If you’re looking to build long-term wealth, investing in the stock market is an excellent way to reach financial freedom. The key is to focus on quality companies and hold on to their stocks for the long haul. Patience is your best friend, as your investments will have the chance to compound over time.

One company that’s been making waves in the fintech world is SoFi Technologies (SOFI 2.09%). The company is rapidly attracting customers and has successfully expanded beyond student loans to become a comprehensive financial services provider.

Over the past year, SoFi has shown impressive growth, and the company has enjoyed robust demand for its loans. With multiple avenues for expansion, you may wonder: Could SoFi be a millionaire-maker stock in your investment portfolio?

SoFi’s platform has evolved in recent years

SoFi, a dynamic player in the fintech space, began its journey helping people refinance their student loans. However, during the pandemic, it had to adjust to the student loan forbearance and shifted its focus more toward personal loans. In recent years, SoFi has expanded its offerings to provide a diverse range of products, including banking and savings accounts, investment accounts, and other financial planning tools.

One pivotal moment in SoFi’s growth story came in 2022 when it acquired Golden Pacific Bancorp. The move provided it with a much-needed banking charter. With this, SoFi could accept deposits, retain loans, and roll out a suite of banking products that extend beyond its initial loan offerings. As a result, SoFi’s deposit base has grown rapidly over the past several years.

SOFI Total Deposits (Quarterly) data by YCharts

Another advantage of owning a banking charter is the opportunity for SoFi to offer financial products to nonbanking companies. The fintech has invested in technology platforms like Galileo and Technisys, positioning itself to provide essential back-end banking services that can support a wide array of financial products simultaneously. SoFi’s technology segment is compelling due to its steady, fee-based revenue, helping SoFi differentiate itself in the competitive fintech landscape.

Can SoFi become a millionaire-maker stock?

For a stock to be a millionaire maker, several key things must align for investors. The company needs to experience consistent, long-term growth. After all, building long-term wealth isn’t a sprint; it’s a marathon, and patience is essential as you navigate the inevitable highs and lows of investing in growth stocks.

Image source: Getty Images.

Not only that, but the size of your initial investment and any subsequent contributions can significantly impact your journey. If you invest $10,000 in SoFi today and don’t add any more to it, you will need that investment to grow at a 20% annual compound rate for the next 25 years.

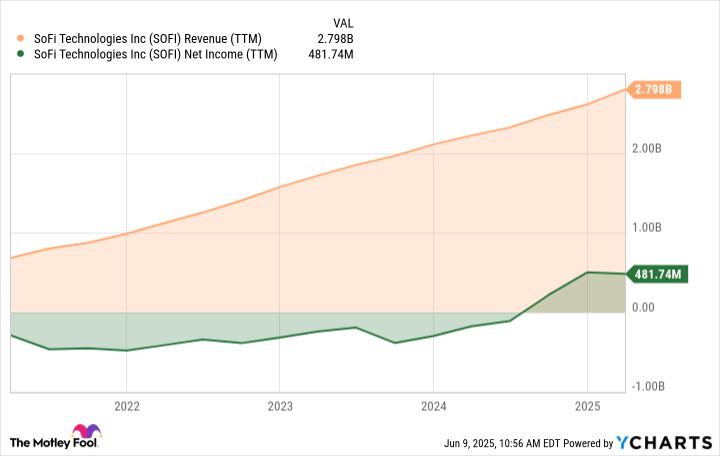

SoFi is growing at a very impressive pace. Last year, it reported $2.67 billion in total revenue, representing 26% growth from the previous year. A rapidly expanding deposit base helped it, which grew 39% to $25.9 billion. Its net interest income growth was stellar, and analysts covering the company believe it could generate an additional 23% growth in revenue this year.

On top of that, SoFi achieved generally accepted accounting principles (GAAP) profitability for the first time in a full fiscal year last year. Earnings per share of $0.39 crushed estimates. It posted another profitable quarter in the first quarter, with EPS of $0.06 on revenue of $771 million, representing a 33% increase from the same period in the prior year.

SOFI Revenue (TTM) data by YCharts

Is SoFi right for you?

SoFi has what it takes to be a solid stock for long-term investors, but a few things need to go its way. One, continue to grow and expand its customer base and get existing customers to use its offerings more. An important aspect is that SoFi must not only maintain but also cross-sell to customers, engaging them with all of its various offerings.

Second, its credit must hold up. A promising sign is that alternative investors have shown a strong interest in scooping up loans. SoFi has expanded its loan platform business, where it refers pre-qualified borrowers to loan origination partners. The loan platform enables SoFi to meet borrower demand while shifting toward less capital-intensive, fee-based revenue sources, as its investor partners retain ownership of those loans.

Last year, the fintech agreed to a $2 billion agreement with Fortress Investment Group. It has further built upon this agreement and now has a commitment of up to $5 billion from the investment company. The company also agreed with Blue Owl Capital for up to $5 billion in loan commitments, showing incredibly strong demand for personal loans.

Third, its technology platform needs to continue to grow as well. This business offers SoFi the potential for higher margins and is one aspect that can differentiate it from competitors.

SoFi has the potential for strong returns, but it should be viewed as part of a larger investment strategy. As a long-term investor, focus on building wealth by investing in quality companies across various industries with different strengths, with SoFi being one part of your diversified approach to building wealth.