Online investing provider Public.com, which began life as a social trading focused app, has announced that it is now shuttering social trading.

And the reason given? AI, of course.

In a blog post entitled “Sunsetting Social”, Public explained that when it first launched, a key feature of the product was the ability to see other people’s trades and their insights around the markets — all coming together in a social feed. It was a novel idea that helped make Public not just a place to trade but a community.

Over the years, the product matured, and so did Public’s customers. Public is now a suite of tools that help people build portfolios spanning a vast array of asset classes — from stock, crypto, and options, to treasuries and bonds. Existing customers became more sophisticated as they learned their way around the markets, and new customers are now mostly people who already have extensive investing experience.

At the same time, a new technology emerged — AI.

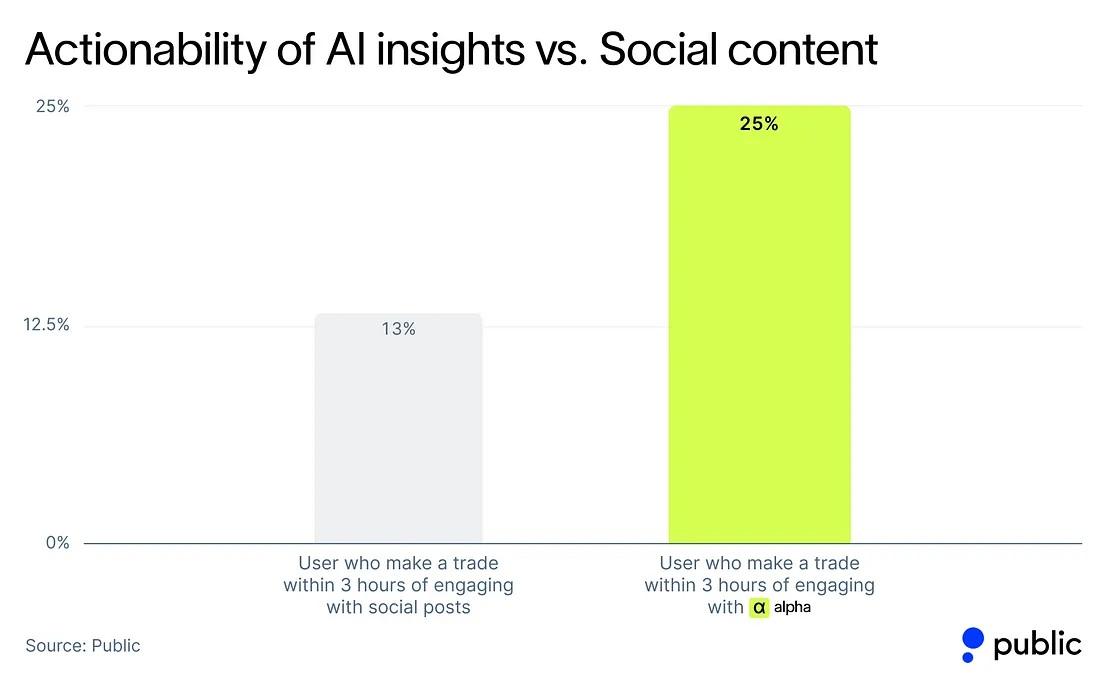

It’s now been over two years since Public launched Alpha, which integrated AI-powered capabilities to many aspects of the Public platform. Its customers today are much more sophisticated than they were when Public first started. At the same time, a new technology has emerged that has the power to adapt to any person’s level of experience and sophistication. No matter how nerdy, deep, and experienced they are.

The core use-cases of the social feed used to be people posting recaps of earnings calls and bite-sized updates on what’s happening in the markets on a given day. Now, this exact content is created by AI. Faster, more accurate, and woven throughout the product experience, where it’s showing in the best context.

AI has cannibalized social

The company added that this is an incredibly exciting time to be building. Public said it will continue to expand on how AI can drastically improve everyone’s experience and performance in the markets. Through new ways to create financial products, like Generated Assets, market insights and research, like Alpha, and other exciting new features you will learn about soon.