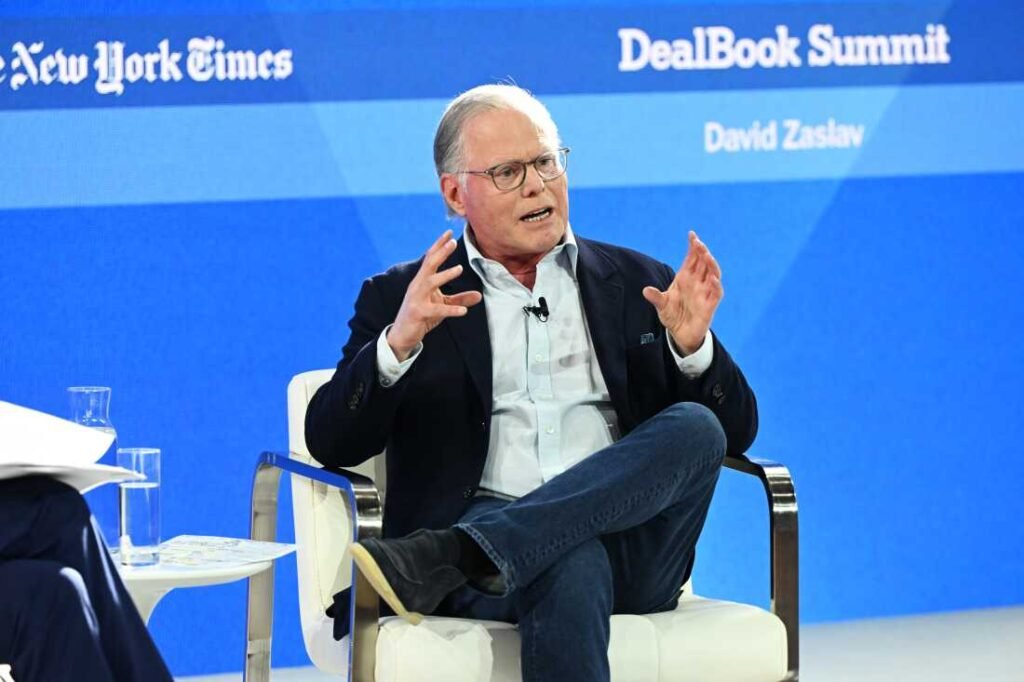

David Zaslav, movie mogul at last. Zaslav’s vision board, which includes him sitting behind Jack Warner’s old desk and living in Robert Evans’ former home, is complete.

On Monday, we finally got the news we were waiting for: Warner Bros. Discovery, formed just three years earlier via the merger of Zaslav’s Discovery, Inc. and AT&T’s WarnerMedia, is being split back up. Zaslav keeps the goods: HBO, HBO Max and the Warner Bros. studios (including TV and DC). His righthand man, WBD CFO Gunnar Wiedenfels, gets the leftovers — the cable channels, basically. Oh yeah, and Gunnar also gets the “majority” of WBD’s $37 billion debt load. That makes Wiedenfels the Mark Lazarus in this Versant copycat situation — if Versant was buried in debt.

Hollywood couldn’t have scripted it better — for Zaslav. (Ironic considering his unfavorable positioning during the writers guild strike.)

Zaslav, a former attorney, started his True Hollywood Story in the late 1980s as president of NBC’s cable, domestic TV and new media distribution divisions. At the time, even he couldn’t see how the latter department would basically cannibalize the former three decades later. At what point that became clear to Zaslav, we’ll never truly know — not through his (ongoing) public comments, at least. At NBC, Zaslav launched MSNBC and oversaw the Olympics on cable — two properties that would inform future interests.

In 2006, Zaslav jumped to Discovery and to his first CEO title; two years later, he took the company public. He always liked the stage. The existing Discovery portfolio wasn’t enough for his big ambitions, so Zaslav launched some new networks — like OWN and ID — and bought others (like HGTV and Food Network via an acquisition of Scripps). He got the Olympics back — internationally — in 2015.

For 15 years, Zaslav was Mr. Cable (being coached all the way by his mentor: “Cable Cowboy” John Malone). Zaslav defended the delivery system and the bundle for as long as he could — and then for a few years longer than that.

How synonymous with cable was Zaslav? In 2017, he was inducted into the Cable Hall of Fame. Zaslav is a member of the Cable TV Pioneers Class of 2018. Satirically, that was the same year that Zaslav waved the white flag via the launch of Discovery+.

Even Zaslav had to say it: streaming was in and cable was out. But there was no way that Discovery+ could compete in the streaming wars, which at the time were all about subscriber growth. A man with mogul ambitions — and a mogul paycheck — wanted more.

Also in 2018, AT&T finally closed its wildly dragged out and misguided (and expensive: it was north of $100 billion) acquisition of Time Warner. It took two years for that deal to go through; it only took three years for AT&T to reverse course and sell off the repackaged WarnerMedia, taking a major “L” in the process. Something about all of this sounds so familiar…

In 2022, the $43 billion deal that formed Warner Bros. Discovery — with Zaslav at the helm — was finalized. The creation of WBD came with a mountain of debt, but there were perks. Zaslav, an Old Hollywood head, got his legacy movie studio (WB is 102 years old this year) and a bonafide film lot. He got CNN (and his daughter got a job as a congressional producer there), an upgrade from his old left-leaning cable news channel MSNBC. He also inherited the prestige of prestige-TV through HBO, and for a while there it looked like HBO Max/Max/HBO Max-again just might compete with Disney+ and Netflix. Hell, the New York Knicks fan even got the NBA through Turner. Life was good.

The pay wasn’t so bad either. Zaslav’s 2024 compensation package was valued at nearly $52 million; his 2023 pay was about $50 million. Even in his Discovery-only days Zaslav was among the highest-paid CEOs in media. Patagonia vests aren’t cheap.

You know who wasn’t making money? WBD shareholders. The newly formed company’s stock opened April 9, 2022 at $42 per share. Today, shares are teetering around $10.

Warner Bros. Studio Tour Hollywood media preview at Warner Bros. Tour Center on June 24, 2021, in Burbank, California.

Getty

What went wrong? Well, the whole plan, basically.

Though direct-to-consumer would become profitable for WBD, it was too little, too late. The film business had its ups and downs. There were the strikes. Cable, the very thing Zaslav is escaping via today’s split-and-spin announcement, has only had downs — for Warner Bros. Discovery that included the loss of the NBA and the subsequent implosion of its sports-centric joint venture (with Disney and Fox) Venu, which was dead before arrival.

CNN languished under a short-lived Chris Licht regime; CNN+ made it about a month. Even Zaslav’s PR was a nightmare: he became the name and the face of Hollywood corporate greed by killing off completed and near-completed projects in the name of tax write offs. A certain panic sets in when you have $50 billion in debt to pay down in a struggling marketplace.

So Zaslav jumped ship. He will soon be rid of the “Also Ran” that is cable TV — and he’ll be rid of most of WBD’s existing debt as well. If all goes according to plan, Zaslav will have effectively traded in a dying basic-cable bundle for the most influential brand in television and a top-2 or 3 film studio. And he got paid hundreds of millions of dollars to do it.

The Zaslav Prophecy will be completed in mid-2026.