Weakness in consumer-facing sectors is a painful reminder of the differences between the economy and the stock market.

2025 has been an encore year for the S&P 500 (^GSPC 0.34%). The index is up 13% year to date (YTD) at the time of this writing after gaining 24.2% in 2023 and 23.3% in 2024.

Some investors may be concerned that the S&P 500 has run up too far and too fast. Or maybe you’re of the mindset that we are in the middle of a prolonged bull market fueled by artificial intelligence (AI).

Regardless of your preference, here are six metrics worth considering before buying S&P stocks at all-time highs.

Image source: Getty Images.

Business-to-business sectors are thriving

Under the Global Industry Classification Standard, each stock is assigned to a market sector. These categories make it easier for investors to track what’s driving or holding back the broader market.

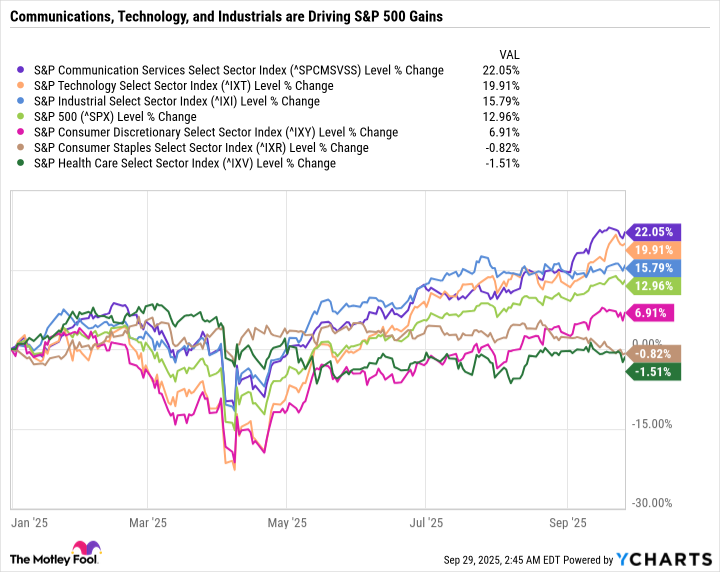

The S&P 500 may be up 13% YTD, but those gains are largely due to a few outperforming sectors.

The technology sector makes up 34% of the S&P 500 and has been crushing the index since the start of 2023. Many of the largest growth stocks by market cap — such as “Ten Titans” names like Nvidia, Microsoft, Apple, Broadcom, and Oracle (ORCL 3.00%) — are in the tech sector. As well as smaller, but still massively valuable companies like Palantir Technologies, International Business Machines, and Advanced Micro Devices.

Nearly half of the communications sector is concentrated in Alphabet, Meta Platforms, and Netflix. Those stocks are up 27% to 36% YTD. Over the last three years, Meta Platforms and Netflix are up over 440% and Alphabet is up 153%.

The industrials sector is doing well thanks to gains in machinery and equipment makers like Caterpillar and GE Vernova, and aerospace and defense companies like GE Aerospace and RTX. These companies are benefiting from increased infrastructure spending on AI, a recovery in air travel, and strong government spending on defense.

Many of the stock market sectors that are performing well focus on business-to-business spending, which doesn’t tell the full story of what’s happening in the economy.

Consumer-facing companies are in a downturn

The consumer discretionary sector is cyclical and tends to outperform the S&P 500 during periods of economic expansion. But it is noticeably absent from this year’s winning sectors, along with the consumer staples sector and healthcare. Staples and healthcare are defensive and usually underperform when investors are willing to take on more risk. But they are also consumer-facing and support the narrative that the consumer side of the economy is completely different than the commercial and industrial side.

The consumer discretionary sector includes industrials such as retail, restaurants, home improvement, automotive manufacturers, and household appliances. These industries have been hit hard by a slowdown in consumer spending. Home Depot‘s organic growth has ground to a halt due to a sluggish housing market and high mortgage interest rates. Former Wall Street darling restaurant stocks like Chipotle Mexican Grill are down big as consumers pull back on non-essential spending. This pullback is rippling through to consumer staples companies.

Consumers are seeking value in household goods, impacting companies like Procter & Gamble. And a shift toward health-conscious snacks and drinks is impacting Coca-Cola and PepsiCo. Even Costco Wholesale, a long-term outperformer, is down year to date. Many of the highest-quality, most reliable dividend-paying companies in the sector are struggling, which is indicative of the current state of the economy.

Be selective when approaching growth stocks at all-time highs

Glancing at S&P 500 year-to-date returns, you may think that stocks are doing well. But that’s only partly true. Many companies that rely on consumer spending are in a downturn, both in terms of their earnings growth and stock performance. In other words, enterprise-facing companies and affluent consumers are doing well, but the rest of the economy is struggling.

There’s also reason to believe that the American middle class is shrinking, which is bad news for companies that rely on high sales volumes. Metrics like higher cost of living, lower home ownership rates, and a declining share of U.S. household income owned by the middle class all point to a potentially prolonged period of consumer spending weakness.

A lot of growth-focused companies in the technology, communications, and industrial sectors have gotten more expensive, but many stocks in the consumer discretionary, staples, and healthcare sectors are trading at steep discounts to their historical averages. This doesn’t mean investors should smash the sell button on stocks that have run up a lot and dive headfirst into beaten-down sectors. Rather, the key takeaway for long-term investors is to make sure that growth stocks that have gone up can justify their elevated valuations.

For example, Oracle has an extremely expensive valuation, but it’s also planning on launching over 70 data centers in just a few years. Oracle is landing contracts left and right with major hyperscalers, including a record cloud computing deal with OpenAI. The company expects to increase cloud revenue by over 14-fold in the next five years. If that happens, Oracle’s valuation could go from expensive to reasonable or even cheap. But if contracts fall through, Oracle could sell off big time. Investors considering Oracle must understand that multiyear growth is already priced in.

There are many companies like Oracle right now — at the top of their game, growing rapidly, chock-full of potential, and expensive. Investors seeking top growth stocks will likely have to pay a premium price, so investing in only high-conviction ideas is paramount.

Daniel Foelber has positions in Chipotle Mexican Grill, Nvidia, and Procter & Gamble and has the following options: short October 2025 $40 puts on Chipotle Mexican Grill and short October 2025 $42 calls on Chipotle Mexican Grill. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, Chipotle Mexican Grill, Costco Wholesale, Home Depot, International Business Machines, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, and Palantir Technologies. The Motley Fool recommends Broadcom, GE Aerospace, Ge Vernova, and RTX and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short September 2025 $60 calls on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.