While AUDCAD isn’t among the highest-volume pairs in Forex, it’s often in the lesser-traded instruments that sharp traders find unique opportunities.

Commodities heavily influence the Australian and Canadian dollars, as both nations are major exporters. The AUD tends to react more to moves in industrial metals—especially copper—while the CAD is tied to oil price fluctuations.

Beyond commodities, the currencies are driven by their respective economic ties: Canada is closely linked to trends in the U.S., whereas Australia is more sensitive to developments in China. In the absence of fresh geopolitical shocks, traders are focusing on central bank policy divergence and incoming economic data.

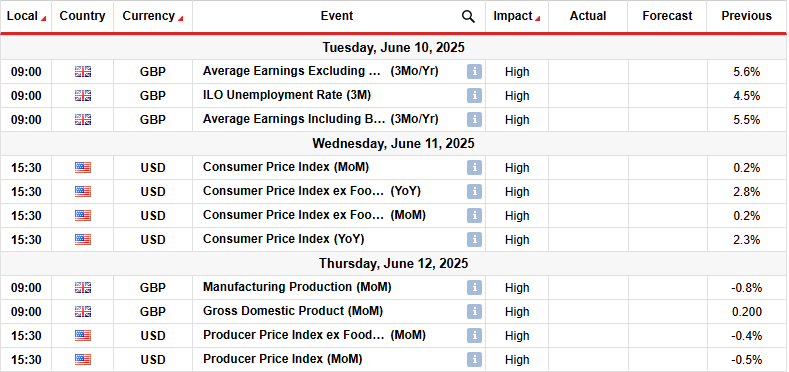

On that front, the Bank of Canada paused its rate-cutting cycle at its last meeting after starting in June 2024. Its next decision is due Wednesday, June 4, and markets widely expect another hold, as the BoC remains in wait-and-see mode following the latest U.S. tariff changes.

Meanwhile, the Reserve Bank of Australia kicked off its own cutting cycle in May 2025 with a 25 bps cut and signaled more may follow. This gives the pair a bearish tilt, though sentiment remains cautious until the economic impact of tariffs becomes clearer.

Let’s dive into the charts and examine AUDCAD across higher timeframes, starting from the weekly view to the 4-hour chart.

AUDCAD Weekly Timeframe

AUDCAD Weekly Chart, June 3, 2025. Source: TradingView

AUDCAD has been in a broader downtrend since 2016, though that long-term move has been marked by multiple intermediate upswings and pullbacks.

Given both currencies’ sensitivity to industrial commodity prices, they generally move in tandem with broader risk sentiment, resulting in relatively stable correlation patterns.

The pair often trades within well-defined ranges on the weekly chart rather than trending aggressively. At current levels, AUDCAD sits near the midpoint of that range—there is less technical direction at the current levels;

This is a good moment to zoom into the daily chart for more precise context and to identify shorter-term opportunities.

AUDCAD Daily Timeframe

AUDCAD Daily Chart, June 3, 2025. Source: TradingView

The pair wasn’t immune to the volatility that shook Forex markets earlier this year.

AUDCAD had been trading up throughout 2024, profiting from the dovish stance and data coming out of Canada – the BoC started its cutting cycle almost a full year before the RBA! Weakness in the CAD was generally a theme of last year though and this weakness may be found in the current theme of cutting from the Australian Central Bank.

The Pair also had a major selloff on Liberation Day, forming the yearly lows at 0.8450 after coming right back into the current range.

For current trading, look at the range between the 0.8800 lower band and the 0.9050 higher band.

On a purely technical look, the pair is not showing major signs of volatility with the RSI in the neutral range – we are closer to the lower band – the situation may evolve with the upcoming BoC Meeting.

Let’s take a closer look.

AUDCAD 4H Timeframe

AUDCAD 4H Chart, June 3, 2025. Source: TradingView

After coming back from the extremes hit at the beginning of April, the currency pair has been contracting in volatility throughout the month of May.

The most immediate price action has been constrained in a 500 pip range between 0.8850 to 0.89 in the waiting for the release of the Bank of Canada Rate decision at 9:45 on Wednesday.

A break above this tight range hints at the Intermediate Resistance Zone around 0.8950 and a break below would look towards the lower Band at the key 0.88 psychological level.

Momentum is calm though expect more volatility as we progress through the week.

Safe Trades!