Gold price moves within a tight range on Wednesday but remains bullishly aligned following limited corrective dip on Tuesday.

Broken Fibo level at $3355 (61.8% of $3200/$3120 pullback) reverted to solid support which keeps the downside protected so far and guards lower trigger at $3328 (broken triangle’s upper boundary, reinforced by 10DMA).

Technical picture on daily chart remains bullish overall, with the action being strongly underpinned by thick daily cloud (top of the cloud currently lays at psychological $3000 level), but warnings from fading positive momentum and Stochastic entering overbought zone, should not be ignored.

Near-term bias, however, is expected to remain with bulls as long as the price stays above broken triangle resistance, with extended consolidation likely to precede fresh attacks at key $3400 resistance zone (Tuesday’s peak / psychological / Fibo 76.4%) violation of which would unmask key $3500 level (new record high).

The notion is supported by overall favorable fundamental conditions, mainly due to persisting uncertainty over the US trade tariffs, particularly on negotiations with China and EU, as well as doubled tariffs on metal imports that fuel worries about further turmoil in global trading.

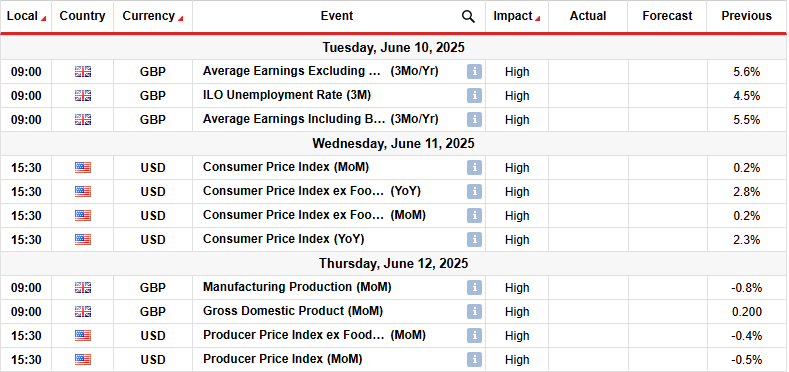

US economic data were so far mixed, as two of three US May labor reports (JOLTS 7.39M vs 7.11M f/c and ADP 37K vs 111K f/c) conflicted, as the markets await release of NFP report on Friday, to get more details about the condition in the US labor sector.

Also, growing concerns about US fiscal growth on signals that enormous US debt would be boosted by recently passed spending and tax cut bills, is likely to provide fresh tailwinds to the yellow metal, along with persistently unstable and overheated geopolitical situation.

Res: 3372; 3392; 3400; 3410

Sup: 3343; 3328; 3318; 3310