underpinned by persistent geopolitical risks, uncertainty on trade and a soft dollar,” said Peter A. Grant, vice president and senior metals strategist at Zaner Metals, in a Tuesday note.

As gold has soared higher, silver has started to catch up. Spot silver prices have surged 24% this year after soaring 21% in 2024.

Silver this week crossed $36 a troy ounce and hit its highest level since 2012.

Michael DiRienzo, president and CEO at the industry group Silver Institute, told CNN that silver prices have surged higher due to industrial demand and heightened economic uncertainty.

“There’s just a lot of concern about the global economy, and when that happens, people turn to hard assets like silver,” DiRienzo said.

“Silver tends to follow gold upwards,” he added.

Silver is widely used for industrial purposes, including data centers, solar panels and smartphones, and uncertainty about tariffs has caused demand for silver to surge, DiRienzo said.

“It’s really reverting back to its dual use as an industrial metal and as a precious metal,” he said. “And both sides of the ledger are kind of coming together to push this price forward.”

Sustained demand for silver, driven by investors and industry, could push the metal to record highs, according to commodities research firm CPM Group.

“Silver offers an attractive entry point for investors seeking alternatives to high-priced gold, bolstered by its extensive industrial applications,” analysts at CPM Group said in a May note.

People can invest in silver or gold in the form of bars and coins, or in the form of exchange-traded funds. The iShares Silver Trust ETF has surged 25% this year alongside the price of silver. The SPDR Gold Trust ETF has surged 27% this year.

Sosnick at Interactive Brokers said he also thinks silver’s rise has been momentum-driven as traders have tried to join in on the rally.

Platinum has also surged alongside silver as a less costly investment than gold.

Platinum has gained a whopping 36% this year after falling almost 10% across 2024. Spot platinum prices this week rose above $1,200 a troy ounce and hit their highest level since 2021.

“While gold has dominated the performance of the metals complex over the last year, we are starting to see the laggards like platinum … emerge from bases to catch-up a bit,” said Jonathan Krinsky, chief markets technician at global financial services firm BTIG, in a recent note.

The precious metal, which is used in industries including automotive and jewelry, has rallied largely due to demand exceeding supply. Platinum has surged higher in recent weeks after the World Platinum Investment Council, a trade group, projected a deficit for the third year in a row.

“This anticipated shortfall, which will draw down existing above-ground inventories, is being driven by demand from the automotive sector and, notably, a surge in Chinese interest in jewelry, bars and coins,” Saxo Bank’s Hansen said.

“Jewelers are the second-biggest platinum buyer after the auto industry,” analysts at Bank of America said in a Friday note. “After years of declining demand, there is anecdotal evidence that interest in platinum jewelry is now bouncing back in China.”

“Rising gold prices are incentivizing jewelers to diversify, in what represents a change to historical patterns,” the analysts noted.